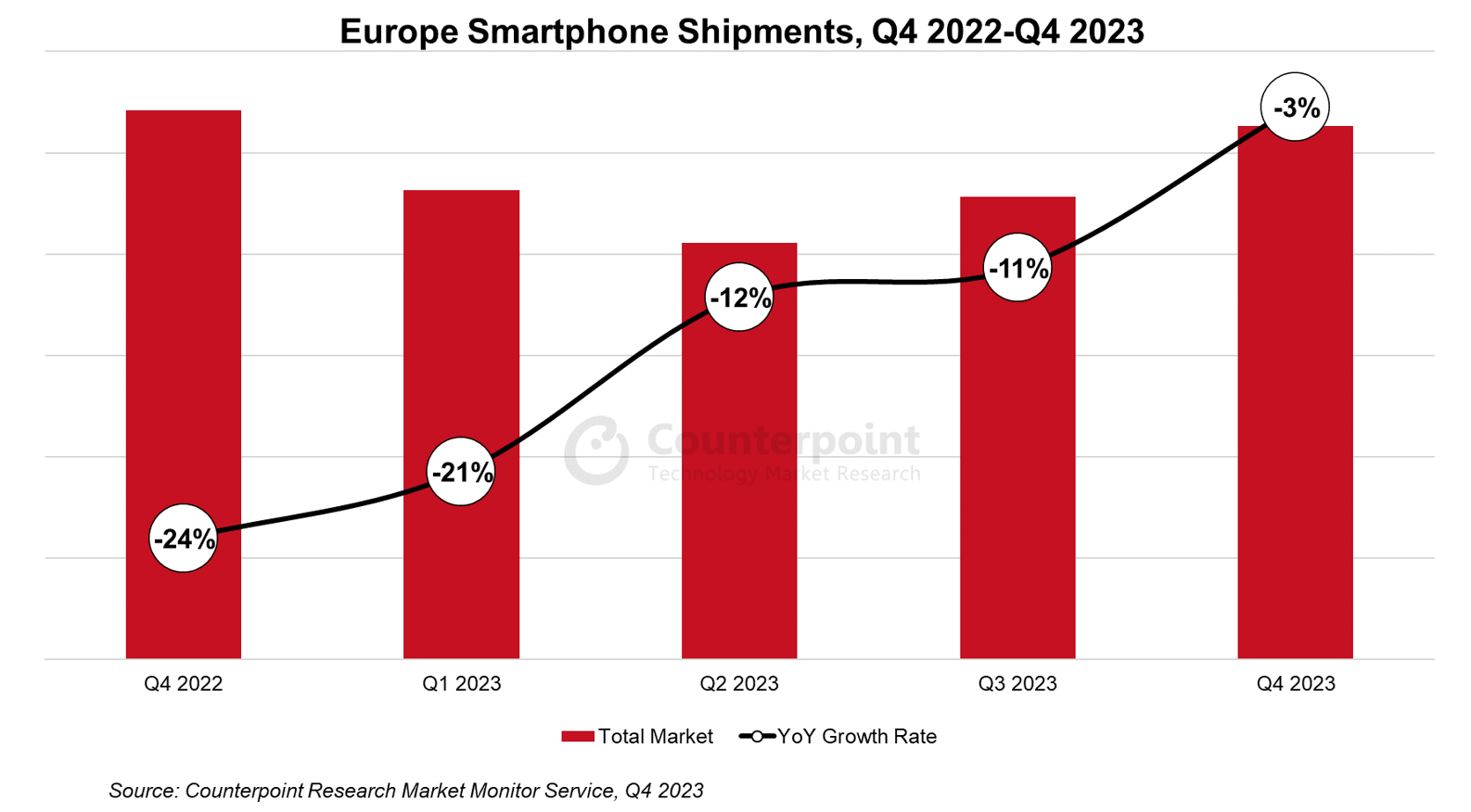

- European smartphone market contracts by only 3% YoY in Q4 2023, marking the first single-digit shipment decline since Q4 2021.

- OPPO and vivo’s 5G patent agreement with Nokia should kickstart a recovery for the vendors, although both have lost a lot of ground.

- Xiaomi registers highest Q4 shipments in Central and Eastern Europe since 2015.

London, New Delhi, Jakarta, Boston, Toronto, Beijing, Taipei, Seoul – February 26, 2023

Europe’s smartphone shipments declined 3% YoY in Q4 2023, according to the latest report from Counterpoint Research’s Market Monitor Service. This was much less severe than the 24% YoY drop registered in Q4 2022 and also marks the fourth consecutive quarter where YoY shipment declines improved from the preceding quarter, suggesting that the European market, which has been in a slump since Q1 2022, may finally have bottomed out. The Q4 2023 results were underpinned by improving macroeconomic conditions and successful new launches, including a delayed debut of the iPhone 15, which limited the decline in the region.

Commenting on the market dynamics, Research Analyst Harshit Rastogi said, “The worst seems to be over for Europe’s smartphone market as it registered a single-digit rate of decline for the first time since Q4 2021. Although Western Europe declined by 5% YoY, Central and Eastern Europe rose 2% YoY during the quarter. Some countries are recovering from their lowest-ever quarterly shipments, including key markets like the UK and Russia, which grew 6% YoY each.”

Commenting on the outlook, Associate Director Jan Stryjak said, “While 2023 was another difficult year for the European smartphone market, the annual contraction improved slightly from -17% to -12%. The region is expected to experience some relief in 2024 driven by Samsung’s early refresh for the A series along with the new S series which boasts impressive GenAI capabilities. Additionally, OPPO and vivo’s patent agreement with Nokia should bring further aid to the floundering market. Google and HONOR are also likely to increase their shipments in the region, especially in Western Europe, as consumers increasingly choose premium devices.”

Market Summary:

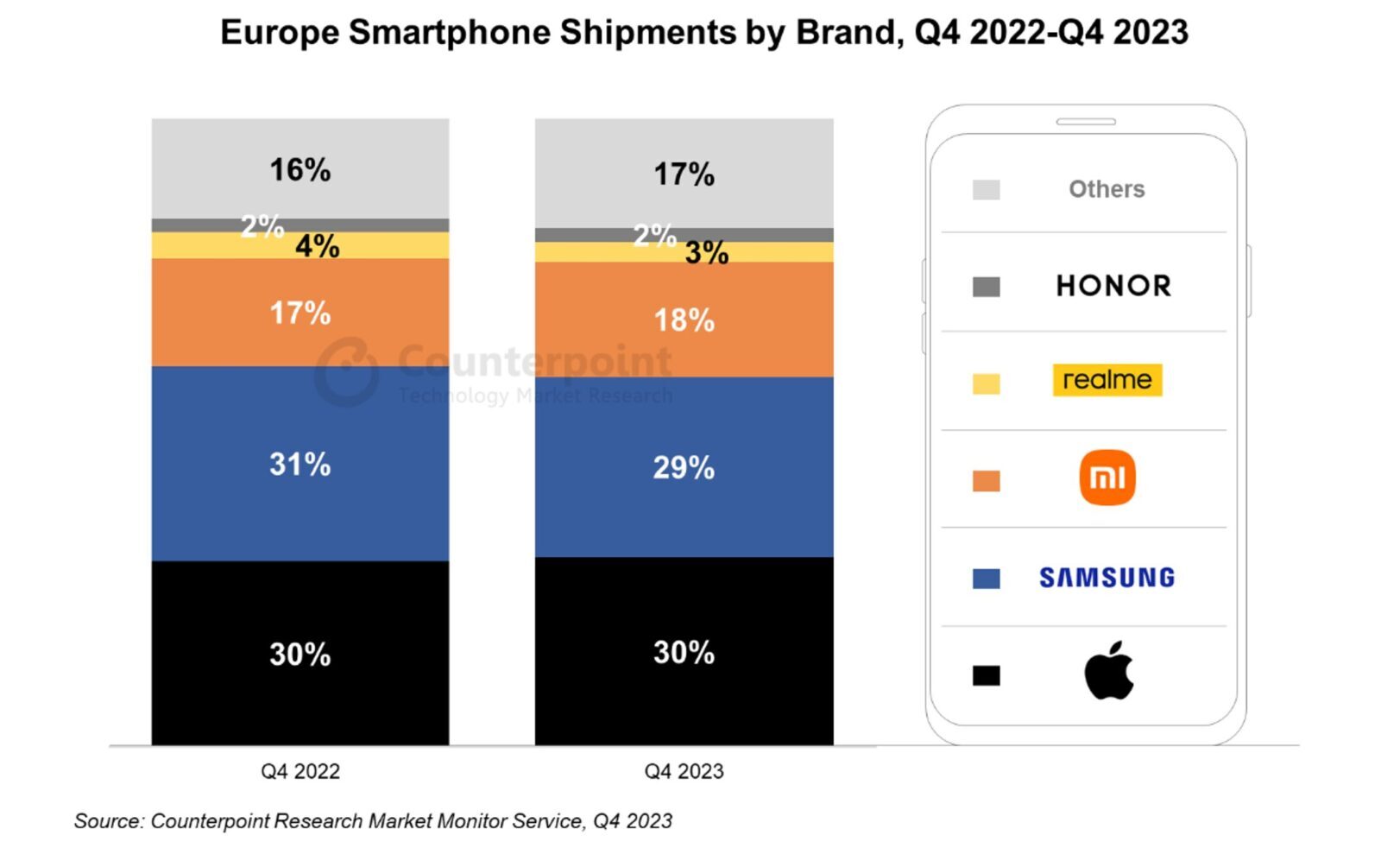

- Samsung declined by 10% YoY and recorded its lowest Q4 shipments since 2015. Promotional offers for the S23 series helped mitigate the decline in the premium market while the A series maintained its share in the lower and mid segments.

- Apple registered a record-high Q4 market share in the region despite recording its lowest Q4 shipment volume since 2015. A warm reception for the iPhone 15 series and continued demand for the iPhone 14 helped limit its decline to just 1% YoY in Q4 2023.

- Xiaomi was one of the few major OEMs to grow in Q4 2023, with shipments driven by its Redmi series targeting the mid-price bands and taking some share from Samsung. It gained further ground in Central and Eastern Europe helped by strong Q4 shipments.

- HONOR registered a 2% YoY growth in Europe overall, driven by Western Europe where its 31% YoY growth offset a 21% decline in Central and Eastern Europe. The brand has substantially widened its portfolio from that in Q4 2022, reflecting its growing ambition in the region.

- OPPO’s troubles continued in the region resulting in a 59% YoY decline in Q4 2023. The brand signed a 5G patent with Nokia in early 2024, which should spark a recovery in the coming quarters. However, OPPO may have lost too much ground to the likes of HONOR and Google.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com