The smartphone market will experience an annual decline for the first time in history

Seoul, London, San Diego, Mumbai, Hong Kong, Buenos Aires – November 3, 2018

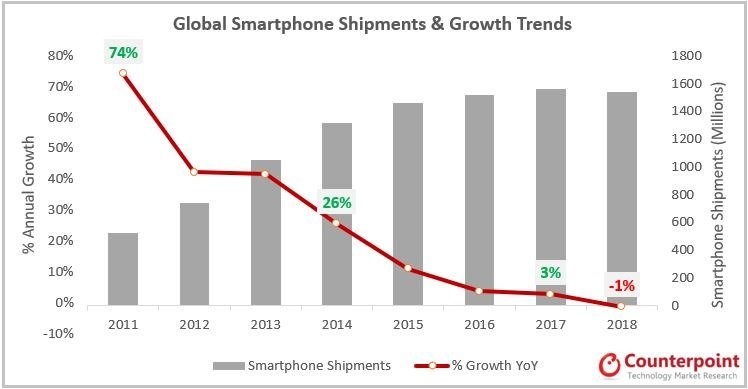

According to Counterpoint’s latest smartphone forecast report, smartphone growth will drop to a negative 1.3% in 2018. This is a first in the history of smartphones that the market has contracted year over year.

It was a tough year already as the market had been experiencing negative growth since the fourth quarter of 2017. This negative trend is expected to continue in the September quarter and upcoming December quarter. After years of growth the smartphone market has finally come to a halt. To be accurate the market had enjoyed a CAGR (compound annual growth rate) of 16% for the last five years between 2012 and 2017. This is close to growing 16% every year.

This is a mixture of multiple factors starting from the global economy slowing down and exchange rates in emerging markets fluctuating rapidly as in the case of Latin America (see here). The US – China tariff wars aren’t helping the situation either. Some markets are cooling down after years of overshooting caused by extreme competition. But at the core of the weak demand could be the change in consumer behavior.

Commenting on the weak market demand, Research Director, Tom Kang explained, “Many markets have already hit a saturation point for new smartphone demand and are dependent on replacement demand. However, since last year consumers have decided to trade up whenever they had the chance and are thus going for a better device, despite the price difference. This is evident in the introduction of Apple’s iPhone X last year. But buying a more expensive device results in extending the length of replacement cycles, especially when your earnings are limited.”

Longer replacement cycles have led to fewer smartphones consumed. However, it has a positive effect to manufacturers. Higher smartphone ASPs has led to more revenue; despite the negative growth in smartphone shipments, smartphone revenues are expected to show positive growth.

Tom Kang added, “Overall smartphone revenue may grow 9% compared to last year. This is even higher than the 7% revenue growth of 2017.”

The higher price points are justified by more capacity NAND flash storage, better processing power with AI functionality baked-in, more durable designs, and of course, more camera sensors for better picture quality.

Next year likely won’t be much different as the trend continues with the new Apple iPhone Xs Max introduced at a higher price point, Samsung’s foldable smartphone coming soon and 5G smartphones on the horizon. But again, smartphone ASPs will likely grow more steeply to offset the low volume growth.

The full forecast with the assumptions is available for subscribing clients to Counterpoint’s mobile device service. The methodology involves insights from consumer surveys, industry interviews and public IR documents. Feel free to reach out to us at press@counterpointresearch.com for further questions regarding our in-depth latest research, insights or press enquiries.

Analyst Contacts:

Tom Kang

+82 2 553 4813

tom@counterpointresearch.com

Peter Richardson

peter@counterpointresearch.com

Neil Shah

neil@counterpointresearch.com

Follow Counterpoint Research

press(at)counterpointresearch.com