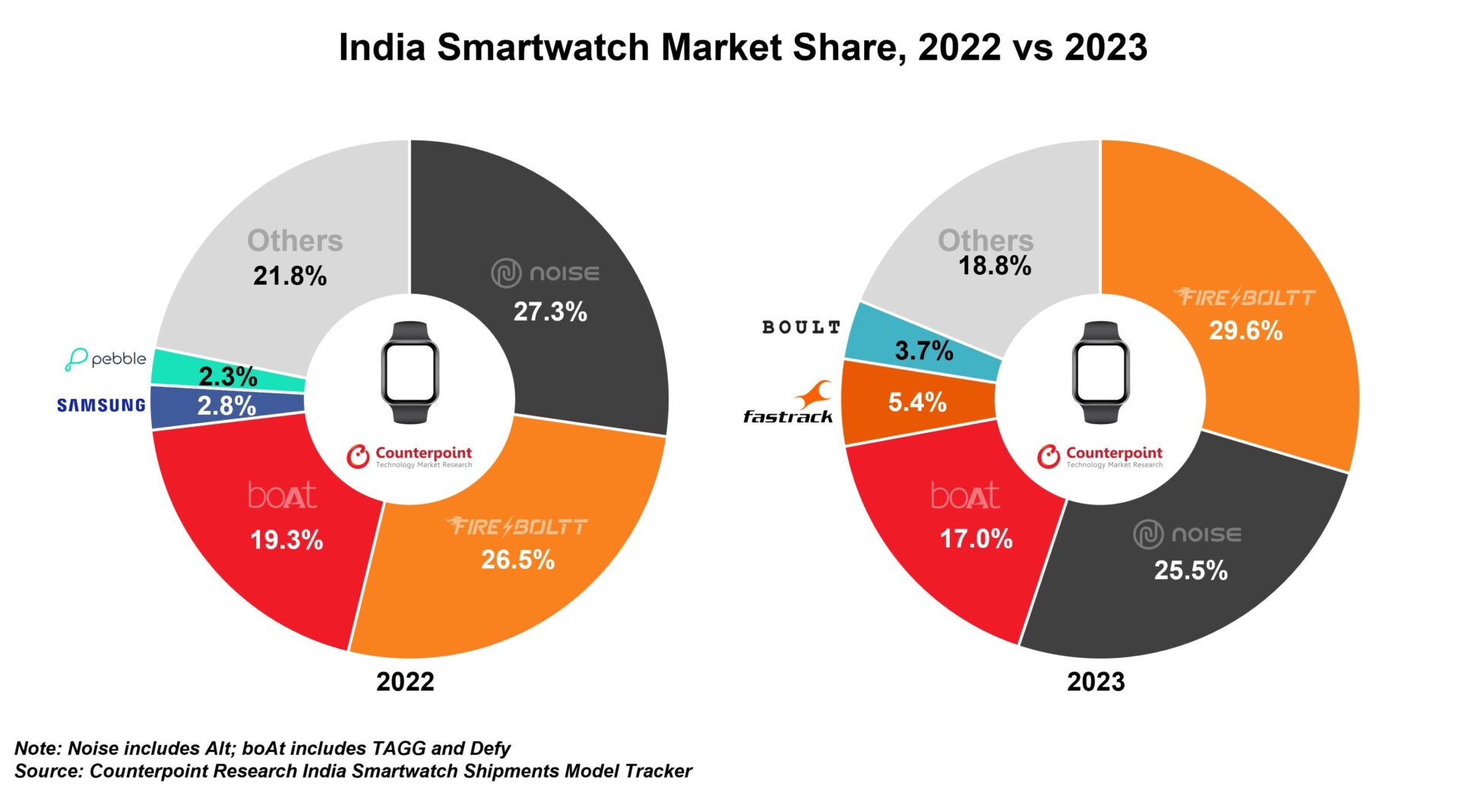

- With a 30% share, Fire-Boltt took the top spot in 2023, driven by the widest portfolio among all OEMs.

- Noise and boAt captured second and third spots with 25% and 17% shares respectively.

- The top five brands’ share was the highest ever at 81%, indicating a growing but consolidating market.

- Fastrack and Boult entered the top five for the first time.

- 54% market was under the retail price band of INR 2,000, which registered over 3x growth.

New Delhi, Beijing, Boston, Buenos Aires, Hong Kong, London, San Diego, Seoul – February 7, 2024

India’s smartwatch shipments grew 50% YoY in 2023, according to the latest research from Counterpoint’s IoT Service. This growth was driven by the rising penetration of smartwatches, proliferation of low-cost devices to target first-time users, and enhanced efforts by Indian brands through extensive marketing and distribution, promotions and local manufacturing. In addition, there is growing awareness and interest among customers to track their health vitals, utilize the device as a style statement, or leverage it for gifting purposes.

Commenting on the market dynamics, Research Analyst Harshit Rastogi said, “The market saw over 125 active smartwatch brands in 2023 even as it started moving towards consolidation. The combined share of the top five brands reached the highest ever at 81%. In addition, growth of emerging players like Fastrack, Boult and BeatXP led to further consolidation of the market. The product portfolio of the top players expanded quite a lot compared to 2022 to cater to different customer segments. Moreover, the market is now further skewed towards the lower price bands with 54% of the shipments in 2023 coming under the INR 2,000 retail price band, up from 26% in 2022.”

Commenting on the outlook, Senior Research Analyst Anshika Jain said, “While the market continues to register high growth rates, we are seeing some stabilisation, signaling wider adoption. The quarterly growth rates have come down from triple to double digits. We expect the market to grow 23% YoY in 2024. With the introduction of new features like cellular connectivity, high-level OS (HLOS) and better displays, the market is likely to sustain growth. We are now observing that OEMs are tapping into new emerging markets like Southeast Asia and the Middle East and foraying into other wearable categories like smart rings to accentuate their presence in the market.”

Market Summary

- Fire-Boltt led the market with a 30% share. The brand maintained its focus on offering a wide SKU portfolio and a strong offline presence.

- Noise (along with sub-brand Alt) captured the second spot with a 26% market share. The Noise Colorfit Icon 2 and Colorfit Icon Buzz were the best-selling smartwatches in 2023. The brand expanded its retail presence in 2023 and also expanded its portfolio in the kids smartwatch category.

- boAt (with sub-brands TAGG and Defy) maintained its third spot in the market with a 17% share and 40% YoY growth. The brand sported its widest portfolio in 2023 and also introduced its Crest+ OS. Besides, it launched limited-edition smartwatches for the Cricket World Cup in 2023.

- Fastrack registered the highest shipment growth among major OEMs to move to the fourth spot with a 5.4% market share. With existing brand value and wide offline presence, it has expanded rapidly.

- Boult captured the fifth spot with a 3.8% market share. It had the lowest ASP among the top five OEMs.

- Samsung declined by 3% YoY in 2023 but registered 17% YoY growth in Q4 2023. The Galaxy Watch 4 continued to be the brand’s best-selling model owing to its promotional pricing, making it the best-selling WearOS smartwatch in India.

- Apple’s shipments declined by 57% YoY in 2023 owing to longer replacement cycles and higher ASP coupled with iPhone-only compatibility. The brand maintained its lead in the shrinking INR 20,000 and above retail price band. With increased iPhone sales in India in 2023, we can expect gradual growth in Apple Watch shipments in 2024.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com