- Smartphone shipment forecast for 2022 lowered to 1.36 billion units.

- Q2 2022 results will be weaker than expected, but the outlook for a rebound in H2 still stands.

Seoul, New Delhi, Hong Kong, London, Beijing, San Diego, Denver, Buenos Aires – June 2, 2022

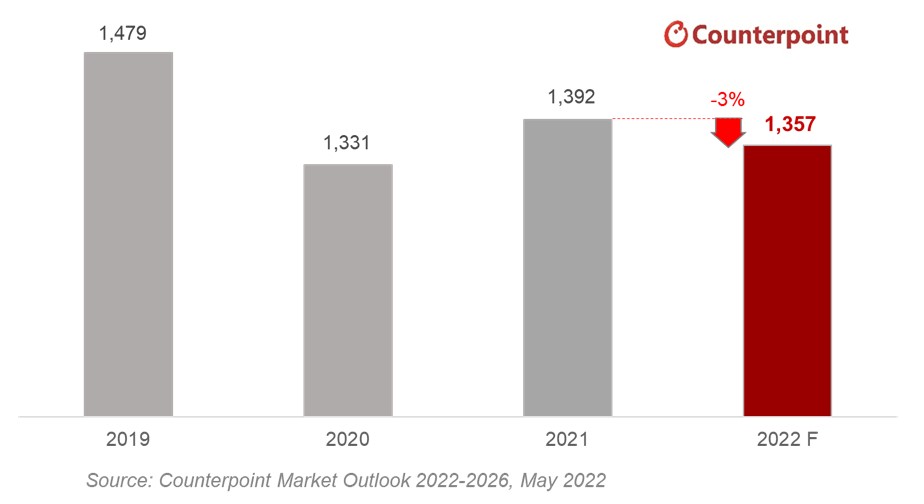

Total smartphone units shipped globally in 2022 are expected to fall 3% YoY to 1.36 billion units, according to Counterpoint Research’s latest Global Smartphone Quarterly Shipment Forecast. The overall supply situation is expected to gradually improve in 2022 compared to the previous year, although shortages of several parts have not been resolved yet. On the macroeconomic front, expectations for recovery are now falling sharply and more concerns are spreading centered on China’s prolonged recession and the Ukraine crisis. Therefore, we expect this year’s smartphone market to contract.

- China’s zero-tolerance approach towards the latest COVID-19 resurgence, with lockdowns of cities and even entire regions, has been slowing down its economy, besides causing a chain reaction across the global economy due to the country’s closed factories and rising logistics costs.

- Consumer sentiment has contracted significantly recently due to the spread of global economic uncertainty and surging inflation due to the prolonged Ukraine-Russia war.

- Due to the US dollar strength amid rising US interest rates, emerging economies will also face capital flight and inflation.

Global Smartphone Shipments, 2019-2022F (million units)

Peter Richardson, Vice President at Counterpoint Research, said, “For the long term, we continue to expect a steady migration from feature phones to smartphones, and 3G/4G to 5G smartphones. As efforts to spread low- and mid-priced 5G devices continue, the global market for 5G devices is expected to show healthy growth and act as a significant driver of the overall smartphone market. Operators are actively promoting 5G, and the incentives are sufficient in many markets to cause consumers to switch to the new technology. However, the recent global inflation trends are hitting the consumer demand and smartphone BoM costs, acting as a risk for the 2022 smartphone market.”

Senior Analyst Liz Lee added, “However, the outlook for a smartphone market recovery in the second half still stands. At the end of May, the Chinese government convened a meeting for large-scale economic stability countermeasures. The government is expected to implement more aggressive policies to stimulate the economy in the second half. Besides, we believe that new foldable smartphone launches, led by Samsung, will be able to stimulate demand in the premium segment.”

Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights, and for press enquiries.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Counterpoint Research

press(at)counterpointresearch.com

![]()