Boston, Toronto, London, Hong Kong, New Delhi, Beijing, Taipei, Seoul – 3 June 2021

The global TWS hearables market managed to sustain its growth trend in Q1 2021 despite the pandemic-triggered economic fall. According to Counterpoint Research’s latest Global Hearables (TWS) Market Report, TWS unit sales grew 44% YoY in Q1 2021. China showed the highest growth YoY while North America continued to occupy the largest share.

Apple continued to dominate, but its share declined due to the intensified competition and the absence of a recent new model launch. Xiaomi, the second-largest brand, also lost its share slightly compared to the previous quarter. Samsung, however, expanded its share QoQ and narrowed the gap with second place.

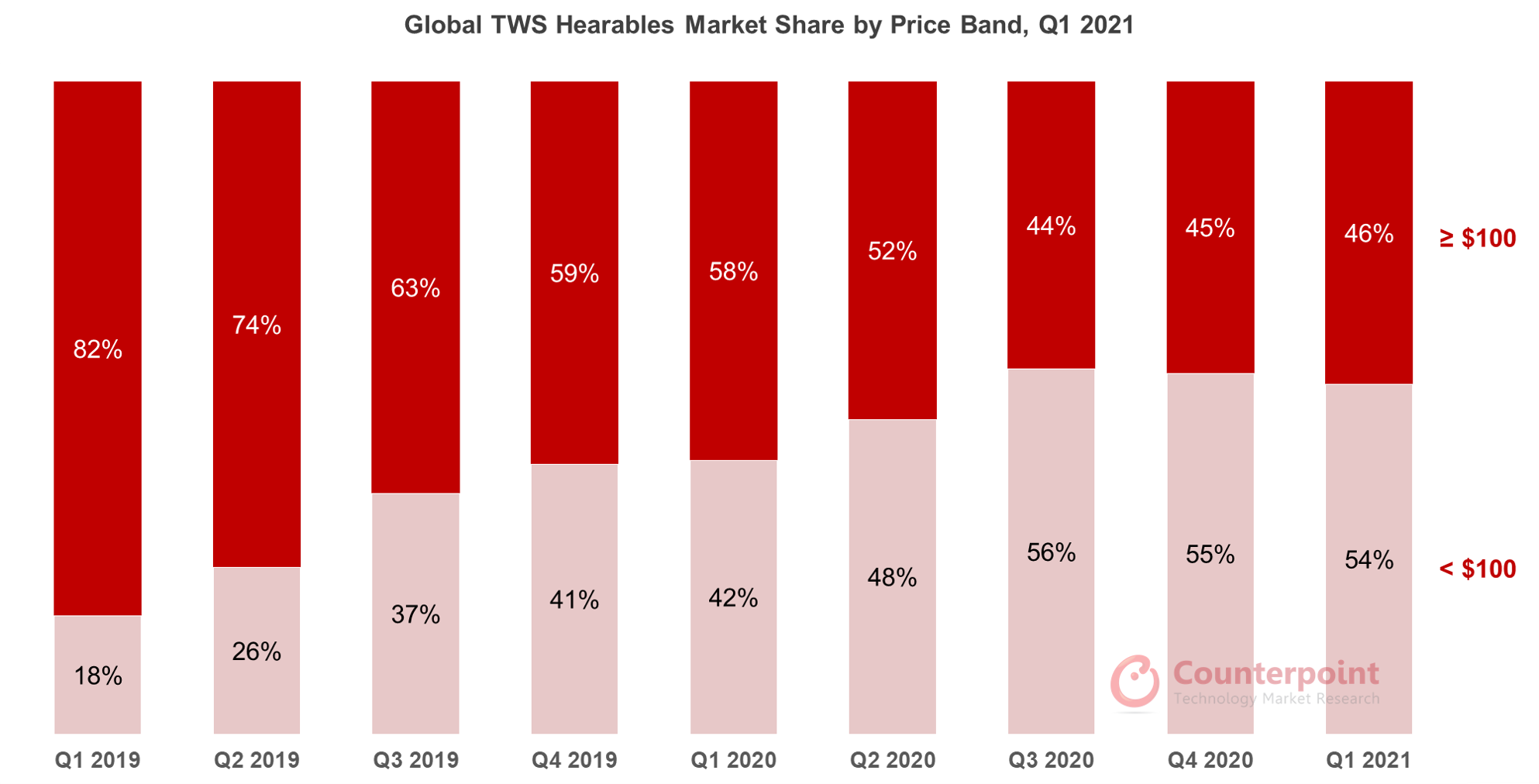

The share of the over-$100 segment dropped through the last year as more consumers decided to go with the mid-range and budget TWS amid the COVID-19 pandemic. However, the segment’s share slightly recovered in Q4 2020 and reached 46% in Q1 2021. This indicates the market focus is starting to shift to the mid- to high-price segment slowly. Senior Analyst Liz Lee said, “Now is the time for companies to prepare for the change in consumer demand trends as vaccinations are expected to help consumer sentiment improve further in the second half of the year.”

Apple dominated the over-$100 segment with 57% share, followed by Samsung at 17%. In the sub-$100 segment, the total share of the top 10 brands, including Xiaomi, fell due to the diversification of industry participants and intensifying competition. Singling out Samsung as an eye-catching performer in Q1 2021, Lee said, “In highly competitive markets like Asia and Europe, Samsung achieved a double-digit share with good performance of all the models. Samsung successfully introduced the Galaxy Buds Pro, timed to connect with the launch of the Galaxy S21 in January. The company also pushed the sales of earlier models like the Galaxy Buds Live and Plus through aggressive marketing promotions.”

Lee added, “Skullcandy is another notable brand with growth potential across low- to mid-end TWS hearables. The brand is now expanding its market, especially in the sub-$100 segment in the US, through favorable responses for new budget models such as the Dime and Dime XT. The steady sales of earlier models like the Indy ANC and Sesh Evo are also helping.”

Our detailed report ‘Global TWS Hearables Market Tracker, Q1 2021’ is available for subscribing clients.

Feel free to contact us at press(at)counterpointresearch.com for questions regarding our latest research and insights, and for press enquiries.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Counterpoint Research

press(at)counterpointresearch.com

![]()