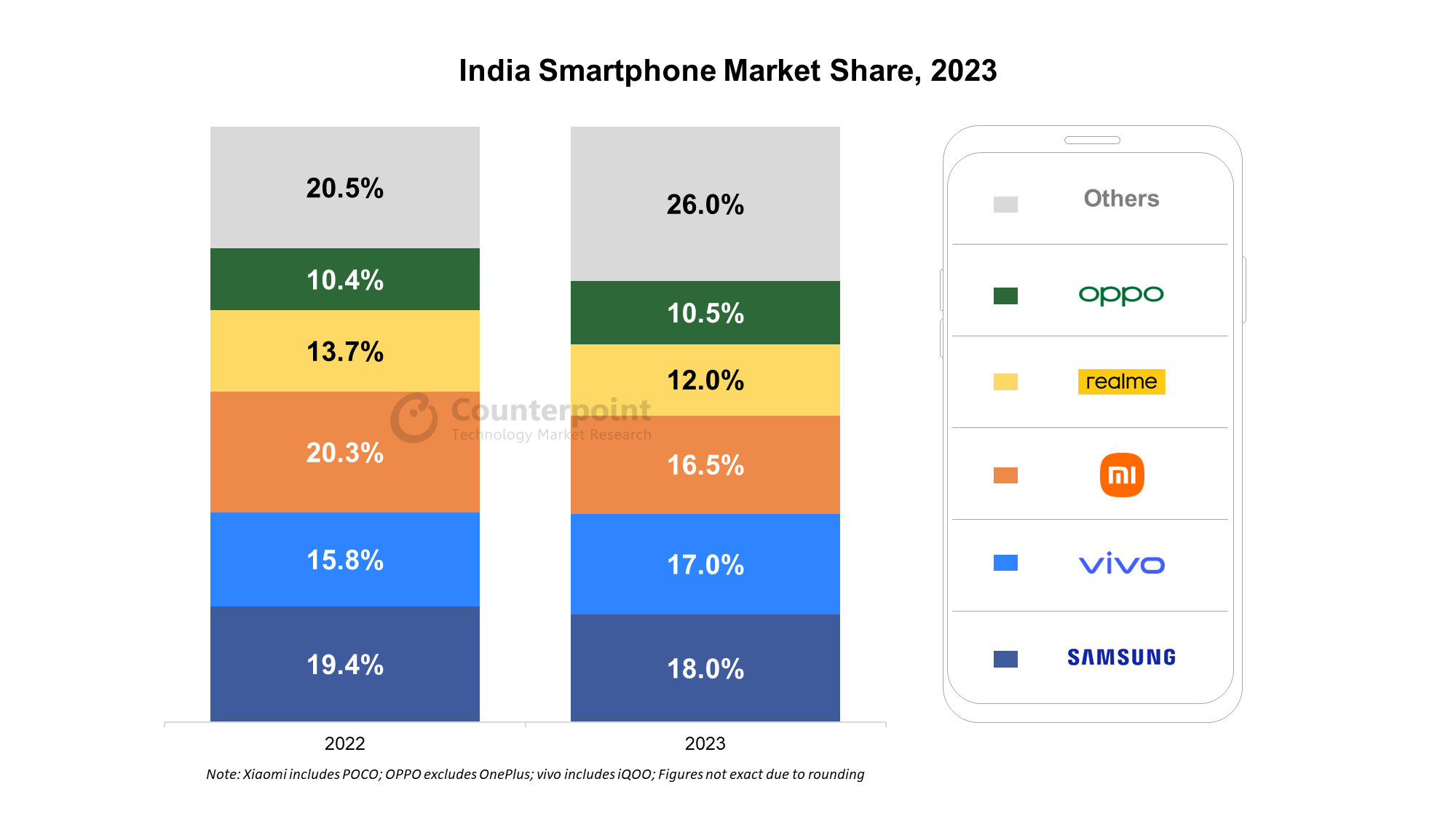

- With an 18% share, Samsung took the top spot in 2023, for the first time since 2017.

- vivo took the second spot in 2023 with a 17% share and led the affordable premium segment (INR 30,000-INR 45,000, ~ $360-$540) with a 33% share.

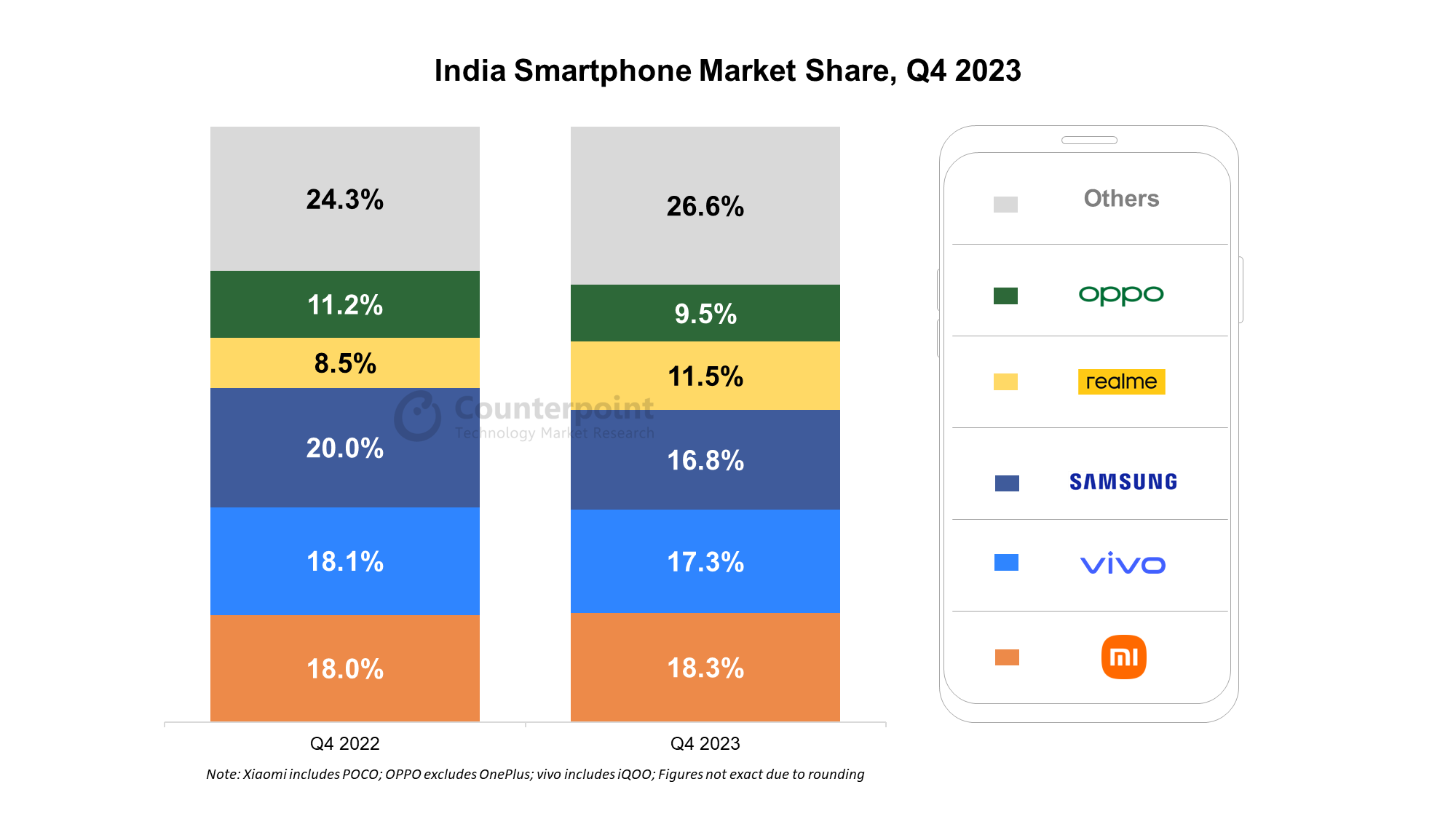

- Xiaomi slipped to the third spot in 2023 but led in Q4 2023 with an 18.3% share.

- Apple shipments crossed the 10-million mark, helping it capture the top position in revenue for the first time ever in a calendar year.

- 5G smartphone shipment share crossed 52% in 2023, growing 66% YoY.

New Delhi, Beijing, Boston, Buenos Aires, Hong Kong, London, San Diego, Seoul – January 31, 2024

India’s smartphone shipments remained flat in 2023 at 152 million units, according to the latest research from Counterpoint’s Monthly India Smartphone Tracker. The first half of the year was challenging due to ongoing macroeconomic turbulence leading to low demand and an inventory build-up. The market started recovering in the second half of the year supported by 5G upgrades and better-than-expected festive sales.

Commenting on the market dynamics, Senior Research Analyst Shilpi Jain said, “Driven by the premium segment’s growth and 5G upgrades, India’s smartphone market grew 25% YoY in Q4 2023 after declining for a year. The elongated festive season further aided this growth, as the availability of steep discounts, easy financing schemes and lucrative promotions boosted demand. For many OEMs, the key focus during the year was on taking 5G to the lower segment driven by a shift in consumer preferences. 5G smartphone shipment share crossed 52% in 2023, growing 66% YoY. The last quarter (October-December) exited the market with healthy inventory levels compared to last year, setting the right tone for growth for next year. We believe the market will grow by 5% YoY next year driven by premiumization, diffusion of 5G in lower price bands and better macroeconomic conditions.”

Commenting on the competitive landscape and brand-level analyses, Research Analyst Shubham Singh said, “Samsung led the market in 2023 with an 18% share driven by a strong performance of the A series, aggressive marketing in offline, and focussed approach in the premium segment. vivo ranked second with a 17% share and led the affordable premium segment in 2023 driven by CMF (Colour, Material, Finish)-focused V29 series in offline and T series in online. Xiaomi slipped to the third spot in 2023 but captured the top spot in Q4 2023 driven by its strategy to launch 5G phones in the affordable segment, offline expansion and a leaner portfolio.

The premium segment (>INR 30,000, ~ $360) witnessed a 64% YoY growth in 2023 driven by easy financing schemes, which resulted in consumers jumping price bands to purchase higher-priced smartphones. One out of every three smartphones was purchased through financing in 2023. Apple’s focus on India is also aiding the trend, with the brand surpassing the 10-million-unit mark in shipments and capturing the top position in revenue in a calendar year for the first time, propelled by robust demand for both its latest and older iPhones. The opening of own retail stores and increasing focus on LFR (large-format retail) through regular promotions contributed to increased offline shipments. Besides, higher trade-in values presented an appealing proposition for consumers to transition to iOS.”

Other key insights

Offline channel growth: Offline channels witnessed growth throughout the year to reach 55% share in 2023 driven by consumers’ preference for the ‘look and feel’ of the device. We believe offline channels will continue to grow in 2024 as well due to the ongoing trend of premiumization, increasing trade-ins and availability of more financing schemes.

Looking at 2024

- There will be a huge OEM focus on CMF across different price points, encouraging consumers to opt for the same.

- We expect a growing trend of audio-video enhancements in smartphones, powered by features like Dolby Atmos, Dolby Vision and Dolby Vision recording. Consumers can also share their video content on short-video platforms like Moj in Dolby Vision. Also, the incorporation of GenAI in smartphones is expected to contribute to the development of more personalized content and smarter digital assistants.

- Foldables will also become more popular in the premium segment as more OEMs are coming up with foldable devices. We believe that foldable shipments will cross the 1-million milestone in 2024.

Other notable brands

- OnePlus grew by 33% YoY in 2023 driven by offline expansion and better product portfolio in the affordable premium segment (INR 30,000-INR 45,000, ~ $360-$540).

- Transsion brands grew by 31% YoY mainly driven by a hybrid channel strategy, focus on bringing premium features to the affordable segment and strong presence in Tier 2 and Tier 3 cities. Infinix was the first brand to bring 8GB RAM and OLED to the sub-INR 10,000 (~$120) segment.

- Other brands that grew in 2023 were Google (111%), Lava (36%) and Motorola (13%).

The comprehensive and in-depth ‘Q4 2023 India Smartphone Tracker’ is available for subscribing clients.

Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights.

The Market Monitor research relies on sell-in (shipments) estimates based on vendors’ IR results and vendor polling, triangulated with sell-through (sales), supply chain checks and secondary research.

You can also visit our Data Section (updated quarterly) to view the smartphone market shares for World, US, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.