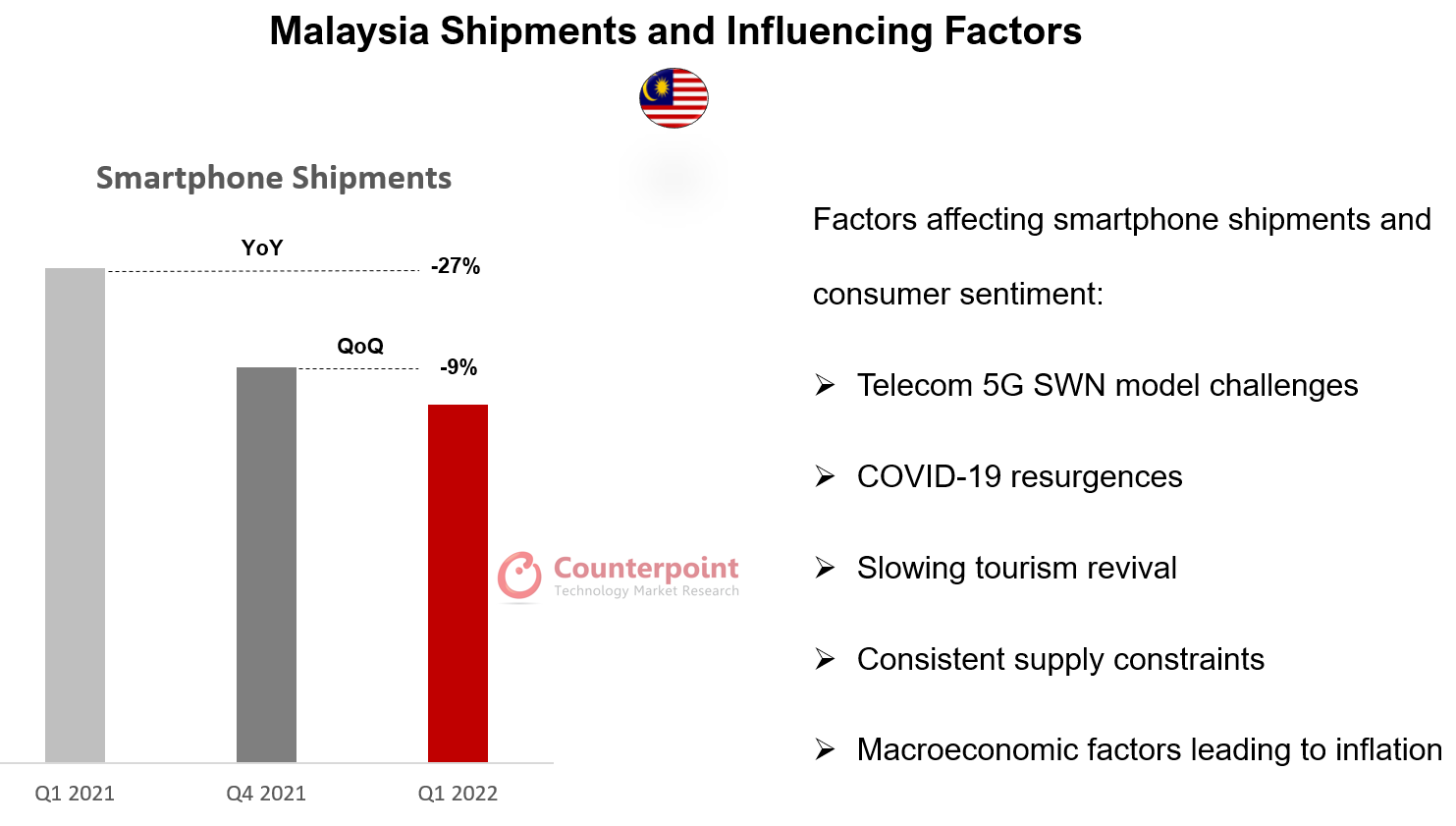

Malaysia’s smartphone market went through its seasonal dip in volumes in Q1 2022, but there were other factors at play as well. According to Counterpoint Research’s Southeast Asia Monthly Smartphone Tracker, not only did Malaysia’s smartphone shipments fall 9% QoQ in Q1 2022 but also dropped 27% YoY, which is notable. Apart from factors like supply constraints, COVID-19 resurgence and drop in tourism revenues, the decline can also be attributed to issues related to 5G spectrum allocation.

5G Conundrum

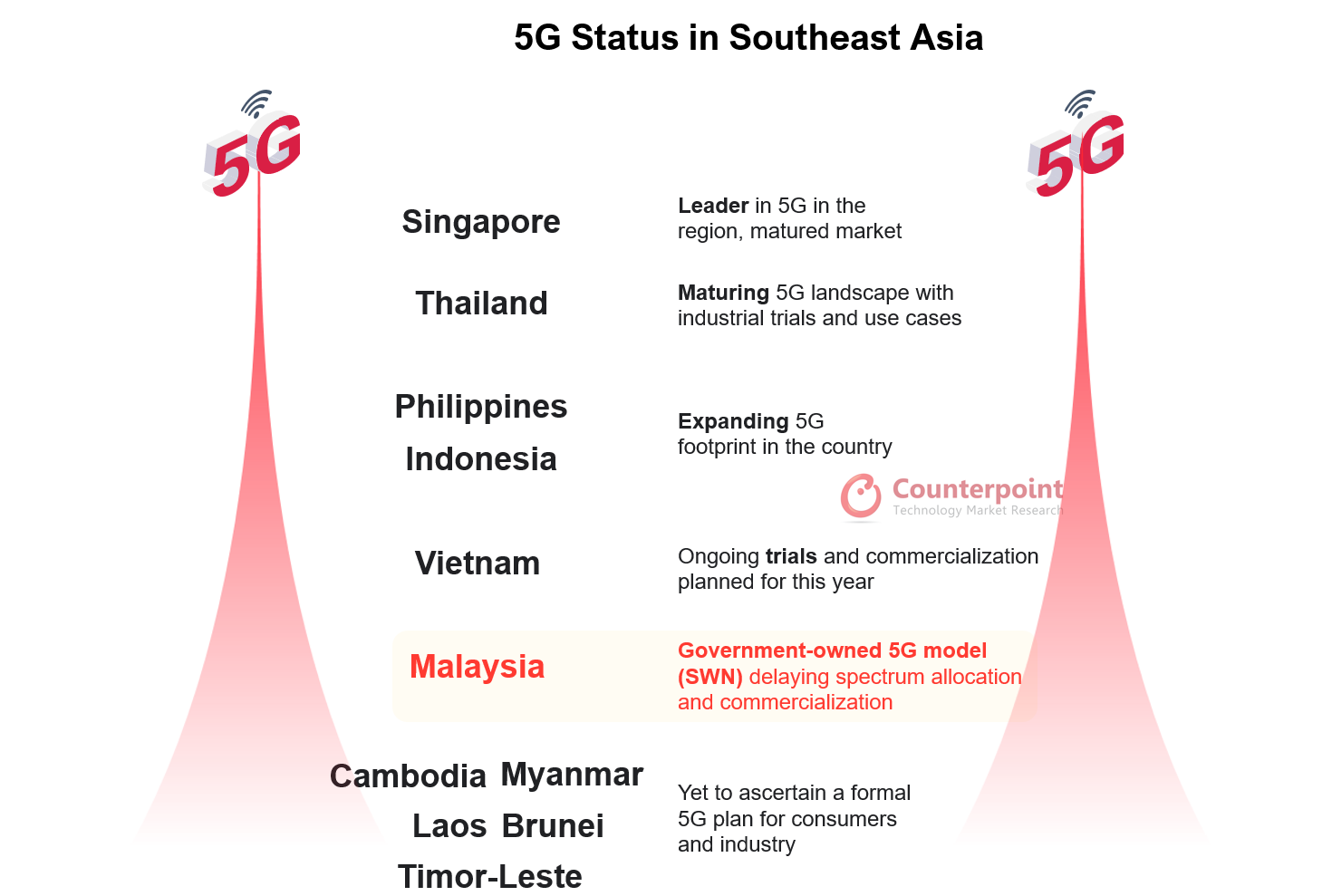

Malaysia is going through an extended negotiation phase in the telecom sector. The two sides here are the government and the four main operators in the Malaysian telecom landscape – Maxis BHD, Celcom Axiata BHD, Digi Telecommunications and U Mobile. These four operators have recently requested a review of the government’s 5G access offer as they want at least a 51% stake in the government-owned 5G agency DNB. They are also looking for a review of the access offer with regard to the pricing plan and network access plan offered by the government. Cost and transparency seem to be a concern here, while control and profit are at stake.

While the government and operators continue to re-pitch propositions and cement their stance on the government-run 5G model, other segments of the industry and consumers are making sure their interests are not affected. OEMs continue to launch 5G smartphones in a country where digital transformation is in full swing, with 28% of smartphone shipments in Q1 2022 coming from 5G-compatible models.

Economy

With a 5% YoY GDP growth in Q1 2022, the country is riding high and promising to show further growth on account of high domestic demand, consistency in external demand and an improved labour market. While the retail industry and offline channels have opened, the manufacturing sector has grown in the first quarter as well. There would have been an added layer of excitement leading to higher achievements had the 5G situation not escalated over the past 18 months. Industrial propulsion is thus limited due to the absence of 5G use cases.

Covid Effect

The country was reeling under its worst COVID-19 resurgence in the second half of Q1 2022, which handicapped a big portion of the offline channel dynamics, leading to much lower shipments. However, April onwards, the country is seeing relaxation in curbs on not only domestic movement but also international travel policies. If supply constraints reduce, we may see much better Q2 and Q3 on account of pent-up demand.

Consumer Front

A big portion of the Malaysian smartphone-using population is tech-savvy. Many consumers have already transitioned to using e-commerce, e-banking, e-finance, digital and social marketing, and other platforms. There are several actively growing consumer sub-genres in the form of gamers, power users, consumers switching from feature phones, and more. At this point, there is a growing frustration as the people have access to 5G devices, they have the know-how and are motivated, but still can’t access 5G. The lack of 5G infrastructure and commercialization is limiting Malaysia’s growth potential in a very important sector — technology.

The Malaysian smartphone market is promising for the region and its consumer base is one of the most versatile with regard to technology. The 5G situation, however, needs to catch up with government and industry momentum. The coming months may see higher volumes for the smartphone market, but it will see an overall development only when 5G is commercialized.