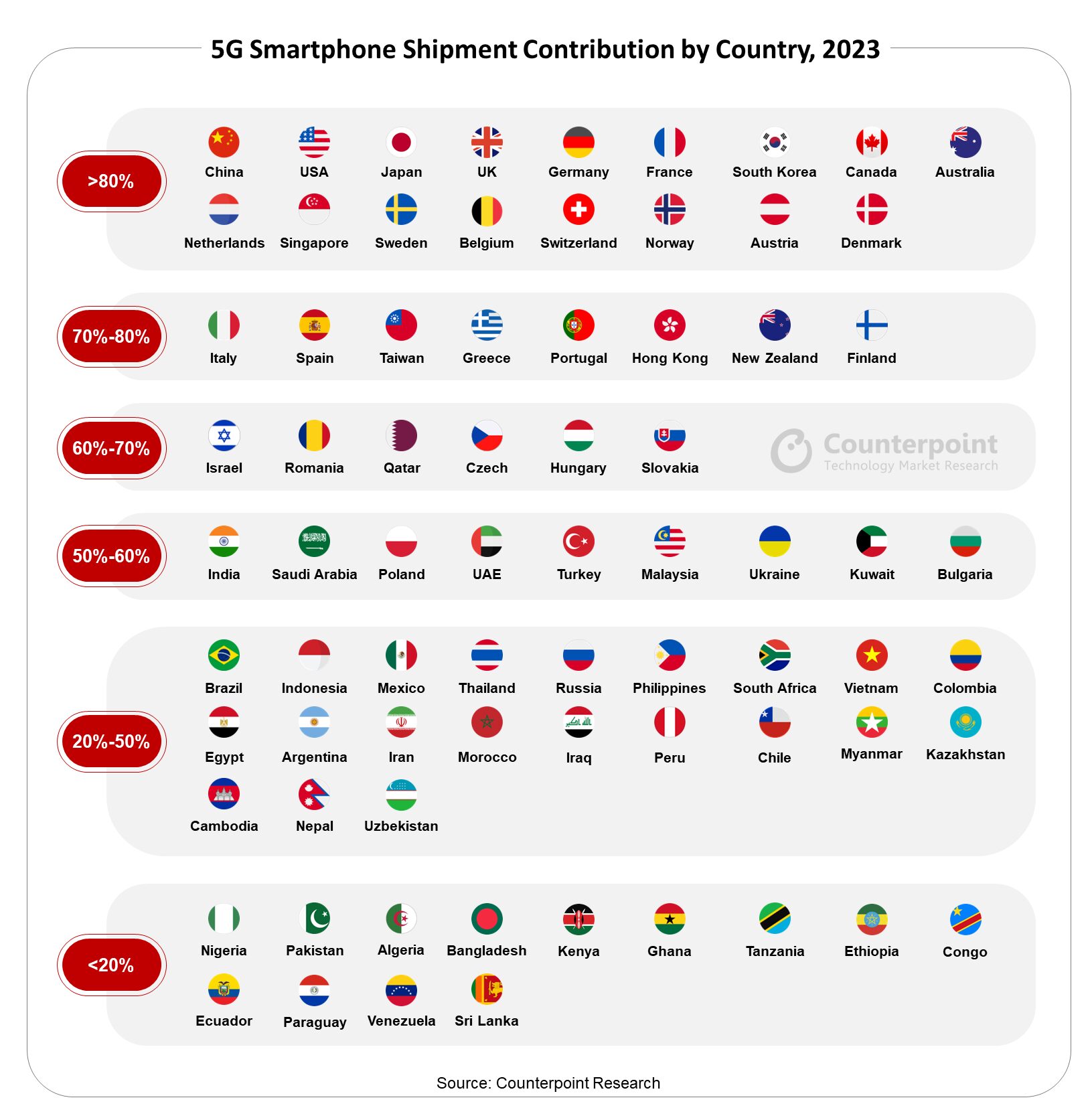

- Nearly 70% of all 5G shipments came from developed smartphone markets.

- Apple and Samsung were the top 5G smartphone brands, shipping over 1 billion 5G smartphones cumulatively.

- The launch of the iPhone 12 series, the first 5G-capable iPhones, significantly accelerated 5G adoption.

Seoul, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi – February 23, 2024

Global cumulative shipments of 5G smartphones surpassed 2 billion units in Q4 2023, according to Counterpoint Research’s Global Market Monitor Service. This milestone was achieved in less than five years, the shortest period when compared to previous technologies like 4G or 3G. It took 4G smartphones six years to reach this mark. Nearly 70% of all 5G shipments came from developed smartphone markets such as China, US and Western Europe. Apple and Samsung were the top 5G smartphone brands, shipping over 1 billion units cumulatively.

Smartphone brands have heavily promoted 5G capabilities and features while differentiating their offerings in a highly competitive market. The launch of the iPhone 12 series, the first 5G-capable iPhones, significantly accelerated 5G adoption, taking global 5G shipments to above 100 million units in a single quarter for the first time in Q4 2020. The momentum continued and the shipments hit a new record in Q4 2023, reaching 200 million units in a single quarter.

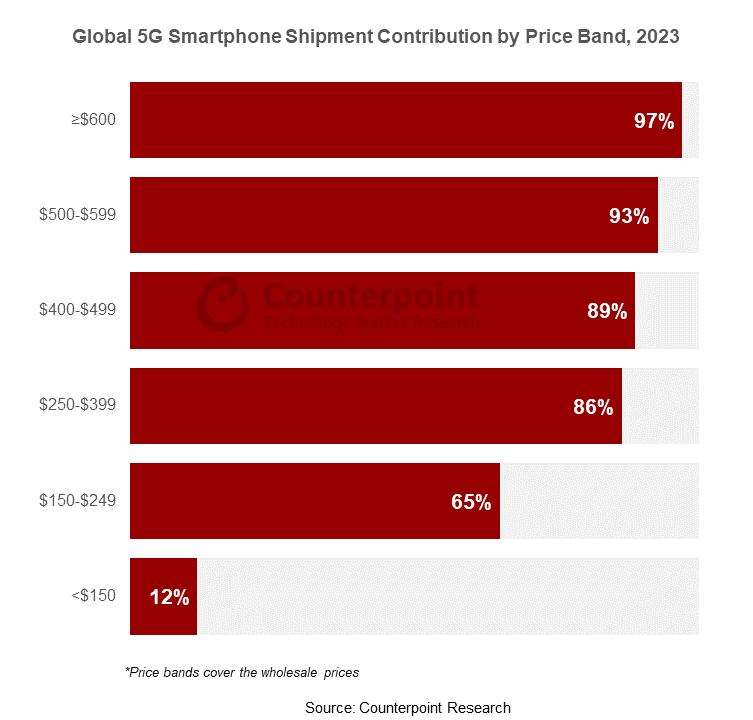

The affordability and accessibility of 5G smartphones have improved due to the narrowing price gap between 5G and 4G chipsets, along with strategic component selection by OEMs to maintain the bill of materials (BOM) cost. Besides, chipset players such as MediaTek and Qualcomm have helped smartphone OEMs to offer affordable 5G phones by launching entry-level 5G chipsets. All this has allowed OEMs, especially Chinese brands, to offer a wider 5G smartphone portfolio, particularly in mid and mid-to-high segments. Even in markets where 5G networks are not fully operational, consumers opt for 5G smartphones to future-proof their investment.

Developed markets are nearing saturation, with the contribution of 5G smartphones to the total shipments crossing 80% in 2023 led by the premium segment. Therefore, major smartphone players are introducing 5G capability as a common feature in their mid-range devices while introducing it in affordable segments. Further, there is higher consumer awareness and demand for 5G as a feature in the developing world where telecom operators too are expanding 5G coverage. 5G smartphones are equipped with all the necessary elements to penetrate the affordable segments of emerging markets. Therefore, emerging markets like India and Southeast Asia will drive the momentum for the next billion of 5G smartphone shipments.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com