- Refurbished smartphone sales grew 5% globally but China saw a 17% YoY decline.

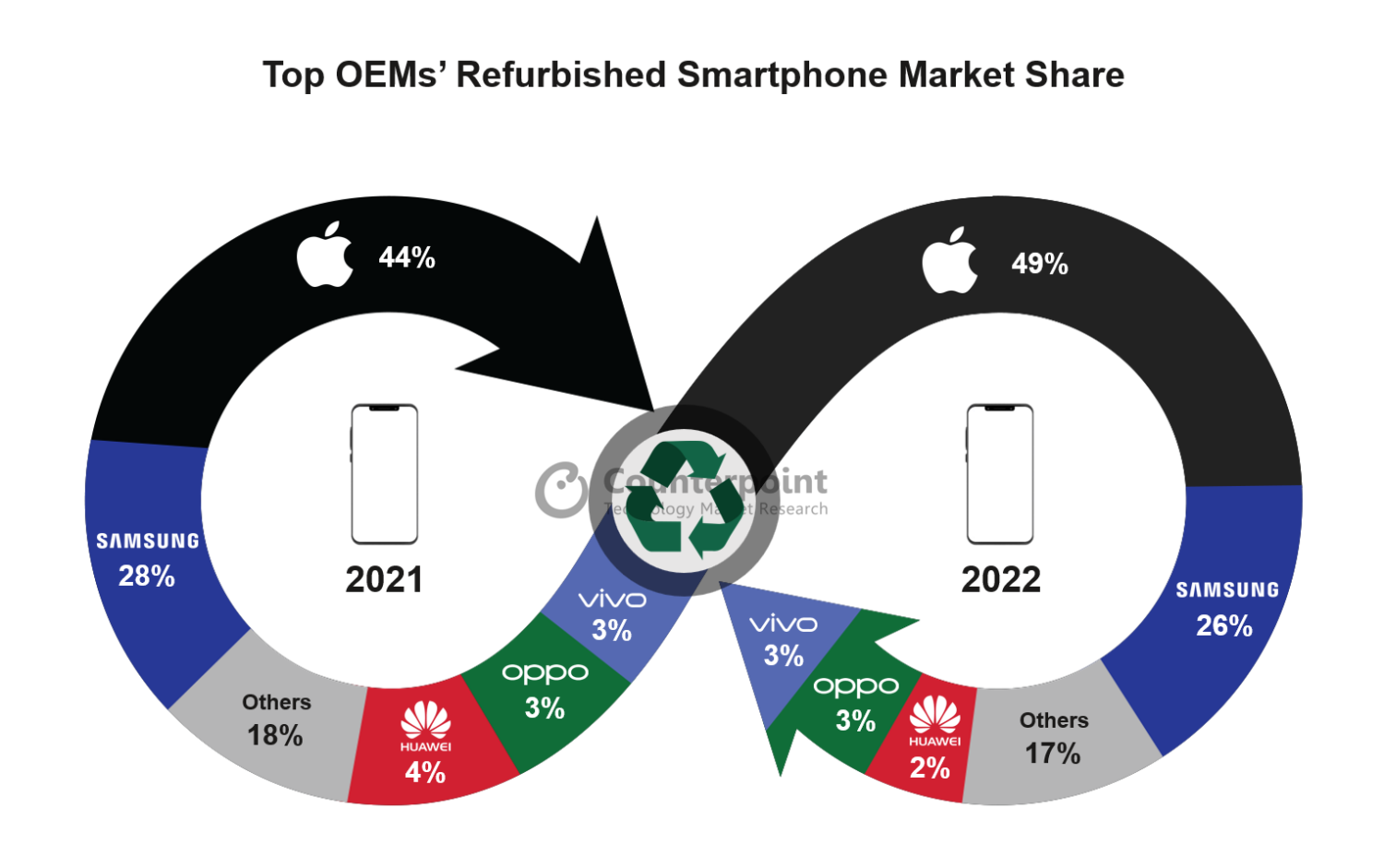

- Apple captured 49% of the global refurbished smartphone market in 2022 followed by Samsung at 26%.

- India led the market with 19% YoY growth, followed closely by LATAM with 18% YoY growth.

- 5G is growing in the secondary markets. It now makes up 13% of global refurbished sales.

London, Hong Kong, Boston, Denver, Toronto, New Delhi, Beijing, Taipei, Seoul – April 24, 2023

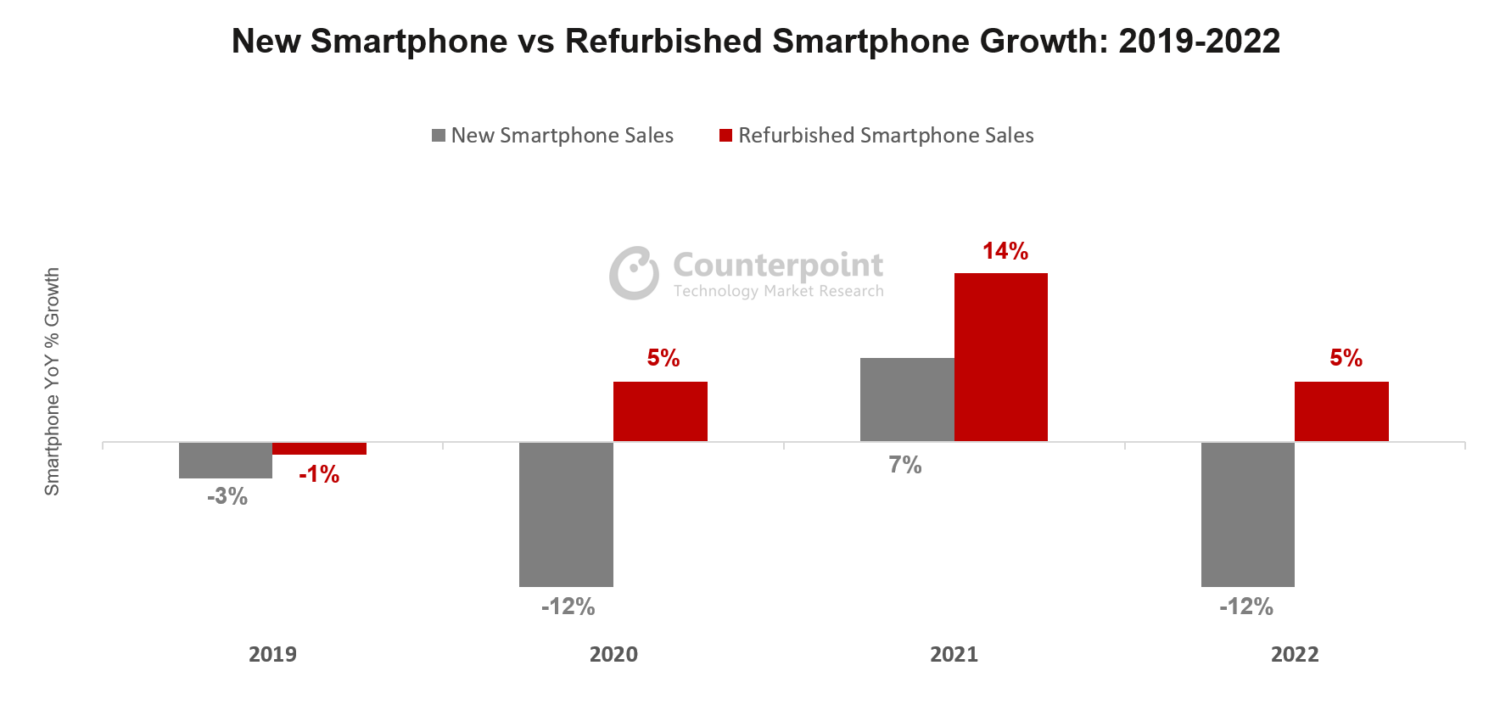

With the demand for refurbished smartphones continuing to grow across most geographies, the global secondary smartphone market grew 5% YoY in 2022, according to Counterpoint Research’s Global Refurb Smartphone Tracker. The growth would have been more if not for the 17% decline in China’s refurbished smartphone sales. This was the steepest drop for the Chinese secondary market in years. A resurgence of COVID-19 and introduction of “COVID-Zero” policies were the major factors affecting business and demand in the country. India led the global refurbished smartphone market in 2022 with 19% YoY growth, followed closely by LATAM with 18% YoY growth.

In terms of brands, Apple’s global volumes grew 16% YoY in 2022, taking its secondary market share to over 49%. Apple is the fastest-growing brand in the used and refurbished sectors globally. This secondary market demand is affecting new iPhone sales and service revenues in many markets. Apple is a major contributor to the increasing refurbished share as compared to the new smartphone shipments in main markets. The supply crunch is mainly felt for iPhones in refurbished markets.

Samsung’s share decreased to 26% in 2022 from 28% in 2021. Within the secondary market, there was a small percentage shift of Android consumers to iOS in 2022, which affected Samsung refurbished sales. This trend will likely continue in 2023.

Source: Global Refurbished Smartphone Tracker

Refurbished smartphone demand is mainly coming from:

- New smartphone buyers (mature markets)

- Feature phone users shifting to smartphones (emerging markets)

- Unofficial channels dependent on C2C or hand-me-downs

While the supply is mainly coming from:

- Refurbished smartphone retailers (growing the most)

- Carriers have started offering refurbished options but mainly in mature markets.

- OEMs are struggling to collect and resell refurbished smartphones.

A larger share of consumers preferred to buy premium and flagship refurbished smartphones compared to previous years, pushing up secondary market ASPs (average selling prices). 2022 also saw many new smartphone consumers shifting their focus towards sustainability and environmental awareness.

Trust levels towards refurbished smartphones increased across markets. Evolved business models and effective marketing strategies were adopted by refurbished players in most markets. Trade-in volumes were higher than ever.

In contrast, new smartphone holding periods grew globally. ASPs of new smartphones continued to increase, pushing consumers to hold onto their devices for longer. This continuing trend has hurt the supply of secondary market devices.

Transport, trade and logistics on global trade routes were affected mainly by main hubs like China shutting down in 2022. Supply levels fell, especially for Grade A refurbished smartphones.

Commenting on the growth in refurbished volumes, Senior Analyst Glen Cardoza said, “The global refurbished markets are going through transitions. Supply remains constrained as consumers are holding on to smartphones for longer. At the same time, demand for 5G is increasing, especially in mature markets like the US, Europe and Japan. In 2022, 5G made up 13% of global refurbished sales. The business potential of dealing in refurbished smartphones remains high, but the limited supply is affecting most emerging markets like LATAM, Southeast Asia, India and Africa. Imports from mature markets like the US, Europe and Japan have reduced as they have to cater to their own demand. We are looking at a transition where most markets are growing their own repair and refurbishment ecosystems domestically. This is changing the trade routes and reducing China’s imports and exports. Domestic players everywhere are focusing on expansion, partnerships and additional supply avenues.”

Commenting on the carrier and retailer dynamics in mature markets, Research Director Jeff Fieldhack said, “Large players within the secondary market ecosystem fared better than small players because the large players got better supply in a supply-constrained year. Global carriers and their partners are collecting higher volumes, gaining more power in the secondary market. The other key dynamic of certified pre-owned volumes (CPO) declined in 2022. Counterpoint’s research shows that consumers prefer a lower cost even if they have to deal with slightly more imperfection in the device. On the handset OEM side, outside of Apple, it is very difficult to make the economics work on reselling CPO-grade devices.”

While domestic infrastructure is being built, most upcoming refurbished players are concentrating on building their B2B channels. Growth was a bit more erratic for businesses in 2022 as there was no pent-up demand like in 2021. Apple’s iPhones remained the most sought-after smartphones due to the brand perception, high margins, and high inventory turnover ratios.

What we can expect in 2023

A lot of the changes in the secondary markets in 2022 will spill into 2023. 5G smartphone share will increase substantially and 4G smartphones may lose their value at a faster rate in 2023. The increased trade-ins and shift towards premium smartphones may bring about a situation where the inventory of low-grade used smartphones may grow significantly. End-of-life activities like disassembly, logistics, warehousing, recycling and e-waste disposal should see additional opportunities. IT asset disposition (ITAD) businesses could see a better outlook, too.

Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Glen Cardoza

Follow Counterpoint Research