Southeast Asia (SEA) has been facing a fresh wave of COVID-19 for the past three months. While the cases are coming down in most of the region, full recovery will take some time. The pandemic has impacted the mobile phone OEMs’ business as most of the region, including the four biggest markets of Indonesia, Philippines, Vietnam and Thailand, is dominated by offline sales channels. However, the restrictions on movement triggered by COVID-19 have pushed the region’s e-commerce sales and revenue to new levels, just like in other parts of the world.

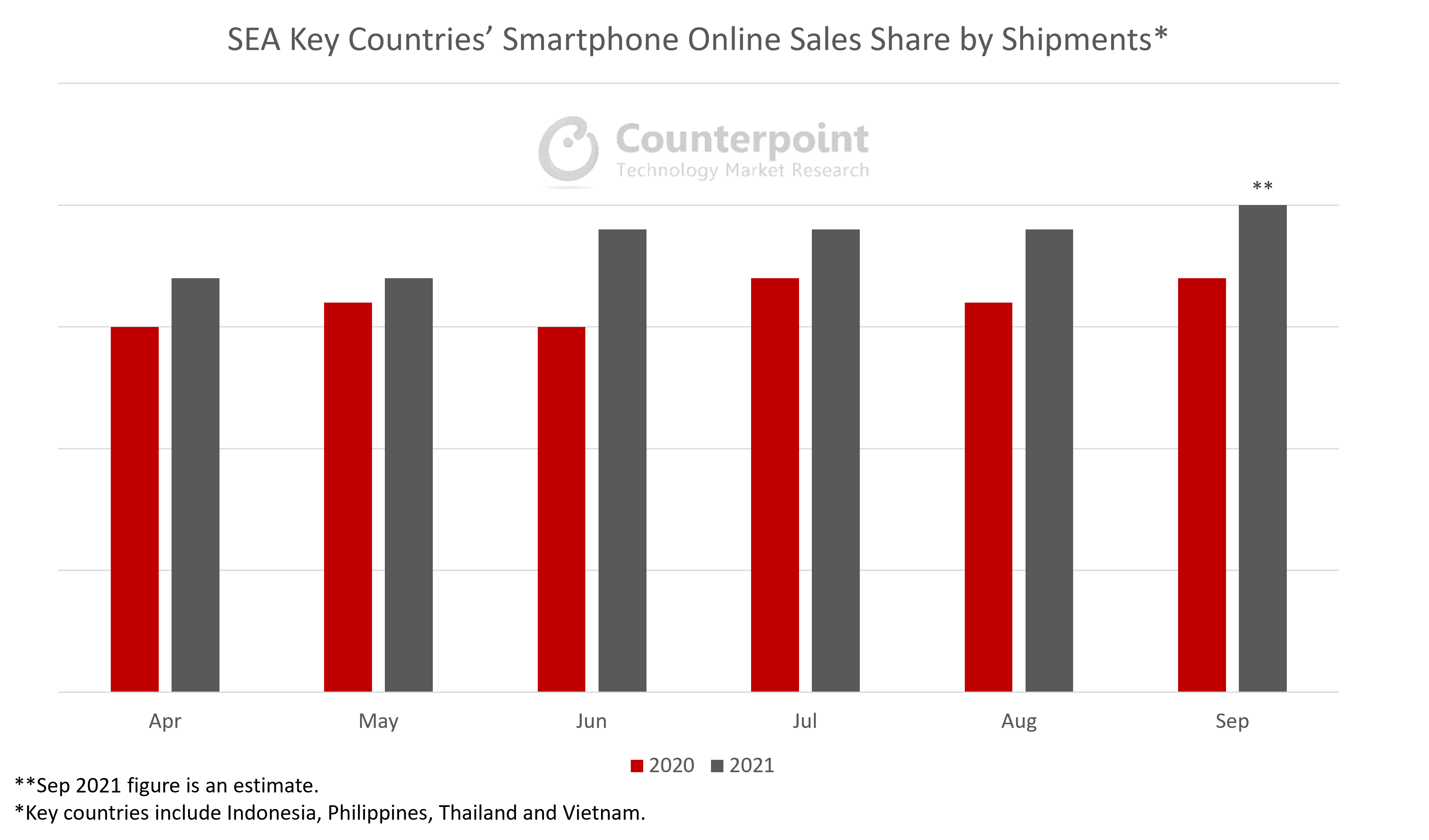

Counterpoint Research’s SEA Channel Tracker shows that in August 2021, online smartphone sales share in SEA’s key markets, including Indonesia, Philippines, Thailand and Vietnam, reached a record high at 20% of the overall shipments. Apart from the immediate reason of the pandemic, there are other factors pushing this e-commerce growth:

- Big Chinese e-commerce players, like Alibaba, JD.com and Tencent, and some Singapore investors continue to make strategic investments in SEA markets.

- Local investors and tycoons are also keen to be a part of the growth story.

- With a median age of around 30, Southeast Asia’s population holds big potential for e-commerce as young people are more likely to try and adopt new things. During the lockdown in September, Vietnamese were told to book vaccination slots online via government channels. Besides helping their families book these slots, young people also assisted them in buying food online.

In the past three years, essential conditions have improved to accelerate the development of e-commerce in the region:

- Development of e-wallets and payment gateways: E-commerce giants, ride-hailing services, banks, carriers and even governments are pushing e-wallet penetration. In the past, with the traditional banking systems, the rate of bank account ownership was relatively low in SEA. This was due to the inability of many to provide the documents required to open a bank account. But this changed with the new technology and mechanism of e-wallets.

- Logistics improvement: Besides the traditional local logistics companies, foreign logistics giants and investors have also set up subsidiaries or invested in existing players in the region to support e-commerce.

- Platform incentives: Typical cases are the e-commerce giants Shopee and Lazada, which have big sales events every year. These have more than 30 big and small promotions in which the platforms, together with the merchants, offer various subsidies and discounts to encourage online purchases.

Smartphone OEMs are becoming more and more mature in online channel strategy and planning:

- OEMs or local distributors have dedicated teams to manage online channels.

- Online-exclusive models are being designed. They have a special channel margin structure. An attractive price point is one of the most essential requirements for online sales conversion.

- Factors such as flagship online stores and 7-14 days unconditional return policy are convincing the consumers about the credibility of online channels.

We strongly believe that Southeast Asia will be the next e-commerce hotspot and smartphone OEMs will surely ride this wave.