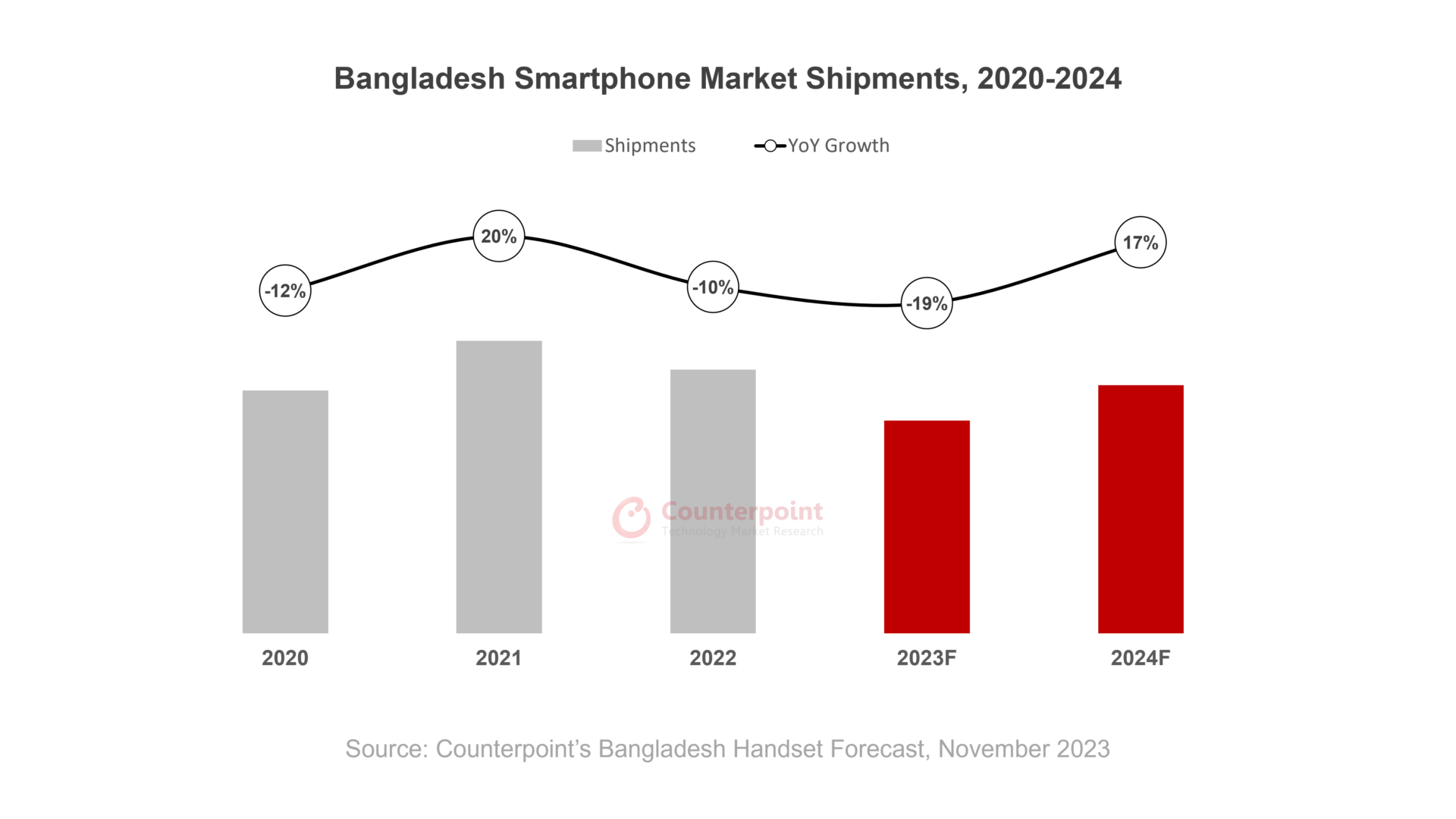

- Bangladesh’s smartphone shipments are expected to fall 19% YoY in 2023, dipping for the second time in the last three years.

- High installed base opportunity, easing economic pressures, rise in the value of local currency, and digitalization will boost the smartphone market in the coming years.

- The market is expected to grow by 17% YoY in 2024.

Bangladesh’s smartphone shipments are expected to fall 19% in 2023, their highest-ever annual decline, according to the latest research from Counterpoint’s Market Outlook. Also, this will be the second consecutive year of a double-digit decline. Economic headwinds in the country, including persistent high inflation and currency depreciation, are affecting the smartphone market. An increase in the value-added tax (VAT) on handsets and a growing grey market are among the other factors contributing to the decline.

More than 98% of Bangladesh’s smartphone demand is met by its strong local manufacturing base, with components mostly imported from China. However, at the beginning of 2023, the Russia-Ukraine war affected the country’s component supply chain. At the same time, the rise in the dollar exchange value caused by rising inflationary pressures increased the cost of smartphone components by more than 25%. Besides, the VAT for manufacturers jumped to 7.5% for the July 2023-June 2024 financial year from 5% in the previous financial year, along with the addition of 5% VAT for distribution and retail revenue. This jump in smartphone costs slowed down the feature phone-to-smartphone migration.

To compound matters, many OEMs are facing difficulties in opening letters of credit (LCs) with domestic and central banks. Businesses have been asked to pay up to 100% of their import payments in advance by domestic banks even as central banks have taken belt-tightening measures due to rising pressure on the country’s foreign exchange reserves and volatility in the exchange market. Also, assemblers and manufacturers in Bangladesh have been affected by the invasion of grey-market smartphones. As a result, the government is implementing the National Equipment Identity Register (NEIR), a system aimed at stopping the unofficial entry of mobile handsets from other countries.

Outlook

We believe the pent-up demand for smartphones due to delayed purchases can be fulfilled in 2024 as the macro environment started to show improvements during the second half of 2023. The dollar exchange rate is expected to ease, resulting in a decline in the cost of components and less difficulty in opening LCs. Currently, Bangladesh has an installed base of nearly 60 million smartphones, which will reach 65 million by 2024, mainly driven by first-time smartphone buyers.

In terms of smartphone sales, online share is still less than 10%, which is forecasted to reach 16% by 2024 as consumer trust in e-commerce continues to rise. There are mainstream large e-commerce players for smartphones such as Daraz, Pickaboo and Gadget & Gear that will drive online sales for smartphones as digitalization improves. The smartphone industry is a vital tool for Bangladesh’s digital transformation. It helps in achieving the ‘Smart Bangladesh’ vision by expanding access to digital services. Going forward, the availability of digital services via high-speed networks will be the main driver of smartphone market growth in Bangladesh.

Despite the expected decline in 2023, Bangladesh’s smartphone market has been resilient and is performing better than many other countries in Asia. The high potential installed base, a huge feature phone-to-smartphone migration, availability of new use cases, development of the supply chain and digitalization will continue to grow the market in the longer term. We expect Bangladesh’s smartphone market to grow 17% YoY in 2024.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com