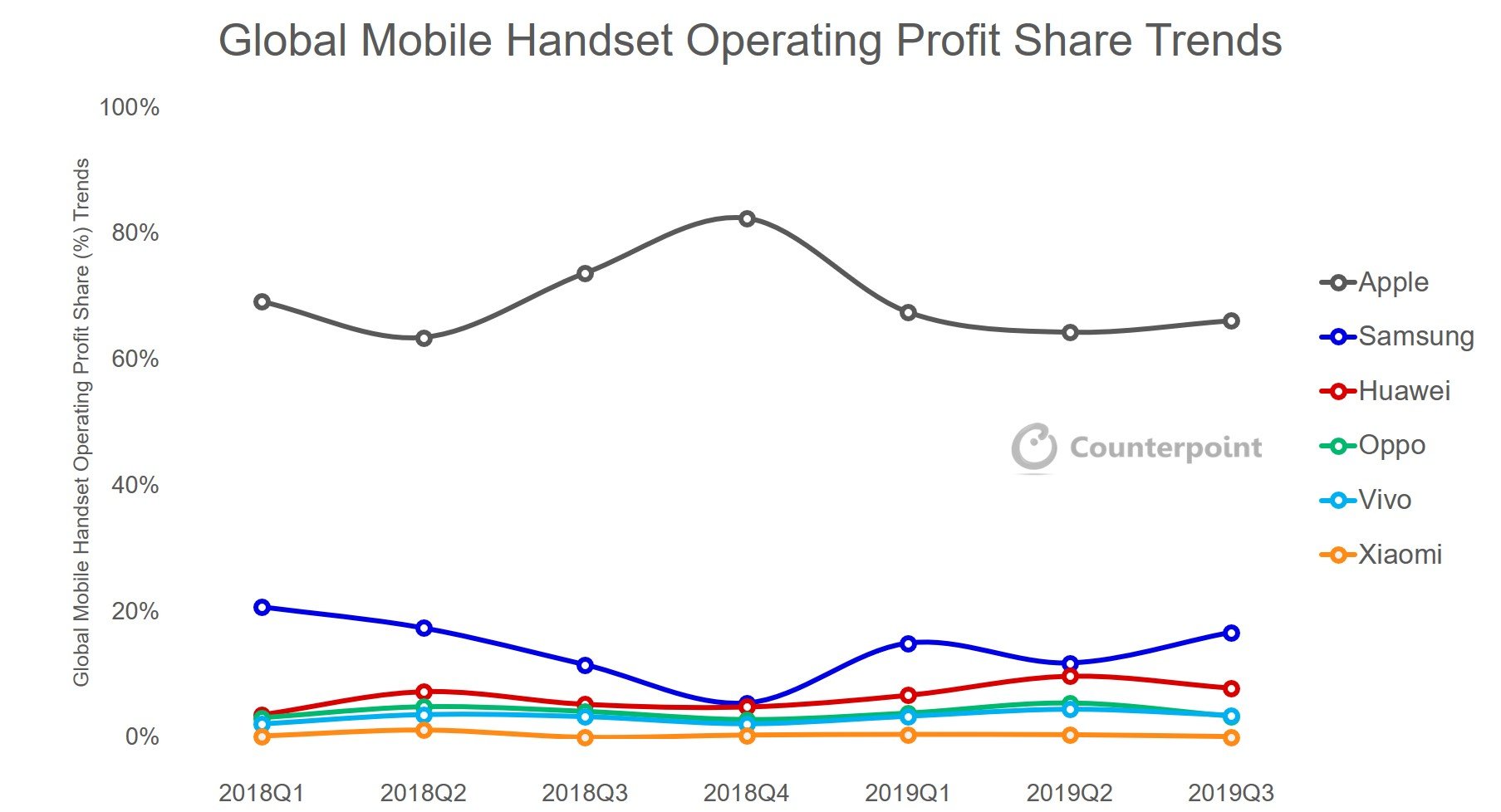

Overall global handset profits declined 11% YoY to USD 12 billion in Q3 2019 due to an increased mix of entry to mid-tier products and a fall in revenues for key smartphone OEMs. Within the top ten brands, only Samsung and Huawei managed to increase their revenue on an annual basis. Additionally, the replacement cycle for premium smartphones has lengthened as recent hardware features have been unable to offer an attractive reason to upgrade.

Apple dominates the global handset market by capturing 66% of industry profits and 32% of the overall handset revenue. The loyal premium user base in the major markets like the USA, EU and Japan is one of the reasons that Apple can still operate at a profit level that its competitors can only wish for. Now with a strong service strategy, Apple’s overall ecosystem is strong enough to guarantee it a steady inflow of revenue in the coming years. In the immediate future, we believe that Apple’s profit for the holiday season will increase with the new line up of iPhones gaining good traction.

Samsung is a distant second, taking 17% of the overall handset Industry profits. The increased mix of Galaxy A Series along with the positive start of Galaxy Note 10 Series was the key reason for the growth.

Chinese smartphone brands operate at low-profit margins, but better than in previous years, even though they are expanding outside China and also penetrating high-tier price bands. Chinese brands offer attractive propositions to mature smartphone users with new feature-packed flagships at affordable prices. Some of these Chinese brands are also now looking at monetizing their userbase by launching services like financial services, IoT products and others. However, it is becoming a challenge for Chinese brands to increase their smartphone ASPs and margins due to a combination of longer consumer holding periods and Apple lowering pricing on some key SKUs, which has limited the headroom that Chinese vendors had used to increase their ASPs.

In coming quarters, the adoption of 5G will drive some upgrades. This will likely lead to revenue growth for OEMs which are already preparing themselves ahead of full 5G commercialization. For example in China- Huawei, Oppo, Vivo and Xiaomi will gain from aggressive 5G push and use this opportunity to increase their ASP. While revenue growth is probable, bill of materials (BoM) costs will also tend to rise, so profit margins may not benefit to the same extent,

*This analysis includes normalized (only positive) operating profit.