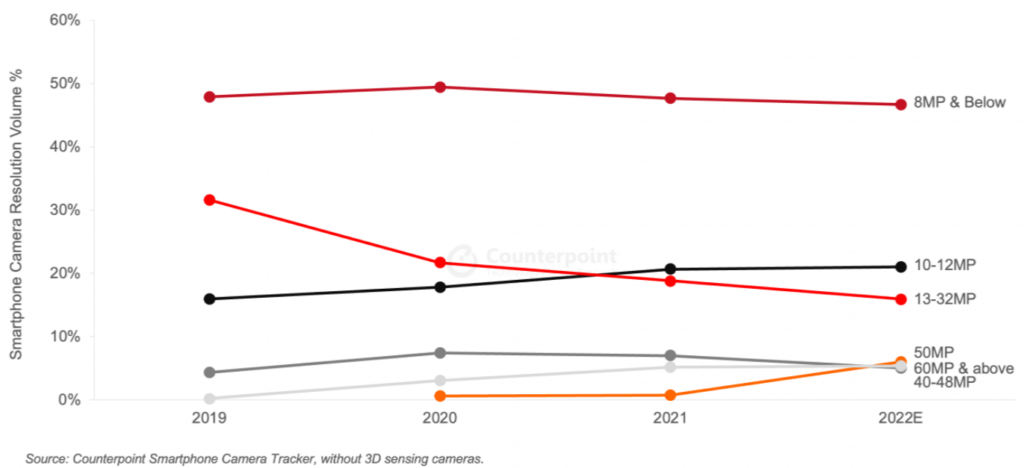

- Despite a sharp YoY decline in smartphone shipments, smartphone camera resolutions continued to improve in 2022.

- The share of 10MP-12MP increased in 2022 driven by Apple iPhones.

- The share of 50MP grew significantly as low- to mid-end phones migrated to sub-0.7μm 50MP and mid-to high-end phones migrated to large pixel 50MP.

- The share of 100MP and above resolutions has been growing steadily.

Although smartphone shipments dropped sharply in 2022, OEMs continued upgrading smartphone camera resolutions during the year, according to Counterpoint Smartphone Camera Tracker. This is because imaging remains a key area of focus for smartphone OEMs.

Smartphone Camera Resolution Trend

With the advancement in chipset processing capabilities and software algorithms, smartphone OEMs have been increasingly using existing cameras to achieve depth effects. Macro functions can now also be accomplished through telephoto and ultrawide cameras. Therefore, OEMs have reduced the adoption of depth and macro cameras to instead focus on improving core camera functions. Consequently, the share of 8MP and below resolutions has continued to shrink.

Despite the difficult global economic conditions in 2022, Apple’s iPhone shipments remained robust compared to those of Android phones. This helped increase the market share of 10MP-12MP resolutions during the year. However, the share of 10MP-12MP is set to decline in 2023 as the iPhone 14 Pro models jump to 48MP.

13MP-32MP resolutions declined sharply in recent years as higher resolutions penetrate the mid- to low-end market through price cuts.

The share of 40MP-48MP resolutions declined in 2022 as more mid- to low-end models continued upgrading to sub-0.7μm 50MP. However, this trend is expected to reverse in 2023 driven by the Apple iPhone migration.

50MP has been a massive hit since its launch in 2020. Smartphone OEMs prefer to use large pixel (1.0μm and above) 50MP for their mid- to high-end smartphones as it can enable high-quality and high-resolution images. Meanwhile, the cost effective sub-0.7μm 50MP resolutions are more popular among the low- to mid-end models. For 2022, the sales volume of 50MP is expected to exceed 260 million units.

In the 60MP and above category, the share of 64MP declined as mid- to high-end smartphones migrated to large pixel 50MP. The share of 100MP and above resolutions has been growing steadily since launch. However, due to the high price, this resolution is still limited to the mid- and high-end segments.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Alicia Gong

Ethan Qi