It has been exactly a year since Fingerprint Cards (Fingerprints) announced that it had shipped one billion fingerprint sensors since its inception. We believe the next billion sensor shipments will see an increased mix of use cases across different industry segments and form factors. While smartphones will continue to drive the volume, there are other growth areas that will likely develop faster, especially in a post-COVID-19 era. One among them, we believe, is biometric payment cards as the need for secure and hygienic contactless payment methods increase.

A biometric payment card works by using biometrics (iris, facial, or fingerprints) to address multifactor authentication. Currently, fingerprints are used as the key form of biometric identity in biometric payment cards. In biometric payment cards, the verification is done directly on the card while retaining existing POS infrastructure.

This Insight will highlight opportunities in the area of biometric payment cards and also in the under-display smartphone sensor.

Fingerprints has always been known for its biometric innovation and has been a leader in biometrics since 1997. Expertise in biometric systems consisting of sensors, software, algorithms, and tools puts it in a strong position to expand into new application areas, including biometric smart cards. E.g. Q4 2019 saw the world’s first commercial launch of biometric payment cards by Cornèrcard in Switzerland, which included Fingerprints’ sensor module and software platform for payments. Fingerprints’ solution with Thales later achieved the first certification from a major payment network. Fingerprints were also a part of the UK’s first market trial for biometric payment cards by NatWest, partnering with Thales. This is a result of last year’s partnership of Fingerprints and Thales where the latter will offer EMV payment cards to banks powered by Fingerprints’ sensor and biometric software platform. There have been other notable announcements in the space. There are other players too which are active in the space and collaborating within the value chain to provide cost-effective solutions. Idemia recently chose IDEX biometrics to provide biometric sensors to be integrated into its new biometric payment cards. Idemia also signed an exclusive partnership and distribution agreement last year with Zwipe to co-invest in a platform to bring biometric payment cards to the mass market. More partnerships in this space will be crucial for mass adoption.

Fingerprints conducted a study in China, France, and the UK which indicates consumer appetite for biometric payment cards. This initial positive response should accelerate the large scale commercial roll-outs of the biometric payment cards. The ongoing pandemic will ensure that consumers are likely to increasingly favor contactless card payments.

Cash is facing strong competition from digital payments, with contactless cards and mobile payments rising. Alongside this, there is a sizeable market for the adoption of biometrics in card payments. It’s a similar transition to that from feature phones to smartphones when comparing a normal card to biometric cards with respect to security and the role of security in contactless card payments being paramount to its continued success. In an industry controlled by three big players Visa, Mastercard and American Express (capturing 3/5th of the card market) a push by any one or two of the players to contactless will see adoption accelerating and we have already seen the signs of the same. Some regions are aligned well to leverage this opportunity like contactless payments works in Europe because of the universal provision of contactless points of sale terminals. Mastercard has recently enabled a contactless limit raise in 29 European markets and also ensured all payment terminals became contactless-ready from 1st January 2020. 75% of all Mastercard transactions across Europe are now contactless and this makes a strong case for the adoption of biometric cards in Europe followed by other countries such as China. Recently the FPC-BEP (biometric software platform from Fingerprints) and T-Shape fingerprint sensor solution, passed the accuracy and security test performed by the Bank Card Test Center (BCTC) in China. Currently, 21 out of the 21 announced dual-interface biometric payment card market trials use biometrics by Fingerprints

Another positive development for Fingerprints in this space includes a global license agreement with FEITIAN (a leading supplier of two-factor authentication and smart-card-based security solutions) for Fingerprints’ biometric software platform, combined with a volume agreement for sensors. The agreement applies to biometric cards and various types of access devices.

We believe that the current COVID-19 pandemic is likely to accelerate the contactless card’s adoption as businesses and banks will favor more hygienic and secure transactions, a biometric card performs well in this context. According to a Nilson report from October 2018, there are 20.48 billion debit, credit, and other prepaid cards in circulation worldwide. Therefore even a single-digit adoption of biometric cards over the next five years will be a big business opportunity for Fingerprints. However, there is a likely competitor in the form of mobile payments too where adoption has been increasing and heavy smartphone and wearables users are likely to drive this going forward. Mobile payments also lead to lower operational costs and transaction fees for retailers.

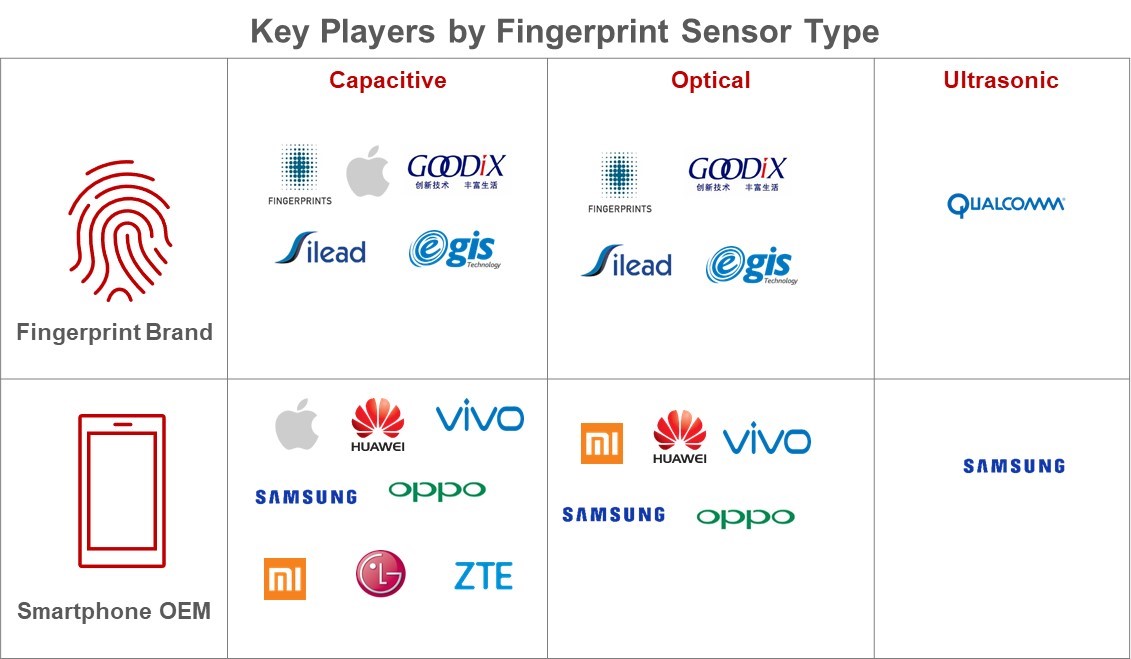

Now let us talk about the other opportunity in mobile phones. The smartphone market is the biggest segment for the fingerprint biometrics industry. Strong relationships and partnerships with the smartphone value-chain are essential for fingerprint biometrics players to target this fast-changing market. The penetration of fingerprint-enabled phones in total global smartphone sales reached 70% in 2019. The considerable adoption of the fingerprint sensor in smartphones over facial unlocking, iris scanning, voice, etc is driven by the technology’s sophistication and efficient cost. Fingerprints is already leading in the active capacitive fingerprint sensor solution market for smartphones. The capacitive fingerprint sensor is the preferred solution as it’s a low-cost solution and a mature technology. It contributes to roughly half of the smartphone market which is led by Fingerprints Cards and Goodix. We believe the capacitive sensors will remain dominant in the low-to-mid price segment due to the increasing adoption of biometric security and their low cost which is important of this price segment

Top smartphone OEMs rely on several fingerprint suppliers such as Fingerprint Cards, Goodix, Egis, Qualcomm, etc.

However, we expect the penetration of under-display fingerprint sensors will increase. This also presents a big opportunity for Fingerprints. The trend of achieving bezel-less, full display, foldable and flexible designs is creating demand for under-display fingerprint sensor solutions. In 2019, under-display sensor penetration reached 14%. Optical and ultrasonic fingerprint sensors are suitable options for smartphone OEMs to achieve these designs.

Qualcomm has partnered with Samsung to deliver an ultrasonic fingerprint sensor solutions in its flagship devices. But the adoption of the ultrasonic sensor is low given it’s a new solution with a high cost. However, we believe the optical sensor for under-display designs will exceed ultrasonic adoption, given the cost factor. Several fingerprint solution providers are targeting the optical sensor segment. Fingerprint Cards and Silead are looking to challenge Goodix and Egis which are leading the segment and should provide a good business opportunity.

This was also highlighted in the recent earnings report of Fingerprints where its CEO, Christian Fredrikson said, “We are continuing our work to capture the position in a growing market for under-display sensors. We are now running a few R&D tracks in this area with different time horizons. So far, we have not secured any design wins. But our ambition of capturing a significant share of this market remains. It has taken more time than we initially estimated to enter this market, but we will continue our work, as it is important for us to ensure the high-level of security and quality that Fingerprint is known for before we launch.”

Fingerprints launched its Touchless 2.0 platform late last year by combining iris and facial recognition for a compelling combination of convenience and security. We also believe that as there is an increasing focus on security, especially for personal computing devices, the user will gradually adapt to newer trusted biometric experiences for personal devices.

As the use of biometric solutions increases, Fingerprints is currently looking to broaden its offering by appealing to other market segments, such as smartcards, PCs, automotive, biometrics for access control applications, and other IoT devices. Fingerprints’ strong background in trusted biometrics, along with inhouse IP and testing, and a complete solution in hardware and software, should position it strongly to leverage upcoming market opportunities.