- In 2022, global smartphone image sensor shipments were estimated to drop by mid-teens YoY.

- Global smartphone image sensor revenues were down around 6% YoY during the year.

- Sony was the only major vendor to achieve a YoY revenue growth, thanks to Apple’s camera upgrades.

- Both Sony and Samsung managed to improve their product mix.

The global smartphone image sensor market had a disappointing 2022. Even as the annual smartphone shipments dropped nearly 11% amid the unfavorable macro environment, the multi-camera trend decelerated with less adoption of low-pixel cameras for depth-sensing and macro-lens applications. The related CIS (CMOS Image Sensor) sales entered a period of contraction and a sizable inventory correction was made to alleviate the oversupply situation, particularly for 8MP and lower-megapixel sensors.

According to Counterpoint’s Smartphone Camera Tracker, global smartphone image sensor shipments were down mid-teens compared to 2021, with all major vendors suffering different degrees of decline. But when it came to the revenue in dollars, Sony managed to achieve a YoY growth as Apple, which was estimated to have contributed half of Sony’s mobile CIS revenue, further improved the iPhone camera specs during the year.

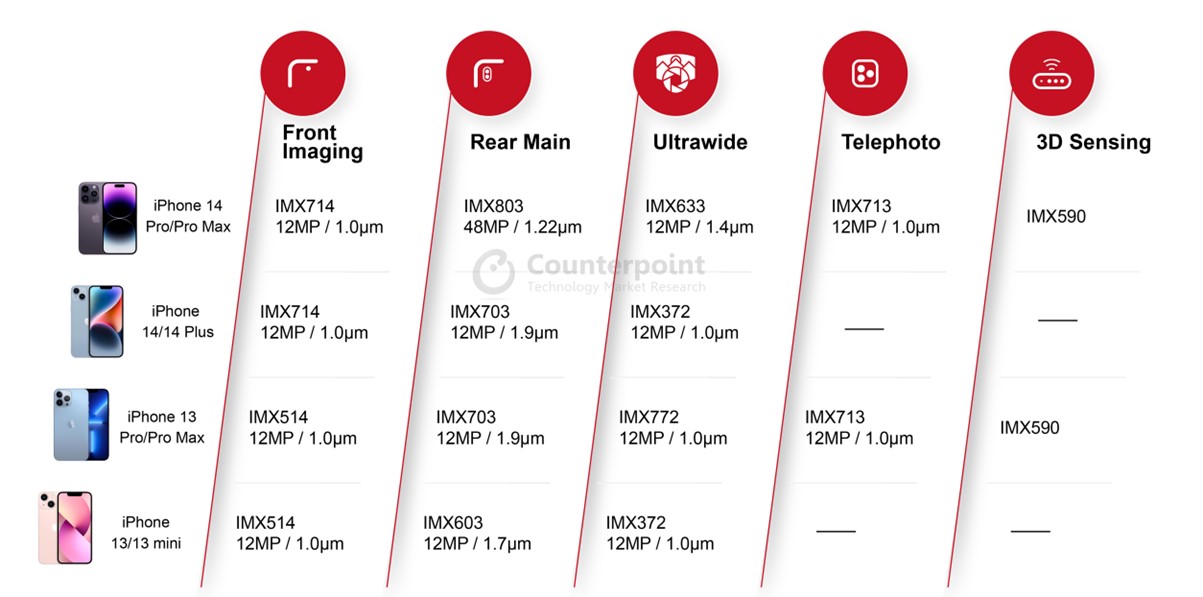

Sony Benefits From Apple’s Image Sensor Upgrades

Source: Counterpoint BoM analysis service

For instance, the iPhone 14 Pro and Pro Max feature a brand-new 48MP image sensor for their rear main cameras, a larger-size ultrawide sensor and an autofocus-capable front sensor. Thanks to the upgrades, Sony was estimated to have added more than $6 per unit or approximately $300 million in sales in the second half of 2022.

In the Android camp, Samsung LSI also benefited from the camera enhancement trend and improved its product mix, which partially offset the significant loss in shipments. Taking the first-mover advantage in mass-producing sub-0.7μm high-resolution sensors, Samsung shipped an estimated 200 million affordable 50MP image sensors in 2022. The 0.64μm-based Samsung S5KJN1 was a great success. It has good versatility and has been widely applied not only in mid- to low-end smartphones’ rear main cameras but also in front or ultrawide cameras of premium models. Moreover, Samsung still dominates the supply of 100MP and above sensors and has raised the bar higher with the commercialization of 200MP sensors (ISOCELL HP1 @ 0.64μm, HP3 @ 0.56μm). By the end of 2022, the accumulated shipment volume had exceeded 150 million units.

Unlike Sony and Samsung, which shifted their focus to providing high-megapixel products, the sales performance of OmniVision, Galaxycore and SK Hynix was more susceptible to the contraction in mobile CIS demand. All these three vendors were estimated to have recorded a double-digit YoY decline in their revenues in 2022.

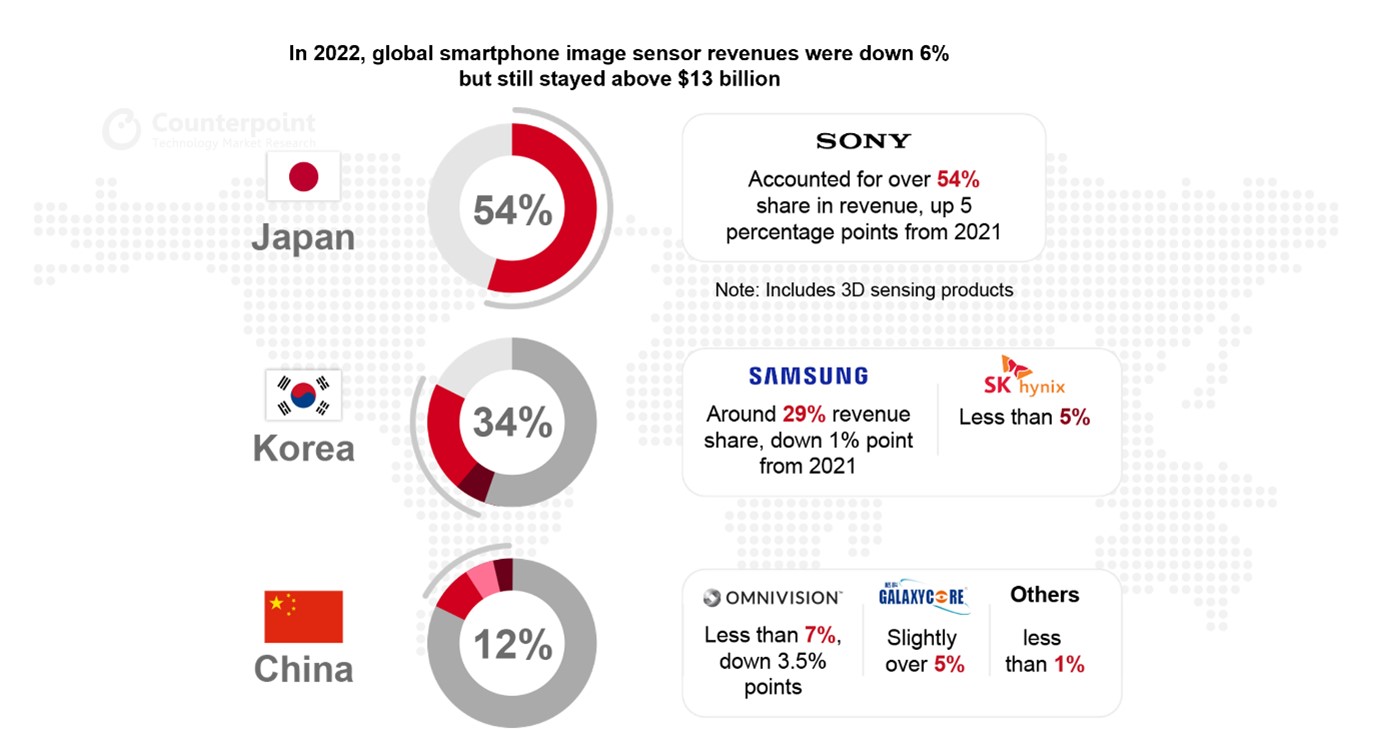

Smartphone Image Sensor Market Share By Vendor, 2022

Source: Counterpoint Smartphone Camera Tracker

The smartphone CIS market became more consolidated in 2022 in terms of revenues. Sony expanded its share to slightly over 54%. The top two vendors accounted for around 83% of the total market revenue. The market consolidation is expected to continue in 2023. Samsung’s new 200MP lineup and Sony’s large-area 50MP sensors, such as the high-profile IMX989, will compete for the premium camera design wins. Despite the shipment and revenue declines in 2022, we expect the mobile CIS market to quickly return to the growth track, as long as the camera system is still at the core of smartphone upgrades, thus resulting in improvements in resolution, sensor size and even integration of AI capabilities.