- The market’s shipments grew 49% YoY in Q4 2022 (October-December).

- Shipments in the INR 2,500-INR 3,000 price band remained the highest in 2022, capturing 47% share.

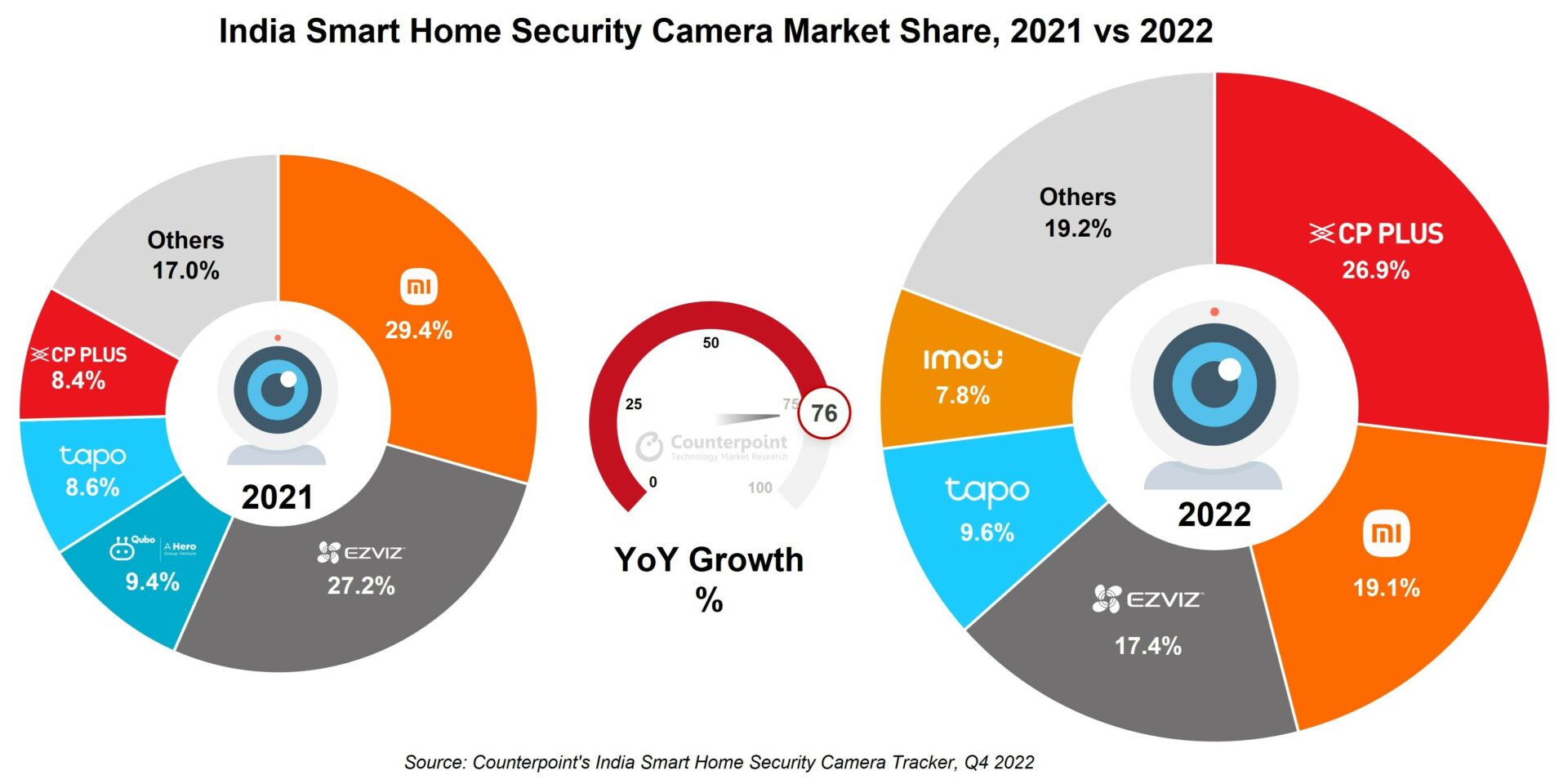

- CP Plus captured the top spot in 2022 with a 27% share as its shipments quadrupled YoY.

- Xiaomi grew by 15% YoY to end 2022 in second position with a 19% share.

- EZVIZ took the third spot with a 17% share and grew by 13% YoY.

New Delhi, Boston, Toronto, London, Hong Kong, Beijing, Taipei, Seoul – March 16, 2023

India’s smart home security camera market shipments grew 76% YoY in 2022 and 49% YoY in Q4 2022 (October-December), according to the latest research from Counterpoint’s Smart Home IoT Service. Throughout 2022, the market saw a boom in demand due to increased consumer awareness and aggressive pricing strategies of companies. Due to the holiday season and the introduction of several new models in the 2MP, 3MP and 4MP categories, the market increased by more than 66% YoY in H2 2022.

Research Analyst Varun Gupta said, “In a price-sensitive market such as India, the entry-level price point of smart cameras (INR 1,500 or ~$18) also creates a big demand pull. Shipments in the INR 2,500-INR 3,000 price band remained the highest in 2022, capturing 47% share. The discount offers around Diwali further pushed the sales in 2022. As safety remains a prime concern among consumers, the market is expected to perform well in 2023 as well. Smart cameras are gaining more popularity among small and medium retailers as they are less expensive and easy to install.”

Note: Figures may not add up to 100% due to rounding

Commenting from the brand perspective, Gupta said, “We expect the market to remain consolidated in 2023, even though the top three brands currently capture a combined share of 63%. We saw new brands entering the market in 2022, which increased the competition and brought down the average selling price (ASP). In terms of features, the 2MP camera remains popular among users, but we expect the 3MP camera to gain more traction as it is becoming more affordable. Though the market remains online driven (more than 60%), the offline market has started to gain traction in the past year through efforts from major brands, especially CP Plus which has a significant offline distribution channel.”

Looking at the market segmentation, Senior Research Analyst Anshika Jain said, “The indoor smart security camera accounted for more than 75% of the total shipments, mainly driven by increased awareness and importance of indoor home security. Even residential developers are increasingly installing smart camera devices due to the hybrid work model.

India Smart Home Security Camera market summary

- CP Plus by Aditya Infotech led the market with a 27% share, with its shipments quadrupling YoY. The brand expanded its portfolio in H2 2022 with multiple launches in 2MP, 3MP and 4MP camera sizes for indoor and outdoor applications. CP Plus leads in terms of domestic manufacturing of smart cameras. The brand has focused on its strong offline distribution channel to offer cameras across India, coupled with aggressive pricing and bundled offers.

- Xiaomi grew 15% YoY in 2022 to capture the second spot with a 19% share. It launched a new 3MP 2K camera in Q3 to offer a more premium experience to its customers.

- EZVIZ by Hikvision fell to the third position with a 17% market share and 13% YoY growth. The brand experienced strong demand for its indoor and outdoor cameras. It offers a diverse portfolio and banks on its expertise and dominance in the surveillance market.

- Tapo by TP-Link continued on its growth trajectory with an impressive 97% annual growth and a 10% market share. The brand dominated online marketplaces such as Amazon and Flipkart. Tapo’s growth can also be attributed to its diversified range of products, along with aggressive pricing. The C200 remained the brand’s bestseller smart camera in 2022.

- Imou by Dahua Technologies was the second fastest-growing brand in 2022 with an 8% market share. Its Ranger series of cameras has been performing well on online platforms.

- Qubo by Hero Electronix saw a 24% YoY rise in shipments in 2022 with a 7% market share. It was the second Indian brand among the top five players and has a focus on local manufacturing. Qubo performed well on online channels during the festive season. The Home Cam 360 Indoor camera was one of its bestsellers.

Other emerging brands

- Kent grew by 19% YoY to end up in the top-10 list for 2022. The brand offers only two camera SKUs as of now, but it has performed well on online channels and is also present in offline retail stores. All the SKUs are being made in India. We expect the brand to expand its portfolio this year.

- realme took a spot in the top-10 list for 2022 with a 38% YoY growth. It offers only one model as of now, but given its rising popularity as a brand, it is expected to offer more SKUs in the future to cater to different audiences.

- Airtel entered the market in late Q3 2022 with a focus on providing its large broadband customer base with smart home products. It is the only brand to offer the devices through its channels only.

- Zebronics experienced a decline of 32% YoY in 2022. The lack of consumer awareness around its offerings and its products not being updated with the latest features were the key reasons for this decline.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Varun Gupta

Anshika Jain

Counterpoint Research

![]()

press(at)counterpointresearch.com

Related Post

- India Robot Vacuum Cleaner Shipments Grow 24% YoY in H1 2022; Xiaomi Captures Top Spot

- India Smart Home Security Camera Market Grows 116% YoY in Q2 2022; Xiaomi, Tapo, Imou Lead

- Smart Home Market Witnessing Rapid Growth

- Consumer IoT Intelligence Tracker- June 2022 Edition

- Bespoke Home 2022: Samsung’s Smart Home Strategy Gathers Pace

- Smart Home Market Report 2021

- Samsung IoT Strategy & Developments

- Xiaomi IoT Vendor Profile

- realme India Growth Story 2021