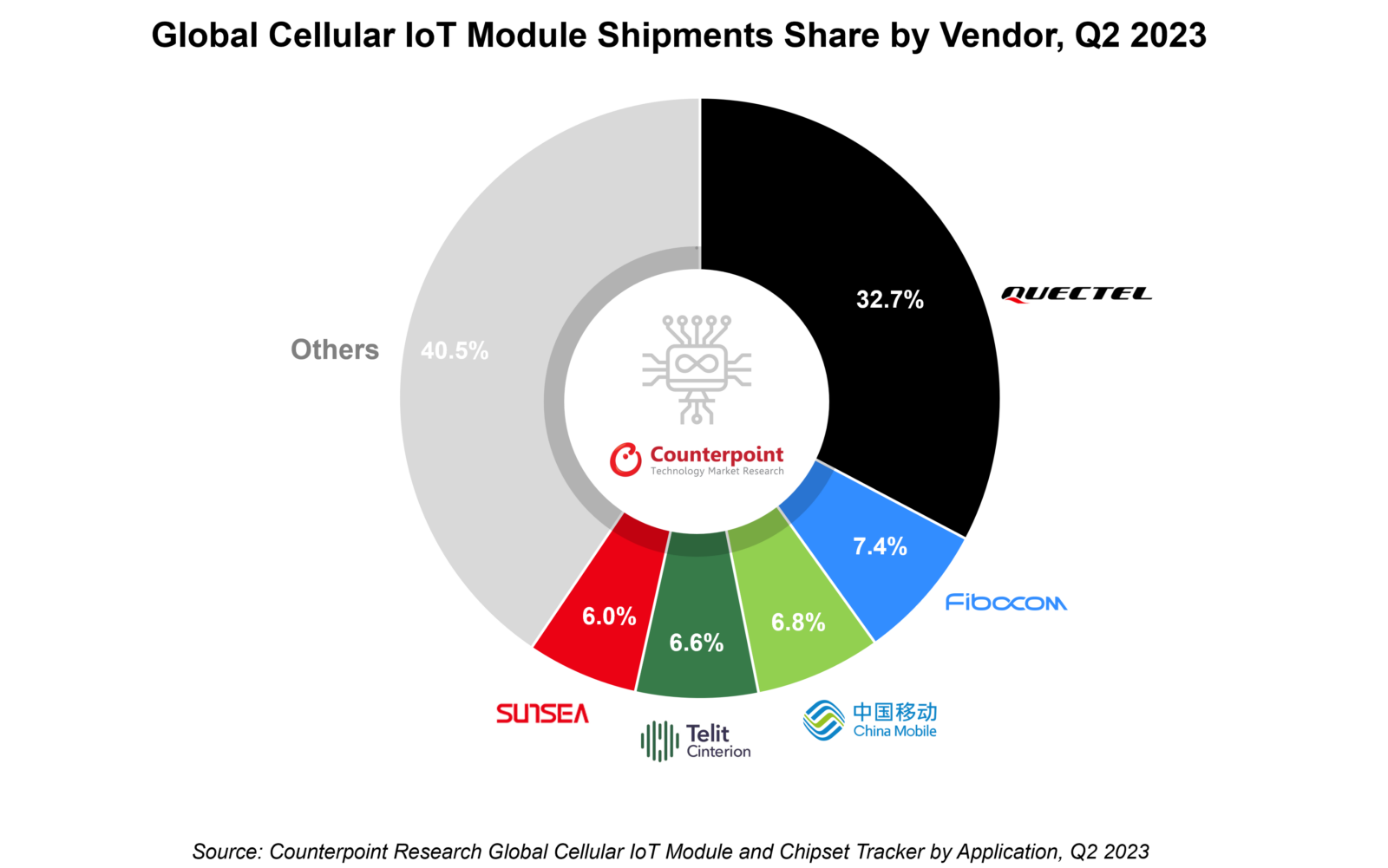

- Quectel and Fibocom maintained their market leadership while China Mobile overtook Telit Cinterion to become the third largest player.

- The top three applications accounted for around 51% of shipments in Q2 2023 compared to 41% in Q2 2022.

- For the full year 2023, global cellular IoT module shipments are expected to remain almost flat compared to 2022.

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Taipei, Seoul – October 16, 2023

Global cellular IoT module shipments saw a 3% YoY decline in Q2 2023, according to Counterpoint’s latest Global Cellular IoT Module and Chipset Tracker by Application report. The decline was driven by factors such as lower demand and weaker economic sentiments. Barring the top three applications – smart meters, point of sale (POS) devices and automotive, most segments experienced a sharp drop in shipments. The top three applications – smart meters, POS devices and automotive – accounted for about 51% of the market in Q2 2023. India was the only market to register positive shipment growth for the quarter.

Commenting on the market dynamics, Associate Director Mohit Agrawal said, “In Q2 2023, many of the module players experienced shipment declines as the market shrunk for the first time since the start of COVID-19. The pandemic-induced demand for connected devices is wearing off while the digital transformation efforts in industrial and other key verticals are yet to translate into shipments. Quectel’s revenue from international markets surpassed its revenue from China. Chinese module vendors are increasingly coming under US scanner for security concerns. This scrutiny could potentially challenge their global expansion plans, paving the way for other vendors to seize more opportunities.”

- Quectel, the leading module vendor, experienced a decline in its market share due to weakened demand.

- China Mobile, with strong performance in smart meter, POS and asset tracker applications, overtook Telit Cinterion to become the third largest player in the global cellular IoT module market.

- Telit Cinterion faced challenges due to the market downturn. With India expected to be the fastest-growing market by 2030, Telit recently partnered with VVDN to produce IoT modules in the country and increase its presence there.

Commenting on the future outlook, Senior Research Analyst Soumen Mandal said, “IoT module shipments for the full year of 2023 are expected to remain flat compared to 2022. The IoT module market’s performance in H2 2023 will be better than in H1 2023 as the market is showing early signs of recovery. However, the lower demand is influencing the market’s long-term growth trajectory, with the current demand shifting by 2-3 years.”

Mandal added, “The adoption of 5G technology has been slower than expected, primarily due to its higher costs, coverage issues and maturity of the 5G device ecosystem. The forthcoming 5G RedCap has the potential to become the industry’s game changer by offering a more affordable solution. Early adoption of 5G RedCap is expected in POS and router/CPE applications.”

For detailed research, refer to the following reports available for subscribing clients and individuals:

- Global Cellular IoT Module and Chipset Tracker, Q2 2023

- Global Cellular IoT Module and Chipset Tracker by Application, Q2 2023

Counterpoint tracks 1,500+ IoT module SKUs on a quarterly basis and provides forecasts on shipments, revenues and ASP performances for 80+ IoT module vendors, 12+ chipset players and 18+ IoT applications across 10 major geographies.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Counterpoint Research

press(at)counterpointresearch.com