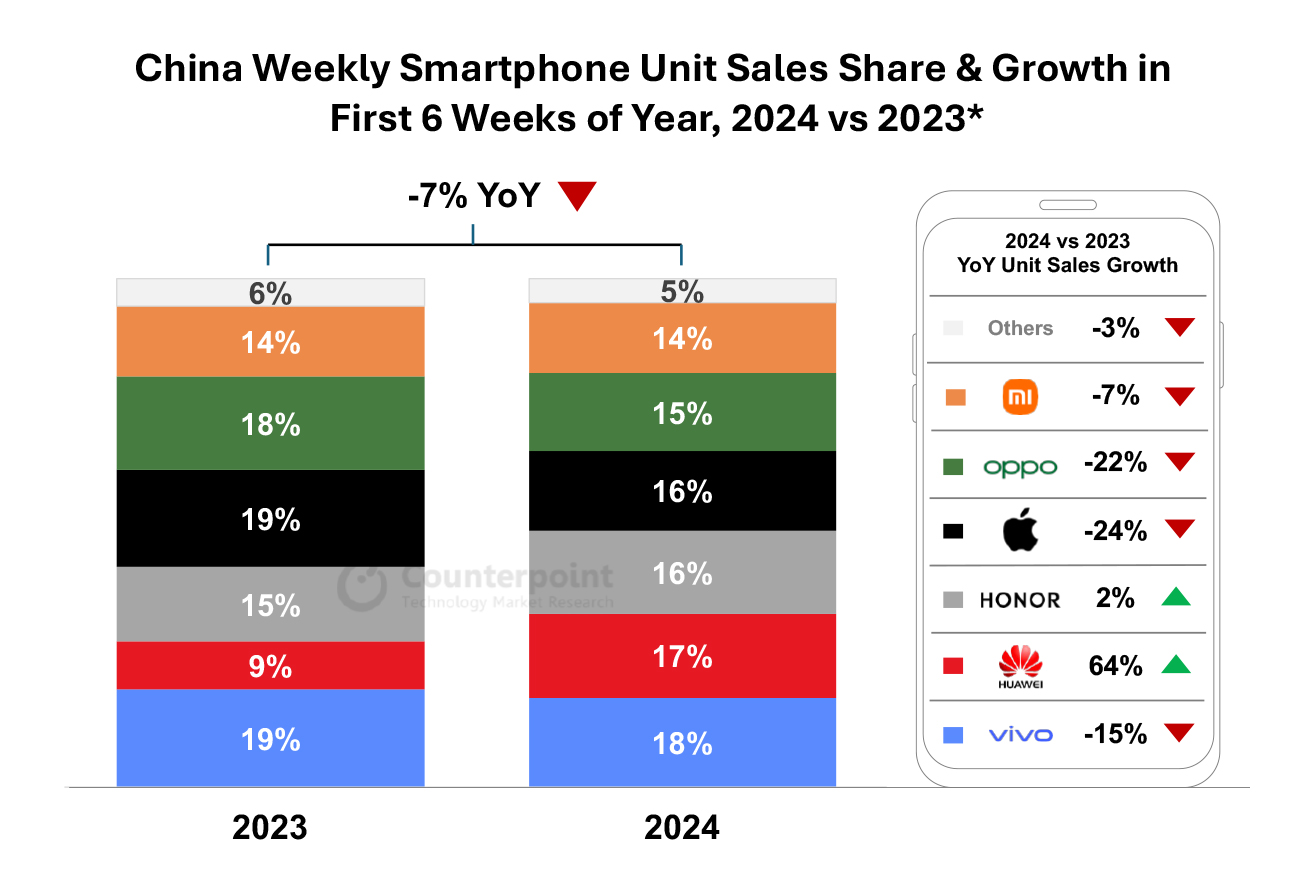

- Growth: China’s smartphone unit sales declined by 7% YoY during the first six weeks of 2024.

- Driver: Apple fell 24% over the period on stiff competition and an abnormally high January 2023.

- Driver: Underperformance of key vendors OPPO and vivo also kept overall growth in the red.

- Driver: Continued demand for Huawei’s Mate 60 series helped support a tough start to the year.

- Outlook: Low consumer confidence and few new launches are likely to temper growth over the short term.

Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi, Seoul – March 5, 2024

China’s overall smartphone unit sales declined 7% YoY in the first six weeks of 2024, with key vendors like Apple, OPPO and vivo seeing double-digit declines, according to Counterpoint Research’s latest China Smartphone Weekly Sell-through Tracker.

Apple’s iPhone struggled during the first few weeks of the year for several reasons. “Primarily, it faced stiff competition at the high end from a resurgent Huawei while getting squeezed in the middle on aggressive pricing from the likes of OPPO, vivo and Xiaomi,” said Senior Analyst Mengmeng Zhang, adding, “Although the iPhone 15 is a great device, it has no significant upgrades from the previous version, so consumers feel fine holding on to the older-generation iPhones for now.”

At the same time, it may be noted that the first six weeks of 2023 saw abnormally high numbers with significant unit sales being deferred from December 2022 due to production issues, magnifying the negative YoY comparison.

*Notes: 2023 – Jan 2 to Feb 12; 2024 – Jan 1 to Feb 11; OEM shares may not add to 100% due to rounding; OPPO includes OnePlus.

Huawei continued to attract and satisfy strong demand for its Mate 60 series, one of the only bright spots to the start of the year.

“Consumer confidence will need to rise to stabilize the market, but it is a tough call right now with everything that is happening, especially in the real estate sector,” said Senior Analyst Ivan Lam, adding, “As far as Apple is concerned, there is more wriggle room in the short term. This weekend’s aggressive promotions are just one example.”

Overall growth is likely to remain in the red during Q1 2024 on muted spending and a few new product launches.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com