- The global TV market’s shipments fell 3% in 2023 to reach 223 million units.

- The US market’s strength proved insufficient in offsetting the weakness in China and Europe.

- Counterpoint Research has initiated global TV market coverage with its first joint shipment tracker with DSCC.

- Premium TV shipments fell 1% during the year despite extremely strong growth in China.

- The premium segment is expected to grow by mid-single digits in 2024 on recovery in the US and Europe.

Seoul, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi – February 27, 2024

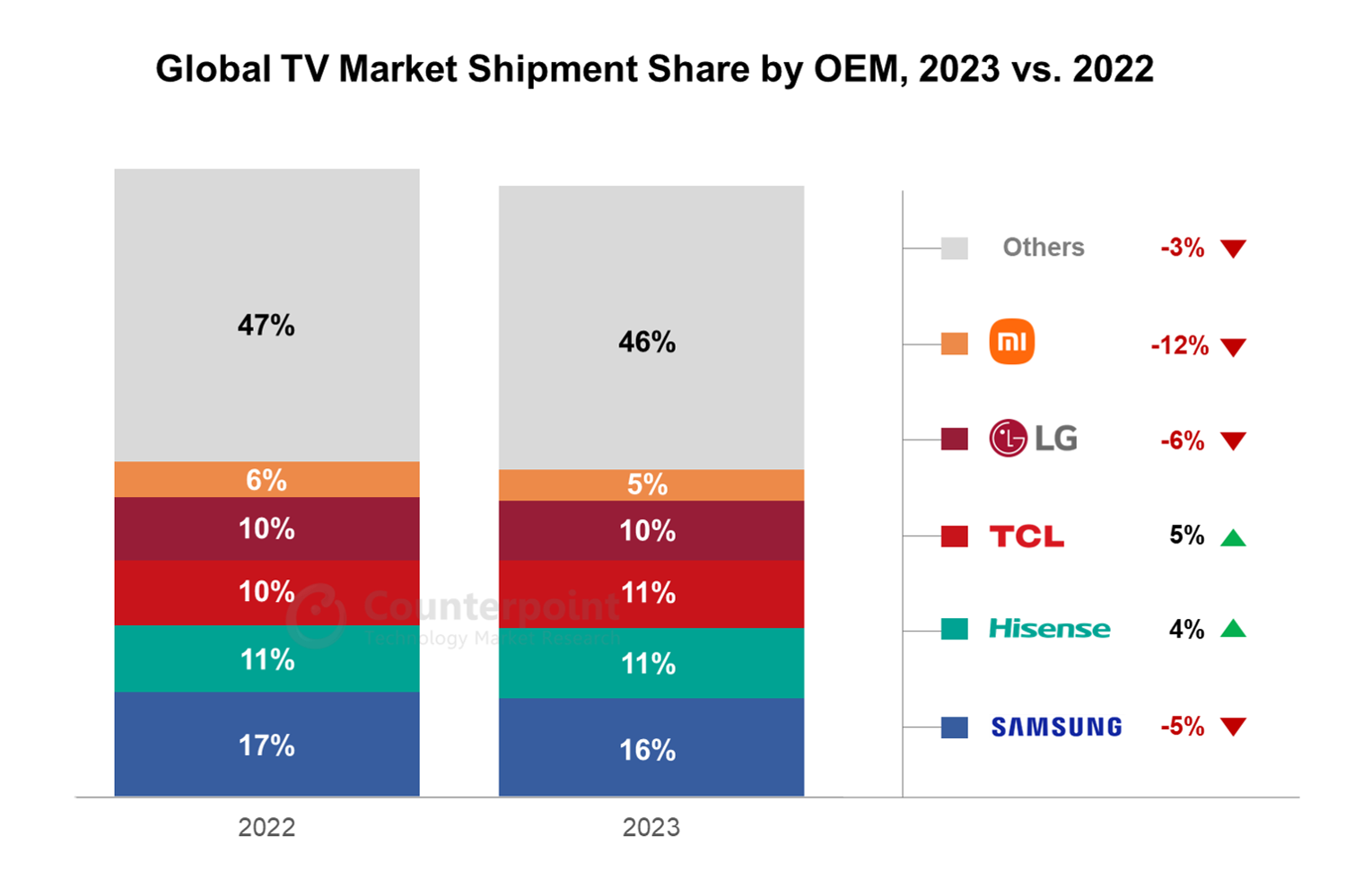

Global TV shipments fell 3% in 2023 to reach 223 million units as the US market’s strength was not enough to offset market declines across China and Europe, according to Counterpoint Research’s Global TV Shipment Tracker. Samsung Electronics remained in the top spot while Chinese vendors Hisense and TCL grew by mid-single digits, riding the growth in North America.

Counterpoint Research has initiated coverage of global TV shipments with the Global TV Shipment Tracker, a quarterly report split by region, screen size, resolution, average selling price (ASP) and other parameters. This tracker comes in collaboration with DSCC, which Counterpoint acquired recently. DSCC is providing enhanced details on premium segments, including advanced display technologies across OLED (includes QD-OLED), Mini/Micro LED and quantum dot LCD.

“We are excited to roll out Counterpoint Research’s Global TV Shipment Tracker, a powerful tool to assess the market and technology trends as well as the competitive environment,” said Tom Kang, Director, Counterpoint Research. “As the first joint product of Counterpoint and DSCC, the tracker also shows how we are bringing additional value to clients, with the net result much greater than the sum of its parts.”

Note: Numbers may not add to 100% due to rounding

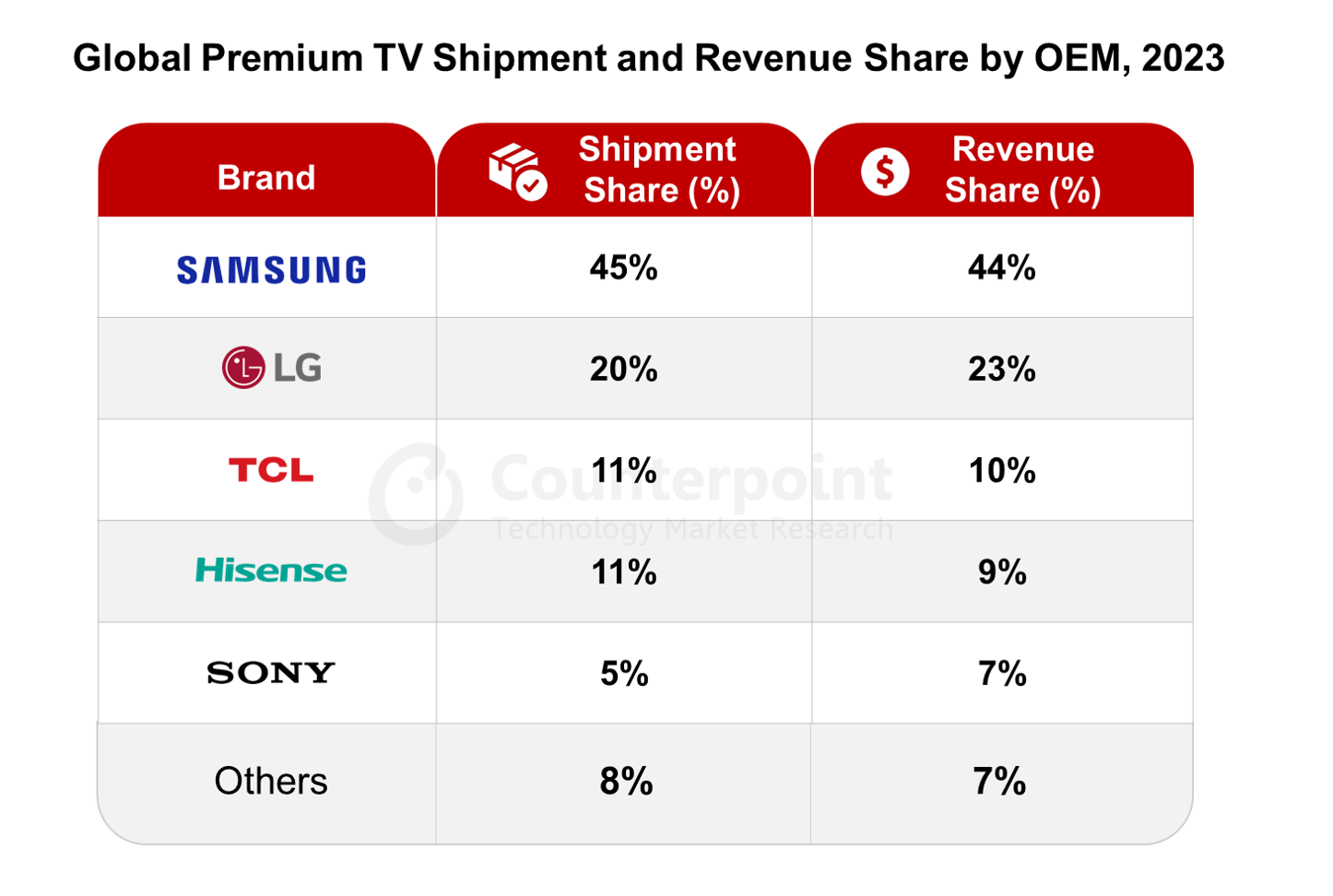

Premium TV shipments for the year decreased 1% annually but increased their market share to 10% helped by a surge in China, which saw its shipments and revenues growing 39% and 49%, respectively. A clear shift towards MiniLED LCD TVs by key Chinese OEMs, coupled with aggressive pricing and promotions, helped drive the segment domestically. The global premium TV segment is expected to grow by mid-single digits in 2024 on recovery in the US and Europe.

“We are expecting premium to do better this year on increasing screen sizes and ASPs,” said Calvin Lee, DSCC Senior Director, South Korea. “Recovery in the US and Europe will be a big factor but, as we are seeing in China, the right balance of features and pricing can be a big driver of replacement rates.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com