- Weak low-end Android sales impacted the overall US market’s growth.

- Apple was the best performer among key OEMs but still saw YoY declines.

- February could be stronger with Samsung’s Galaxy S24 launch likely to bring new competition.

San Diego, Boston, Fort Collins, Beijing, Buenos Aires, Hong Kong, London, New Delhi, Seoul – February 22, 2024

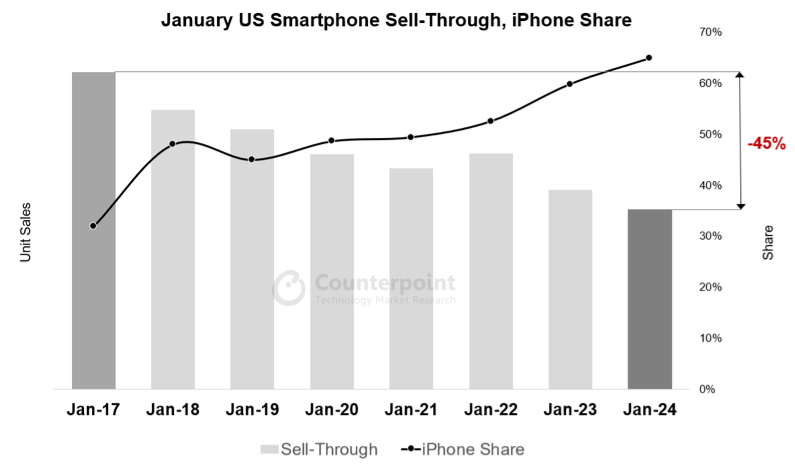

US smartphone sales declined 10% YoY in January, according to preliminary data from Counterpoint Research’s 2024 US Weekly Sell-through Tracker. This declining trend was mainly driven by the underperformance of low-end segments. The premium and ultra-premium segments performed better but overall upgrade rates remained tepid.

“Tough times in the volume-driven low end coupled with delayed upgrades in anticipation of new products drove the market lower,” said Senior Analyst Maurice Klaehne, adding, “But we are likely to see a rebound in February, especially as the Galaxy S24 series becomes available.”

Source: Counterpoint Research US Weekly Smartphone Tracker

Source: Counterpoint Research US Weekly Smartphone Tracker

Apple outperformed most brands with its iPhone continuing to gain share, though its sales were also down low single digits. “We continue to see strong promotions for the iPhone 15 series in postpaid, while there remains significant interest in older models like the iPhone 11 and iPhone 12 among cost-conscious consumers in prepaid. This combination is enabling Apple to maintain stability in a market experiencing double-digit declines,” observed Research Director Jeff Fieldhack, adding, “This is good for share gains and great for the iOS installed base.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research