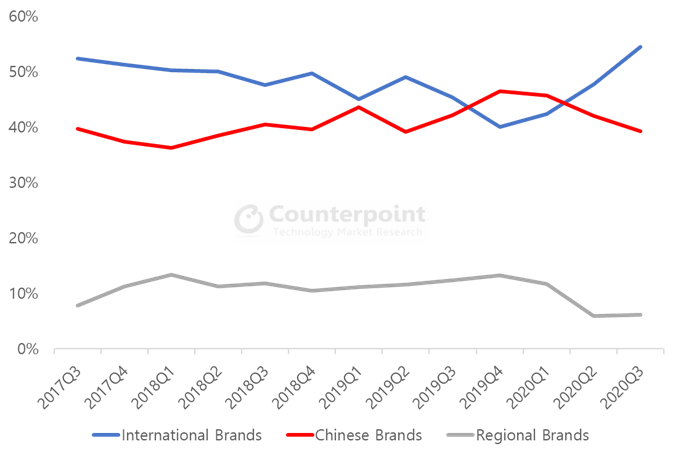

Latin America’s smartphone market dynamics have changed significantly in 2020. Sales plunged in H1 2020 as the COVID-19 pandemic forced closure of stores amid lockdowns. The third quarter not only saw the sales reviving but also a dramatic change in the region’s brand landscape compared to the same period in 2019. In Q3 2020, the share of international brands (includes Samsung, Apple, Nokia, Asus, etc.) increased by 6% YoY at the expense of Chinese and regional brands, with each shedding a 3% share.

Exhibit 1: LATAM Brand Origin Share, Q3 2017 – Q3 2020

Source: Counterpoint Research Market Monitor, Q3 2020

Huawei used to be the second best-selling brand in LATAM, but it lost share sharply due to the tightening of the US trade ban. Motorola and Xiaomi took much of this share. But still Samsung alone had more than 45% of the market in Q3 2020. So, both operators and retailers are looking for brands that can challenge Samsung’s dominance in the region.

With all this context, Chinese brands OPPO, realme, vivo and OnePlus have set their sights on LATAM. All these brands are already available in small quantities at a few online marketplaces in the region. But now they are setting up teams and offices in the region. Interestingly, these brands have adopted a ‘divide and conquer’ strategy, with each brand entering a different country, trying not to step on each other’s toes.

realme has already announced its official launch in Colombia, Brazil, Chile and Peru. But so far it has set up offices in Colombia and Chile only. In the case of Brazil, realme is currently selling two models through some marketplaces and has promised their delivery by Christmas. But these models are not yet available through national retail or operator channels.

OPPO has set its foot in Mexico, selling its models through the country’s two major operators – Telcel and AT&T. In the short term, OPPO may not enter any other country in the region.

Meanwhile, vivo is launching in Chile and Colombia. In September, vivo set up an office in Chile after opening one in Colombia in August in the middle of the COVID-19 lockdowns. vivo models are sold through retail channels in Colombia and local operator Entel in Chile as it is an operator dominated market.

It is clear that vivo and OPPO will not compete for market share, while realme will be positioned as the low-cost option.

These are not the only Chinese brands looking to enter the region. Others such as Tecno are also looking to fill the gap left by Huawei. So far, the volume of such brands does not surpass 30,000 in any country in the region and is not expected to increase much in the short term. It takes some time to attain high volumes in this brand conscious region. Xiaomi, for example, entered LATAM in 2015 but was able to cross the one million mark in quarterly shipments only in 2020.