Boston, Toronto, London, New Delhi, Beijing, Taipei, Seoul – August 3, 2021

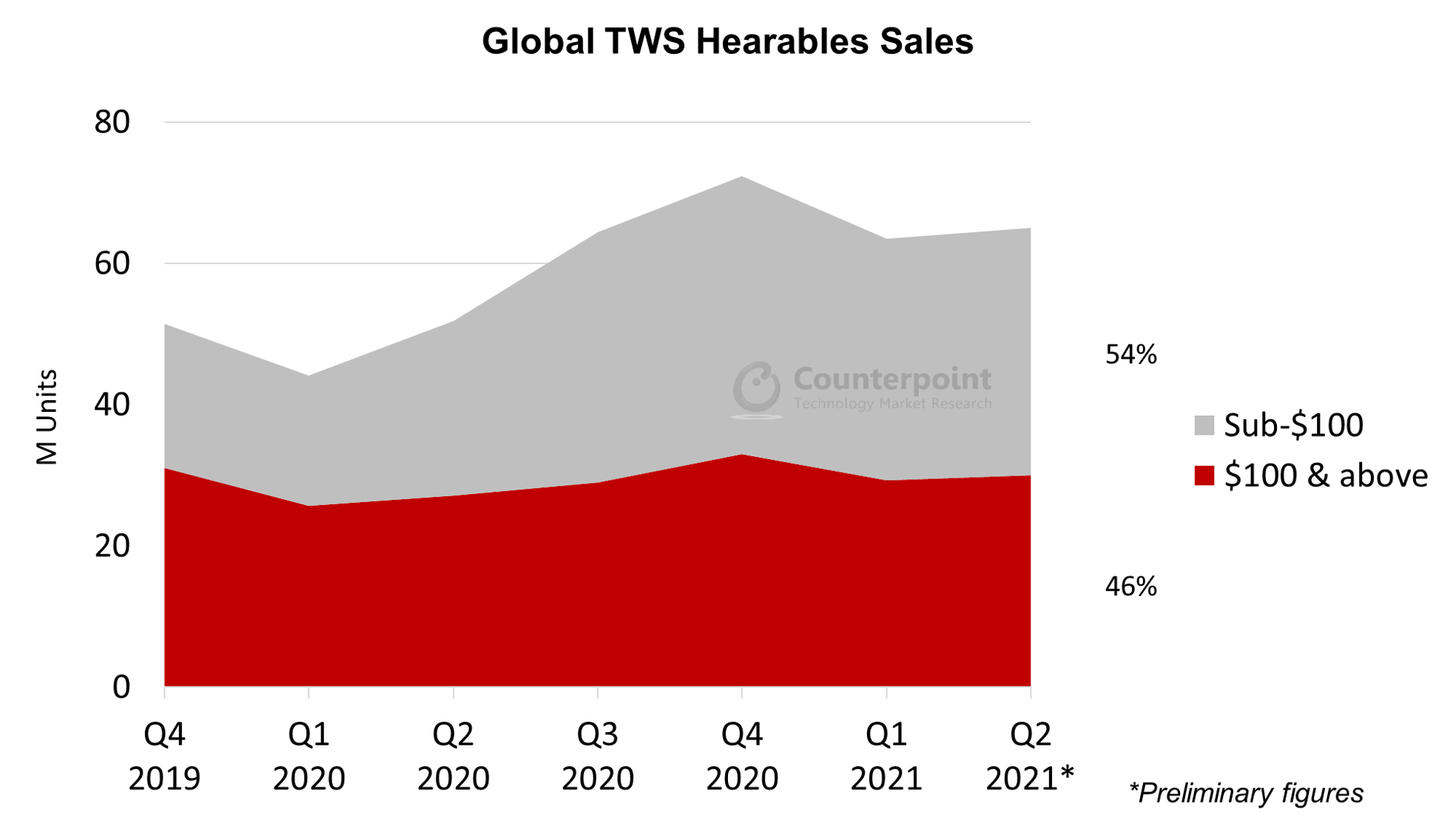

Global TWS hearables sales are enjoying strong year-on-year growth, supported by resilience across affordable and high-end segments. Premium is garnering special interest as its sales share remains steady at 46% in Q2 2021 according to Counterpoint Research’s Global TWS Hearables Service, with plenty of upside possible over the second half on the back of new launches from Samsung and Apple.

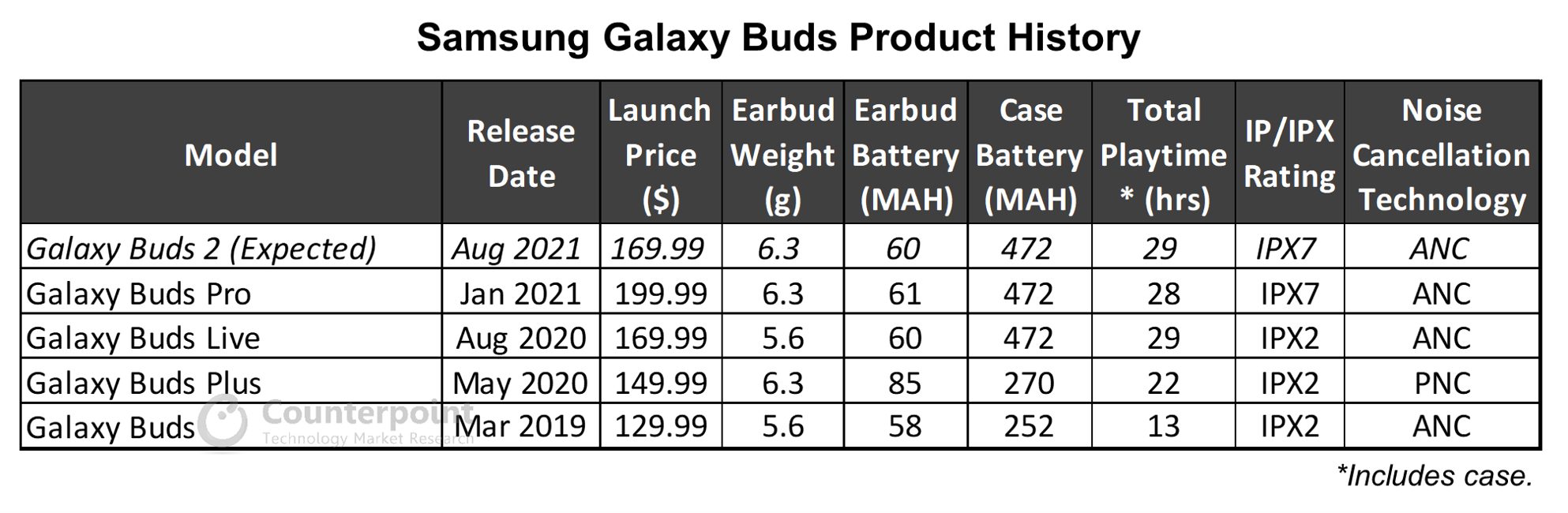

One of the most anticipated TWS launches this year is the upcoming Galaxy Buds 2, which will be released on August 11 at Samsung’s Unpacked 2021 event. “Features-wise, I don’t expect to see major differences from the Galaxy Buds Pro. What I’m really focusing on is the price,” says Senior Analyst Liz Lee, who oversees TWS hearables research at Counterpoint. “It has increased steadily at each product iteration of the Galaxy Buds, the first of which was introduced back in March 2019. This time around, we’re expecting a 10-20% price cut from the latest Galaxy Buds Pro, which would put things in the $160-$180 range.”

Providing premium segment context, Lee comments, “Samsung has outpaced overall growth in the ‘$100 & above’ segment since Q3 last year. A strong product intro here coupled with continued expansion of earlier models – something the company did well in Q1 2021 – could see Samsung hitting its historical high of 18% or beyond. The biggest determinant of whether that will happen is what price the Galaxy Buds 2 comes in at. If it’s the lower end of our expectations, then we’ll look to increase our volume forecasts accordingly.”

Samsung’s biggest competition in the premium segment comes from Apple, which is expected to release its AirPods 3 later this year. Lee believes that, “the second half does carry risk for Samsung, as the new AirPods 3 release will be the first in over two years, so there will be many upgraders and pent-up demand. Apple also has the luxury of reacting to any pricing surprise from Samsung, and leverage its always strong features and a possible launch timing paired with the iPhone 13 launch.” As well, she adds, “Samsung also needs to keep an eye on the sub-$100 category. Competition here has been fierce, with traditional stalwarts like Skullcandy, smartphone OEMs like Xiaomi and realme, to budget regional (and expanding) plays like boAt and Amoi all jostling for a piece of the overall pie.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Charles Moon

Counterpoint Research

press(at)counterpointresearch.com

![]()

Related Posts