- Smartphone shipments recorded the highest ever annual decline of 25% in 2023 due to economic headwinds.

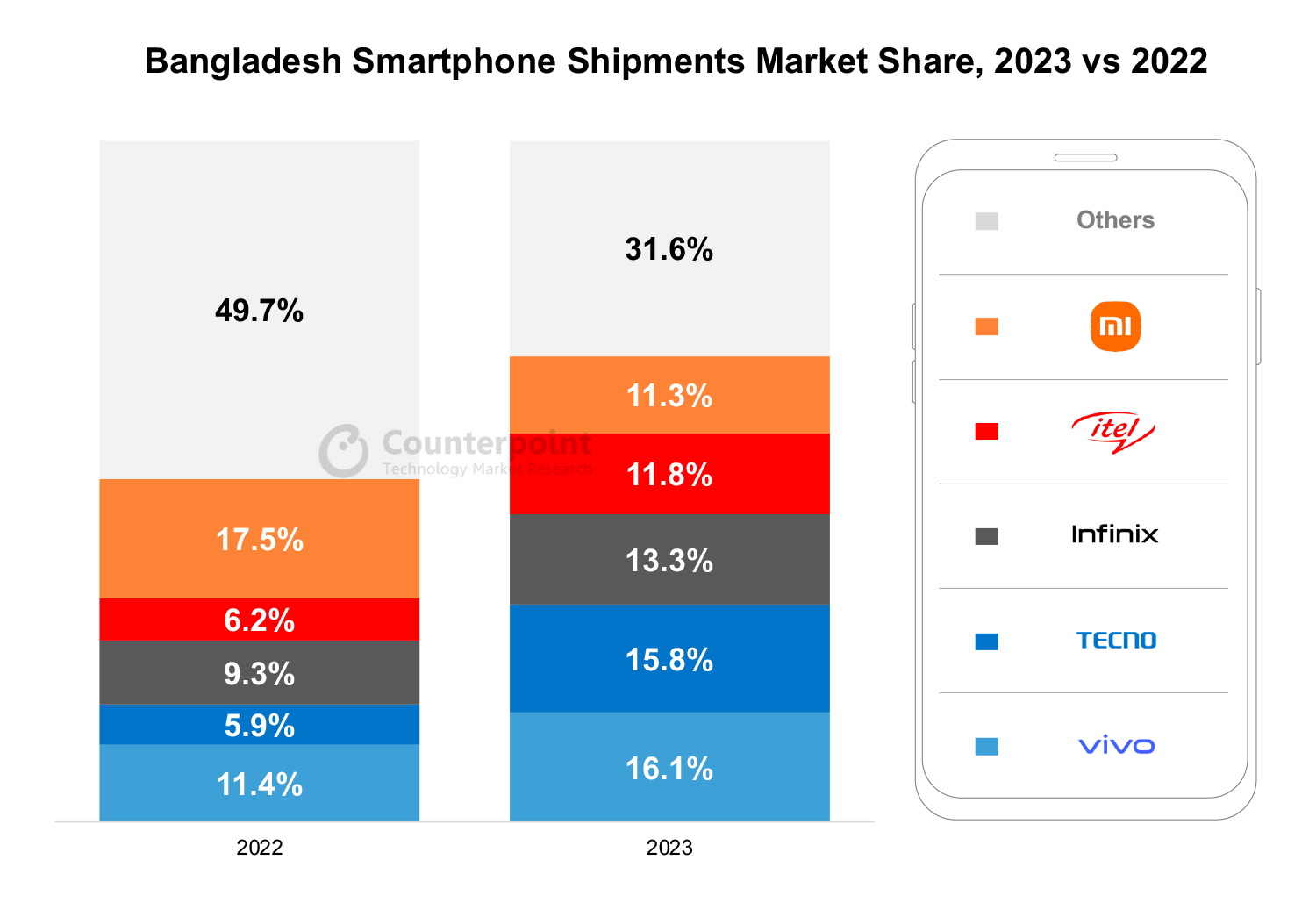

- vivo led the smartphone market for the first time with a 16.1% market share.

- TECNO took the second spot with a 15.8% share. Its annual growth almost doubled.

- Symphony led the overall handset market (including feature phones) in 2023 followed by itel.

- High potential for installed base expansion, easing economic pressures, rise in the value of local currency, and digitalization will boost the smartphone market in the coming years.

Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi, Seoul – February 27, 2024

Bangladesh’s smartphone shipments witnessed an annual decline of 25% in 2023, according to the latest research from Counterpoint’s Market Monitor Service. Economic headwinds in the country, including persistent high inflation and currency depreciation, along with a rise in the value-added tax (VAT) on handsets, affected the smartphone market.

Commenting on the market’s dynamics, Research Analyst Akshay RS said, “Consumer demand for smartphones in the first half of 2023 remained weak in Bangladesh because of higher inflation rates and currency depreciation. This led to the lowest quarterly shipments in Q1 2023 in the previous three years. Besides, consolidation happened in the market with the exit of more than 10 smartphone brands due to difficulty in opening LCs (letters of credit). As a result, the top five brands’ share rose to the highest ever at 68% from 63% in 2022. The smartphone portfolio of the top players shrank compared to 2022 to cater primarily to entry and affordable price bands from where most of the demand came. However, the market started witnessing positive consumer sentiment from the last quarter (October-December) of 2023 as the economy stabilized.”

Note: Numbers may not add to 100% due to rounding

Commenting on the competitive landscape and brand-level analyses, Akshay added, “In 2023, vivo led the market with a 16.1% share driven by the strong performance of its Y22 series. vivo developed a strong presence in offline retail and also launched its own online store. TECNO took the second position with a 15.8% market share. The brand almost doubled its volume in 2023 compared to 2022, driven by strategic partnerships with offline stores and aggressive launches of new mid-range models. Infinix captured the third spot in 2023 driven by its affordable models and offline expansion. itel, which is actively capitalizing on the entry-level (<10,000 BDT) segment, received a good response from consumers. Xiaomi slipped to the fifth spot in 2023 but captured the top spot in Q4 2023 driven by its Redmi 12 series.”

The share of 5G smartphones in the overall shipments declined to 2% in 2023 from 10% in 2022 due to poor demand. For many consumers, it is yet to become an attractive feature. vivo continued to lead Bangladesh’s 5G smartphone shipments in 2023 for the second consecutive year, followed by realme and Xiaomi.

Bangladesh’s overall mobile handset market declined 25% YoY in 2023. Symphony maintained its top position in the handset market, capturing an 18% share. The feature phone market declined 24% YoY in 2023 due to the faster feature phone-to-smartphone migration in the second half of the year. Smartphone share in the overall handset shipments was flat at 32% in 2023 from 31% in 2022. Symphony also retained its top position in Bangladesh’s feature phone market, capturing a 39% share followed by itel, 5Star and Walton.

On the outlook for 2024, Senior Analyst Karn Chauhan said, “We believe the pent-up demand for smartphones due to delayed purchases can be fulfilled in 2024 as the macro environment started to show improvements during the second half of 2023. However, a favorable dollar exchange rate, decline in component costs and less difficulty in opening LCs will be the major factors influencing the market growth. The high potential installed base, a huge feature phone-to-smartphone migration, availability of new use cases, development of the supply chain and digitalization will continue to grow the market in the longer term.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com