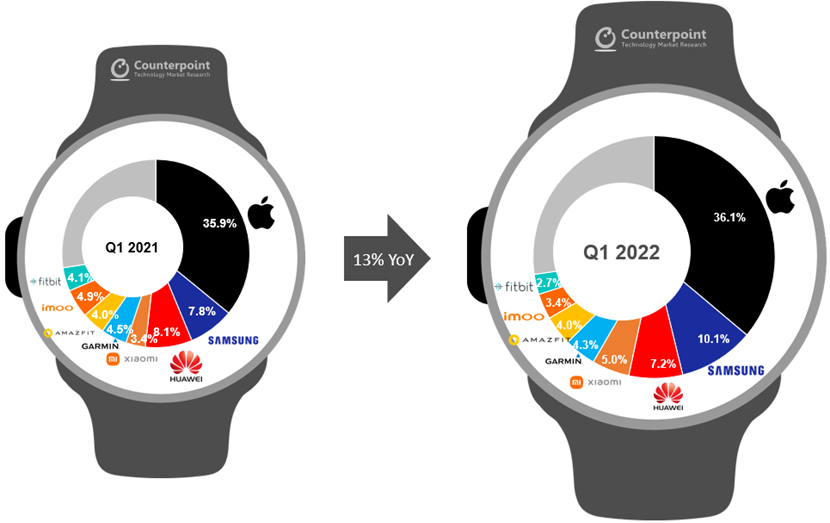

- The market grew 13% YoY and continued double-digit growth for the fifth consecutive quarter.

- Apple maintained its lead, while Samsung solidified its second place.

- Xiaomi recorded first Top 4 position with 69% YoY growth, and is breaking its shipment record every quarter.

Seoul, Beijing, Boston, London, Toronto, New Delhi, Hong Kong, Taipei – May 31, 2022

The global smartwatch market recorded 13% more shipments compared to the same period last year, despite concerns over economic slowdown and inflation, according to Counterpoint Research’s recently published Global Smartwatch Model Tracker. Despite -24% QoQ due to weak seasonal demand, Xiaomi performed well with it record-highest quarterly shipments.

Associate Director Sujeong Lim said, “Although the global smartwatch market saw little growth in 2020 due to the impact of Covid-19, it has continued to perform well since its rebound last year. In particular, Apple accounted for more than a third of the total shipments last year, and it is further increasing its influence with a market share of 36% in the first quarter of this year. The high brand loyalty of iPhone users is one of the success factors of the Apple Watch. This popularity appears to be higher among the younger generation, making Apple an irreplaceable market leader. Of course, everything was possible because the high performance of the product and the excellent connection among supported iOS devices. We believe that Apple’s market share is likely to rise further by the end of this year.”

Global Top 8 Smartwatch Brands Shipment Share, Q1 2022 vs Q1 2021

Source: Counterpoint Global Smartwatch Model Tracker

Market Summary:

- Apple maintained a solid lead and increased 14% YoY in Q1 2022. Some shipments carried over to Q1 2022 due to a month late launch of Apple Watch 7, which helped continue the strength of the brand.

- Samsung solidified second place with 46% YoY increase in shipments. It grew significantly in the APAC region with the popularity of Galaxy Watch 4 series.

- Huawei remained flat YoY in terms of shipments. Due to the weak position in the international market caused by GMS restrictions, the proportion of the Chinese market in the brand’s total shipments is gradually increasing.

- Xiaomi recorded its first Top 4 position with 69% YoY growth and is breaking its shipment record every quarter as it rapidly penetrates globally. A large proportion of its sales come from the low-end segment under $100.

- Garmin ranked fifth in terms of shipments, but came in third in terms of revenues thanks to its higher ASP. It occupies the majority portion in the premium segment over $500.

- Amazfit maintained its market share by occupying 6th place thanks to the GTR 3 and GTS 3 series that launched in the fourth quarter of 2021. In the meantime, it has been working to expand outside of China and has had some success increasing its presence in Europe.

- With the China Kids Watch market sluggish at -7% YoY, and as Huawei and Xiaomi expanded their presence in this segment, imoo suffered a double-digit YoY shipment decline.

- After the merger with Google, Fitbit appears to be undergoing an internal reorganization. As a result, there were no new models released last year, and the transition to Wear OS was delayed, so its sales decreased compared to the same period of the previous year.

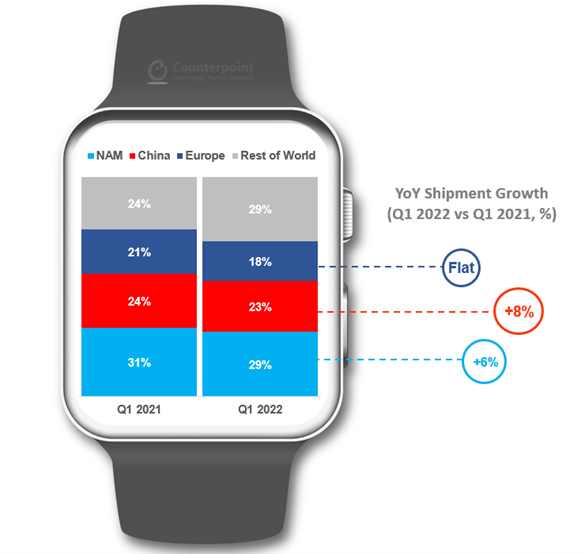

Smartwatch Shipment Proportion by Region, Q1 2022 vs Q1 2021

Source: Counterpoint Global Smartwatch Model Tracker, Q1 2022

By region, while most major regions grew YoY, only Europe recorded flat growth. Although Apple and Samsung continued to grow year-over-year, other major brands such as Garmin and Fitbit performed weakly in the European market during this period.

Ms. Lim said, “We initially expected the war between Russia and Ukraine to have minimal impact on the market in Q1, but the prolongation of the conflict and the resulting logistical constraints have begun to affect the European region. The impact of the war will become more serious in Q2”.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Follow Counterpoint Research

press@counterpointresearch.com

![]()