Apple reported a record June quarter with “better than expected” revenue, up 2% YoY at $83 billion. Supply chain constraints, foreign exchange (FX) headwinds and Russia-Ukraine conflict spillover effect remained the key growth challenges with Apple describing them as a “cocktail of headwinds”.

The company posted record revenues in the Americas, Europe and Rest of Asia-Pacific driven by strong double-digit growth in Brazil, Indonesia and Vietnam, and 2X growth in India. In China, COVID-19 lockdowns impacted the demand which rebounded towards the end of the quarter, but YoY growth still remained negative.

iPhone resilient to unfavorable FX, macro environment; wearables, home categories impacted

Apple recorded $63-billion revenue on the product side, covering iPhone, iPad, Mac, wearables, home and accessories. While the iPhone demand remained resilient, Apple did see some impact in other categories.

- iPhone revenue grew 3% YoY at $40.7 billion despite FX headwinds, but there was no evidence of macroeconomic impact on demand. iPhone 13 camera features, such as cinematic mode and macro photography, have been hallmarks of the model that continue to drive strong demand. The iPhone Mini has been the weak link among the four iPhone SKUs. But stronger differentiation of Pro and non-Pro lineups can bring more choice to consumers in the coming launch cycle.

- Apart from the strong upgrade cycle, Apple is successfully onboarding new users. Its switcher growth, which hit a fresh record during the quarter, is particularly driven by emerging countries where Apple has plenty of headroom to grow. This will continue to build further the 1.8 billion+ device installed base (last reported in January 2022).

- Mac and iPad revenue were down YoY at $7.4 billion and $7.2 billion, respectively. Since both categories were hit by supply constraints, the sensitivity of the demand to macro factors remained untested. Apple remains bullish on both iPad and Mac with vertical integration of its product lineup with the M2 chip and continued investment in Apple silicon.

- The wearables, home and accessories category reported $8.1 billion in revenues, down 8% YoY due to the impact of FX downtrend, macro factors and unfavorable launch timing of certain home and accessory products, like the launch of AirTags in Q2 2021. But Apple continues to add first-time users to its watch ecosystem. Almost two-thirds of the Apple Watch users are first-time users. Watch users still remain underpenetrated when compared to the brand’s strong iPhone user base. Apple continues to lead smartwatch innovation in features, design, pricing and new technologies like 5G Redcap, which are likely to be a growth engine for the next generation of wearables.

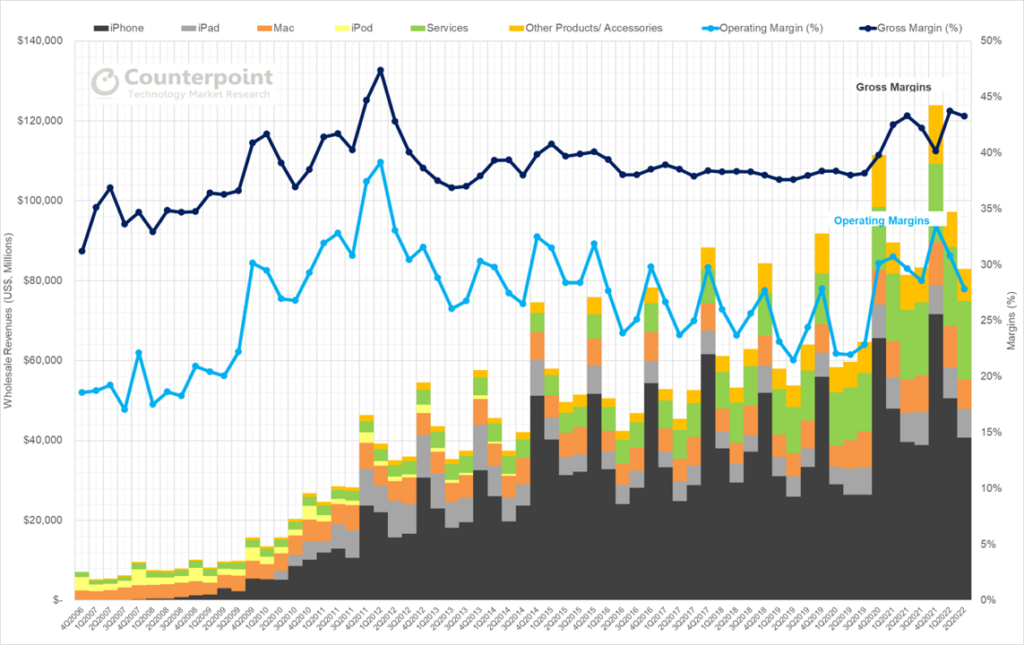

Apple Wholesale Revenues, Operating Margin, Gross Margin

Source: Counterpoint Research

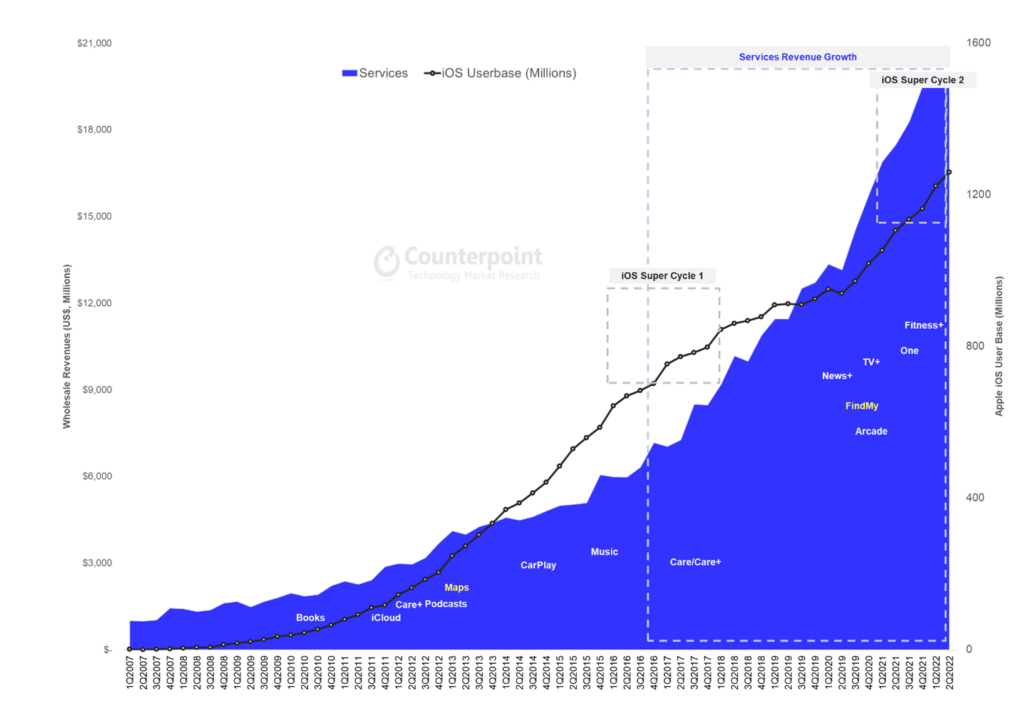

Services continues to post double-digit record revenues; gross margins much higher than hardware

Apple’s services business continues to grow faster than hardware categories. The segment posted $19.6-billion revenue, up 12% YoY driven by a bouquet of services such as news, fitness and gaming. This also marked the highest ever share of Apple’s services revenue in its total revenue at 23.5%. It is important to note that the services gross margin at 71.5% remains much higher than the hardware gross margin of 34.5%.

- Services revenue growth was at an all-time high in the US, Mexico, Brazil, South Korea and India. Music, Cloud, Apple Care and Payment Services posted a record quarter.

- Most services had no noticeable impact due to weaker global economy, but digital advertising was clearly impacted. This is also consistent with the latest earnings reported by Snapchat, Facebook and Google.

- Higher lending rates are leading to leaner advertising budgets. The impact on Apple is likely to be much lower as much of its services revenue is recurring.

- The subtle placement of Apple products in its original content on Apple TV+ has created strong brand loyalty and continues to fuel the growth of hardware products as well. Severance and Black Bird were notable mentions from the previous quarter. This will continue to build up as Apple wins streaming rights for Friday night baseball and soccer leagues.

- Apple now has 860 million paid subscriptions across its services platform, adding 160 million in the last 12 months alone. But Apple shied away from giving a certain growth rate for its services business due to the breadth of services.

Apple Device and Services Super Cycles

Source: Counterpoint Research

Opportunities

- Apple’s next-generation CarPlay, announced at WWDC22 in June, is diving deeper into the automotive industry ahead of the anticipated Apple Car launch. At present, 98% of the cars sold in the US come with pre-installed Apple CarPlay. This further builds an opportunity to sell services to car owners. GM already drives $2 billion+ from in-car subscriptions, while Tesla charges $199 per month for full-self-drive (FSD) capability.

- Apple sees a two-fold initiative to keep affordability in check – the buy-now-pay-later trend that is already picking up across the world, and a trade-in program. The latter is a huge differentiator as the perceived value of a used iPhone remains a key value proposition for consumers making a new purchase.

- Watch is a powerhouse of health data for Apple and the company continues to add new features to target daily lifestyle activities around wellness and fitness. Apple talked about new features awaiting FDA approval that could track irregular heart rhythms.

- On the AR/VR opportunity, there are now 14,000 ARKit apps on the app store accessible through iPhone and iPad. But Apple again shied away from making any speculative statement on the much-hyped AR/VR hardware.

Currency headwinds but eased supply constraints in the coming quarter

Apple expects currency headwinds to continue in the September quarter, but supply chain constraints are likely to ease unless the geopolitical or economic environment worsens. Counterpoint’s base case scenario expects a YoY growth for Apple in the next quarter. Weaker overall demand is seen, particularly in China and Europe, but the US continues to record strong demand driven by carrier subsidies and promos. The brand’s growth in the emerging market also continues.

In the medium term, a modest sales cycle is likely to be followed by another super cycle of iPhone sales. This will further inflate the iOS user base, which will catapult Apple’s services revenue beyond 25% of its total revenue sooner than we expect.