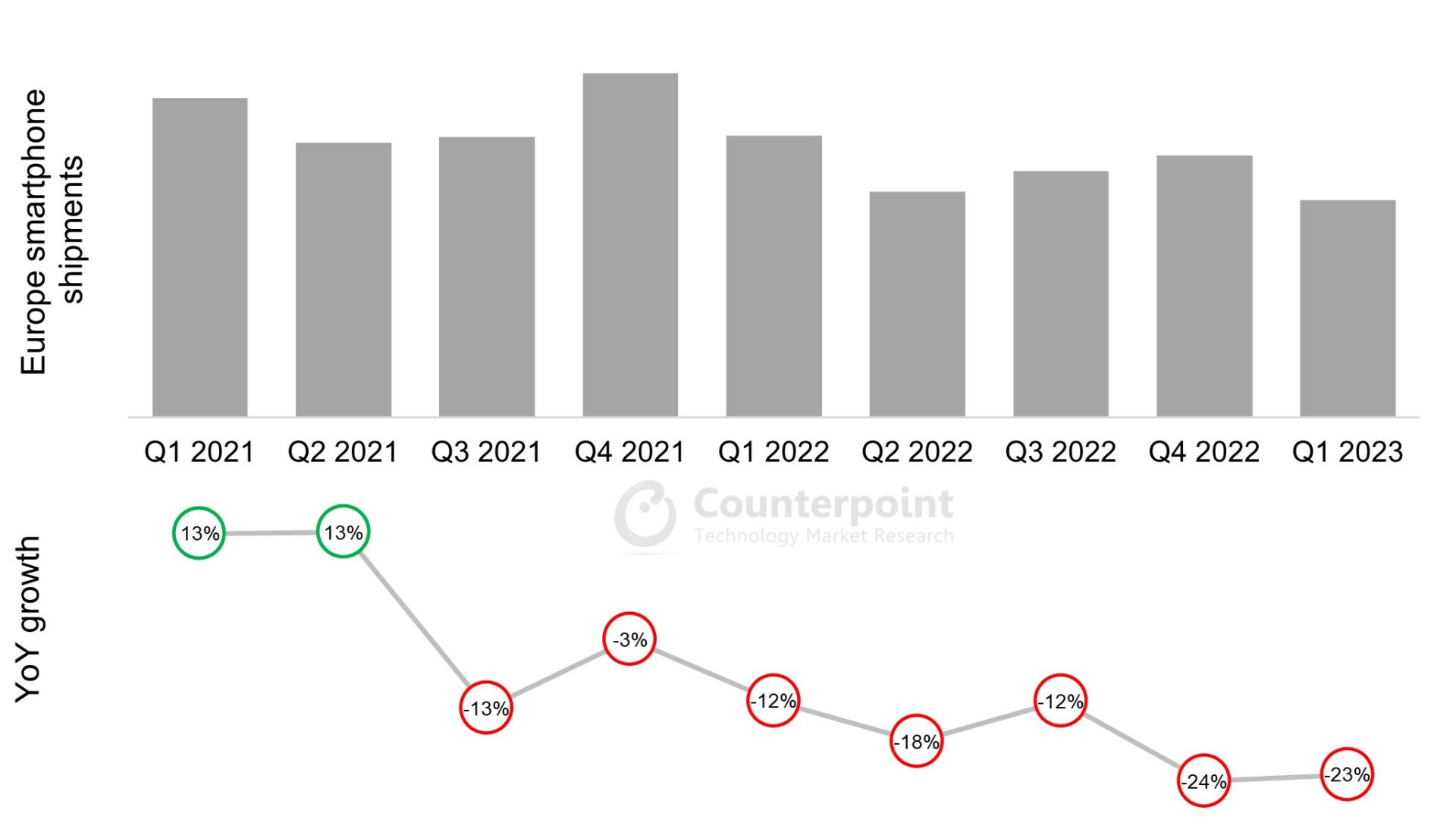

- The Europe smartphone market declined by 23% YoY to 38 million units in Q1 2023; the lowest quarterly total since Q2 2012.

- Samsung maintained leadership despite a 27% YoY shipment decrease, thanks largely to a relatively successful launch of its latest flagship Galaxy S23 series

- Second place Apple gained share slightly YoY, but this was more down to it declining less than most other vendors.

- Xiaomi was the only major vendor to grow YoY, due to a recovery from a poor Q1 2022

London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – May 10, 2023

The challenging economic climate continued to weigh heavily on the European smartphone market, with shipments declining by 23% year-on-year in Q1 2023, according to the latest research from Counterpoint Research’s Market Monitor service. Inflation, interest rates and energy prices remained stubbornly high, as did the conflict between Russia and Ukraine, prolonging the cautious approach consumers are taking with their discretionary spending. This protracted shrinking of the European market resulted in Q1 2023 being the region’s worst quarter for smartphone shipments since Q2 2012.

Europe smartphone shipments and YoY growth

Europe smartphone shipment market share

Note: OPPO includes OnePlus

Counterpoint Research’s Associate Director, Jan Stryjak said, “the cost-of-living crisis continued to pour misery onto European consumers, resulting in a tough start to 2023. There were, however, some pieces of good news: Samsung, despite losing share compared to Q1 2022, successfully launched its latest flagship Galaxy 23 series (outperforming both the S22 and S21), while Apple gained share YoY (although this was more to do with it declining less than some other vendors). The biggest winner, though, was Xiaomi, being the only major vendor to register shipment growth as it recovered from a very poor Q1 2022.”

Commenting on the outlook for 2023, Stryjak added “we predicted the difficult conditions would get worse before they got better, and this was borne-out by the worst quarter for smartphone shipments we’ve seen in Europe in over a decade. However, we remain optimistic that the economic pressures should start easing in the next few quarters, boosting consumer confidence and leading to a better end of the year.”

Feedback or a question for the analyst that wrote this note?

Jan Stryjak

Associate Director

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Jan Stryjak

Peter Richardson

Follow us on LinkedIn and Twitter