Access quarterly data on global smartphone shipments and market share from Q1 2018.

Market Highlights

• The global smartphone market grew by 7% YoY to reach 323.2 million units in Q4 2023.

• Apple grew by 2% YoY, overtaking Samsung for the top spot in Q4 2023.

• Samsung, meanwhile, declined by 9% YoY losing share to Apple in the premium segment, to Chinese OEMs such as Xiaomi in the mid-tier segment and to Transsion brands in the entry-level.

• Samsung, nevertheless, retained the spot as the world's top smartphone player annually, shipping the most number of smartphones in 2023.

• Among the top five smartphone brands, Xiaomi grew the most by 23% YoY to 40.7 million units in Q4 2023.

• HONOR experienced a healthy double-digit growth of 27% YoY whereas Huawei grew by triple-digits, the only top 10 smartphone to do so.

• In terms of regional performance, the Middle East and Africa (MEA) exhibited the highest annual shipment growth while Europe experienced the highest decline.

| Brands | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 |

|---|---|---|---|---|---|---|---|---|

| Apple | 18% | 16% | 16% | 24% | 21% | 17% | 16% | 23% |

| Samsung | 23% | 21% | 21% | 19% | 22% | 20% | 20% | 16% |

| Xiaomi | 12% | 13% | 13% | 11% | 11% | 12% | 14% | 13% |

| vivo | 8% | 9% | 9% | 8% | 7% | 8% | 7% | 7% |

| OPPO* | 9% | 10% | 10% | 10% | 10% | 10% | 9% | 7% |

| Others | 30% | 31% | 31% | 28% | 29% | 33% | 34% | 34% |

| Brands | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 |

|---|---|---|---|---|---|---|---|---|

| Apple | 59 | 46.5 | 49.2 | 72.3 | 58 | 45.3 | 48.9 | 74 |

| Samsung | 74.4 | 62.5 | 64.3 | 58.3 | 60.6 | 53.5 | 59.4 | 53 |

| Xiaomi | 39 | 39.5 | 40.5 | 33.2 | 30.5 | 33.2 | 41.5 | 40.7 |

| vivo | 25.4 | 25.5 | 26 | 23.4 | 20.8 | 21.4 | 22.1 | 23.7 |

| OPPO* | 30.9 | 28.2 | 29.5 | 30.1 | 28.4 | 28 | 28.1 | 24 |

| Others | 97.7 | 92.3 | 92.4 | 85.4 | 81.8 | 86.7 | 99.8 | 107.8 |

| Total | 326.4 | 294.5 | 301.9 | 302.6 | 280.2 | 268 | 299.8 | 323.2 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

*Data on this page is updated every quarter

This data represents the global smartphone market share by quarter (from 2021-2023) by top OEMs. Global smartphone shipments by market share and millions of units are provided.

For detailed insights on the data, please reach out to us at sales(at)counterpointresearch.com. If you are a member of the press, please contact us at press(at)counterpointresearch.com for any media enquiries.

The global smartphone market share numbers are from:

Excel File

Published Date: November 2023

This report is part of a series of reports which track the mobile handset market: Smartphone and Feature Phone shipments every quarter for more than 140 brands covering more than 95% of the total device shipments in the industry.

Recommended Reads:

Published Date: Nov 10, 2023

Market Highlights

• The global smartphone market declined by 1% YoY to reach 299.8 million units in Q3 2023.

• Samsung declined 8% YoY despite growing by 11% QoQ and retaining its position as the top smartphone player in Q3 2023.

• Among the top five smartphone brands, Xiaomi was the only brand to grow YoY, shipping 41.5 million smartphones in Q3 2023.

• Among the top 10 smartphone brands, HONOR, Motorola, Tecno and Huawei saw double-digit annual growth. Infinix and itel, the other Transsion brands along with Tecno, also experienced double-digit annual growth.

• In terms of regional performance, the Middle East and Africa (MEA) exhibited the highest annual shipment growth while North America experienced the highest decline.

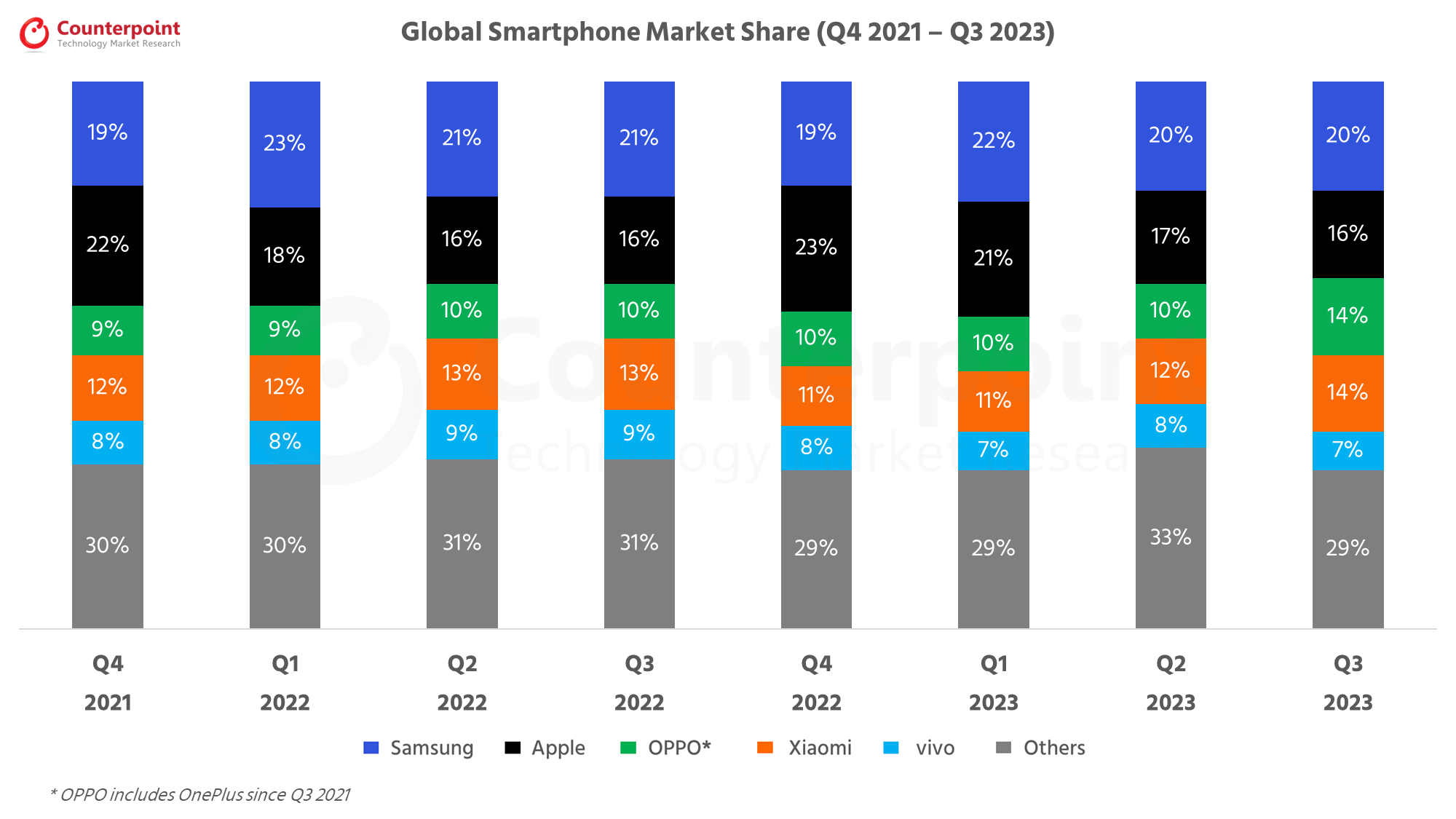

| Brands | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 |

|---|---|---|---|---|---|---|---|---|

| Samsung | 19% | 23% | 21% | 21% | 19% | 22% | 20% | 20% |

| Apple | 22% | 18% | 16% | 16% | 23% | 21% | 17% | 16% |

| OPPO* | 9% | 9% | 10% | 10% | 10% | 10% | 10% | 14% |

| Xiaomi | 12% | 12% | 13% | 13% | 11% | 11% | 12% | 14% |

| vivo | 8% | 8% | 9% | 9% | 8% | 7% | 8% | 7% |

| Others | 30% | 30% | 31% | 31% | 29% | 29% | 33% | 29% |

| Brands | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 |

|---|---|---|---|---|---|---|---|---|

| Samsung | 69 | 74.5 | 62.5 | 64.3 | 58.3 | 60.6 | 53.5 | 59.4 |

| Apple | 81.5 | 59 | 46.5 | 49.2 | 70 | 58 | 45.3 | 48.9 |

| OPPO* | 33.9 | 30.9 | 28.2 | 29.5 | 29.6 | 28.4 | 28 | 42.1 |

| Xiaomi | 45 | 39 | 39.5 | 40.5 | 33.2 | 30.5 | 33.2 | 41.5 |

| vivo | 29.3 | 24.8 | 25.5 | 26 | 23.4 | 20.8 | 21.4 | 22.1 |

| Others | 112.7 | 98.1 | 92.3 | 92.4 | 89.4 | 81.9 | 86.6 | 85.8 |

| Total | 371.4 | 326.4 | 294.5 | 301.9 | 303.9 | 280.2 | 268 | 299.8 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Published Date: Aug 17, 2023

Market Highlights

• The global smartphone market declined by 9% YoY to reach 268 million units in Q2 2023.

• Samsung retained its position as the top smartphone player in Q2 2023, as Apple saw cyclical decline.

• Among the top five brands, Apple experienced the least YoY shipment decline. Among the top 10 brands, Tecno and Infinix, part of the Transsion Group, saw double digit annual growth.

• In terms of regional performance, Middle East and Africa (MEA) exhibited the only annual shipment growth while North America experienced the highest decline.

• The top 5 brands contributed to almost 80% of the total 5G shipments in Q2 2023.

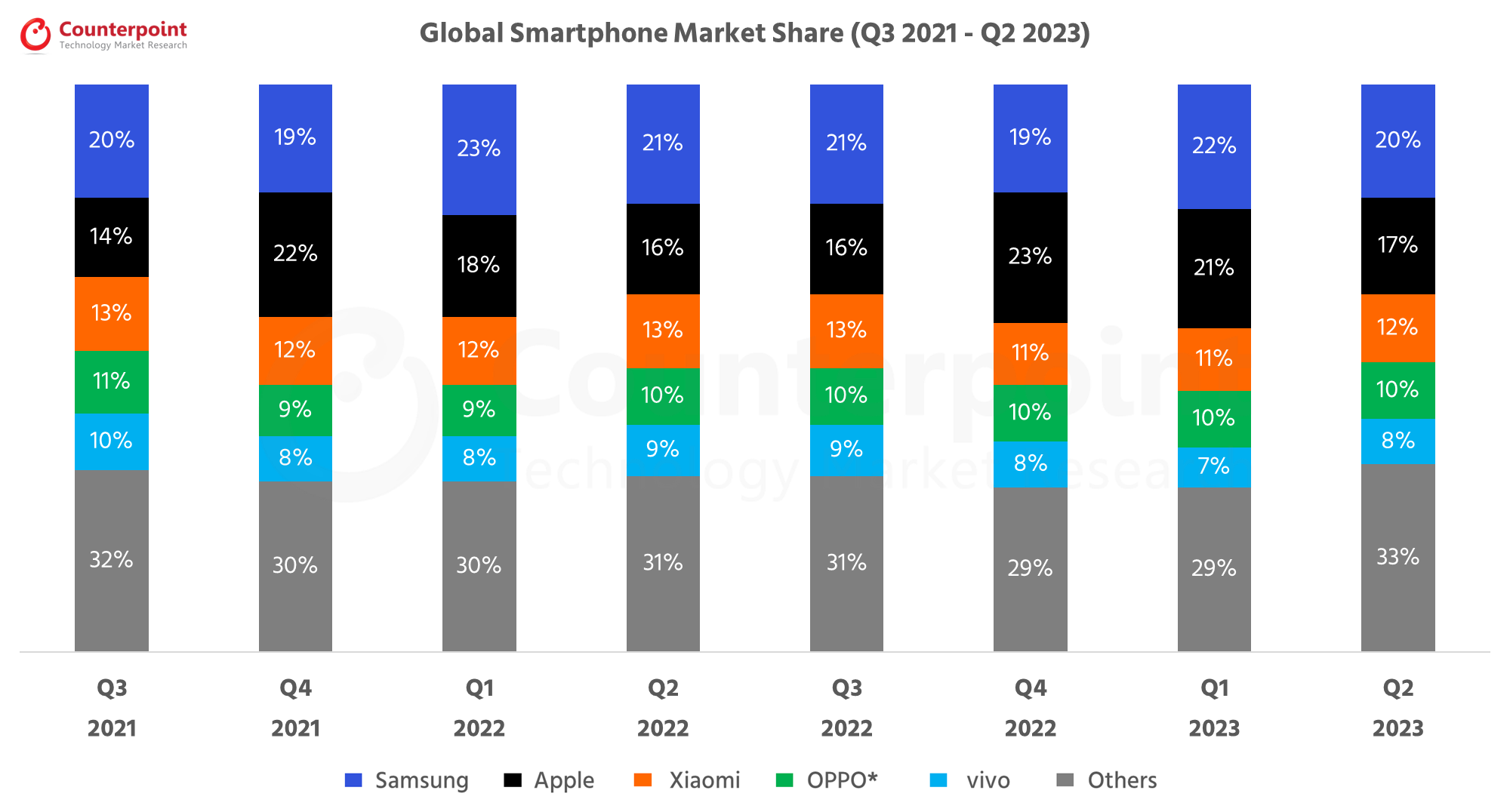

| Brands | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

|---|---|---|---|---|---|---|---|---|

| Apple | 14% | 22% | 18% | 16% | 16% | 23% | 21% | 17% |

| Samsung | 20% | 19% | 23% | 21% | 21% | 19% | 22% | 20% |

| Xiaomi | 13% | 12% | 12% | 13% | 13% | 11% | 11% | 12% |

| OPPO* | 11% | 9% | 9% | 10% | 10% | 10% | 10% | 10% |

| vivo | 10% | 8% | 8% | 9% | 9% | 8% | 7% | 8% |

| Others | 32% | 30% | 30% | 31% | 31% | 29% | 29% | 33% |

| Brands | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 |

|---|---|---|---|---|---|---|---|---|

| Samsung | 69.3 | 69.0 | 74.5 | 62.5 | 64.3 | 58.3 | 60.6 | 53.5 |

| Apple | 48.0 | 81.5 | 59.0 | 46.5 | 49.2 | 70.0 | 58.0 | 45.3 |

| Xiaomi | 44.4 | 45.0 | 39.0 | 39.5 | 40.5 | 33.2 | 30.5 | 33.2 |

| OPPO* | 38.1 | 33.9 | 30.9 | 28.2 | 29.5 | 29.6 | 28.4 | 28.0 |

| vivo | 33.7 | 29.3 | 24.8 | 25.5 | 26.0 | 23.4 | 20.8 | 21.4 |

| Others | 108.5 | 112.7 | 98.1 | 92.3 | 92.4 | 89.4 | 81.9 | 86.6 |

| Total Market | 342.0 | 371.4 | 326.4 | 294.5 | 301.9 | 303.9 | 280.2 | 268.0 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Published Date: May 9, 2023

Market Highlights

• The global smartphone market declined by 14% YoY and 7% QoQ to record 280.2 million unit shipments in Q1 2023.

• Samsung replaced Apple as the top smartphone player in Q1 2023, driven by its mid-tier A Series and the recently launched S23 series.

• Apple’s YoY shipment decline was the least among the top five brands. Consequently, it recorded its highest-ever Q1 share of 21%.

• Global smartphone revenues declined by 7% YoY to around $104 billion. Apple, Samsung, Xiaomi increased their Average Selling Prices YoY.

For our detailed research on the global smartphone market in Q1 2023, click here.

| Global Smartphone Shipments Market Share (%) | ||||||||

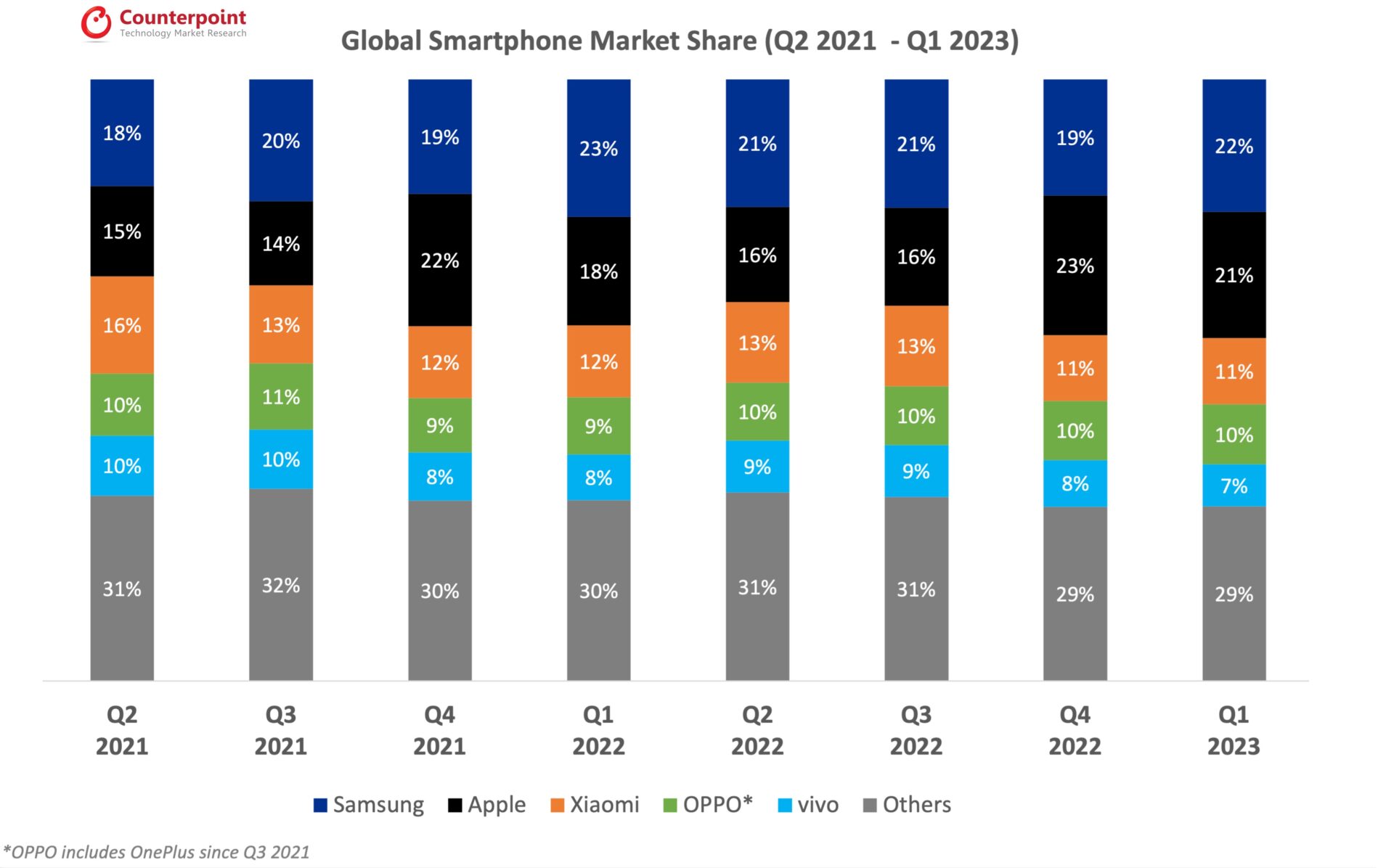

|---|---|---|---|---|---|---|---|---|

| Brands | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

| Samsung | 18% | 20% | 19% | 23% | 21% | 21% | 19% | 22% |

| Apple | 15% | 14% | 22% | 18% | 16% | 16% | 23% | 21% |

| Xiaomi | 16% | 13% | 12% | 12% | 13% | 13% | 11% | 11% |

| OPPO* | 10% | 11% | 9% | 9% | 10% | 10% | 10% | 10% |

| vivo | 10% | 10% | 8% | 8% | 9% | 9% | 8% | 7% |

| Others | 31% | 32% | 30% | 30% | 31% | 31% | 29% | 29% |

| Brands | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 |

|---|---|---|---|---|---|---|---|---|

| Samsung | 57.6 | 69.3 | 69 | 74.5 | 62.5 | 64.3 | 58.3 | 60.6 |

| Apple | 48.9 | 48 | 81.5 | 59 | 46.5 | 49.2 | 70 | 58 |

| Xiaomi | 52.5 | 44.4 | 45 | 39 | 39.5 | 40.5 | 33.2 | 30.5 |

| OPPO* | 33.6 | 38.1 | 33.9 | 30.9 | 28.2 | 29.5 | 29.6 | 24 |

| vivo | 32.5 | 33.7 | 29.3 | 24.8 | 25.5 | 26 | 23.4 | 21.2 |

| Others | 98 | 108.5 | 112.7 | 98.1 | 92.3 | 92.4 | 89.4 | 85.9 |

| Total Market | 323.1 | 342 | 371.4 | 326.4 | 294.5 | 301.9 | 303.9 | 280.2 |

• What’s the global market size for smartphones?

The global smartphone market shipments declined to reach 280.2 million units in Q1 2023.

• What is the global market for mobile phones?

The 2022 global smartphone shipments declined to 1.2 billion units, the lowest since 2013.

• Who dominates the smartphone market?

Apple dominated the smartphone market in 2022 by achieving its highest-ever global shipments, revenue and operating profit share.

• How fast is the smartphone market growing?

The global smartphone shipments declined by 12% in 2022.

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Published Date: February 8, 2023

Market Highlights

For our detailed research on the global smartphone market in Q4 2022, click here.

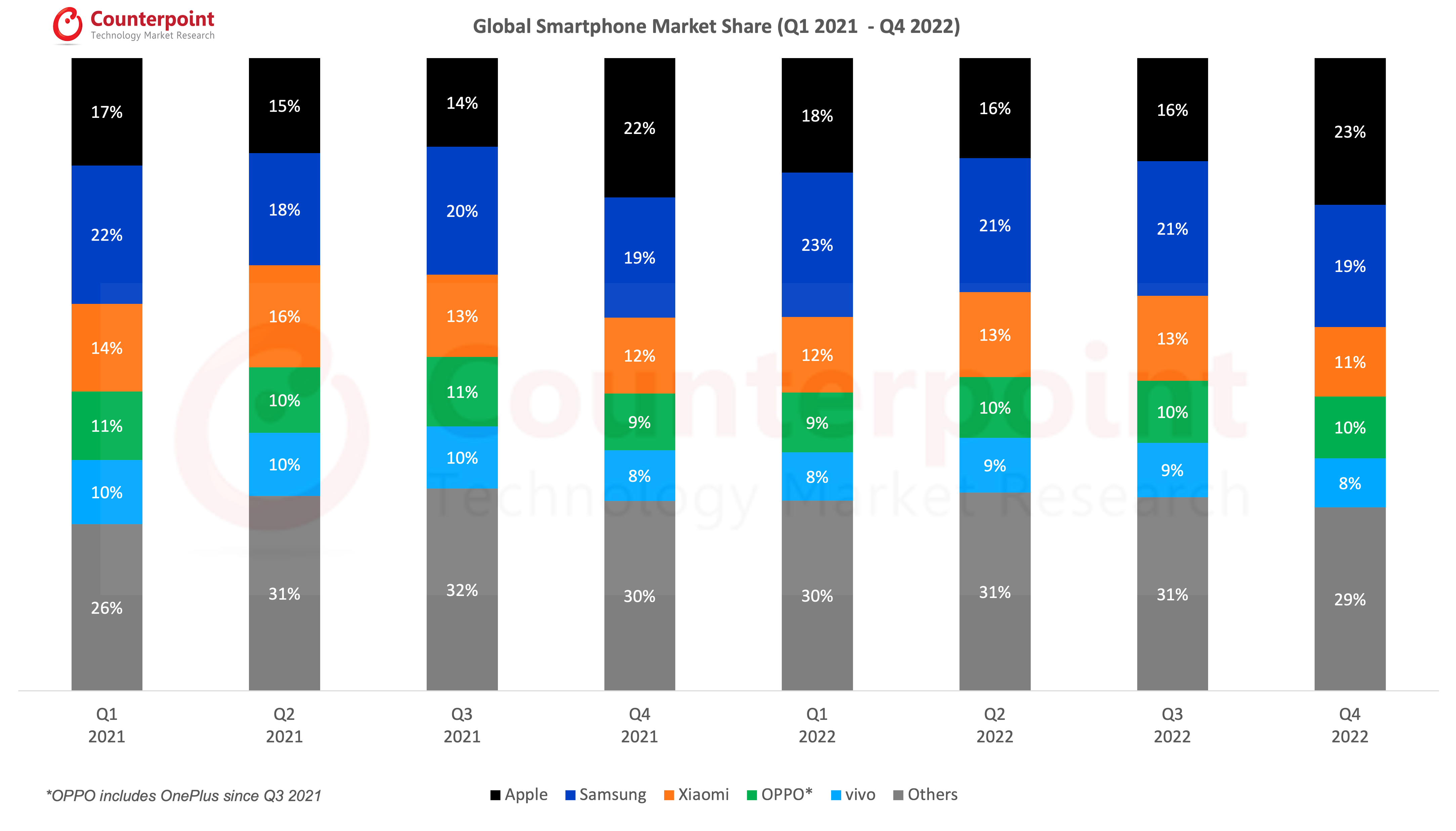

| Brands | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 |

| Apple | 17% | 15% | 14% | 22% | 18% | 16% | 16% | 23% |

| Samsung | 22% | 18% | 20% | 19% | 23% | 21% | 21% | 19% |

| Xiaomi | 14% | 16% | 13% | 12% | 12% | 13% | 13% | 11% |

| OPPO* | 11% | 10% | 11% | 9% | 9% | 10% | 10% | 10% |

| vivo | 10% | 10% | 10% | 8% | 8% | 9% | 9% | 8% |

| Others | 26% | 31% | 32% | 30% | 30% | 31% | 31% | 29% |

| Brands | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 |

| Apple | 59.5 | 48.9 | 48.0 | 81.5 | 59.0 | 46.5 | 49.2 | 70.0 |

| Samsung | 76.6 | 57.6 | 69.3 | 69.0 | 74.5 | 62.5 | 64.3 | 58.3 |

| Xiaomi | 48.5 | 52.5 | 44.4 | 45.0 | 39.0 | 39.5 | 40.5 | 33.2 |

| OPPO* | 38 | 33.6 | 38.1 | 33.9 | 30.9 | 28.2 | 29.5 | 29.6 |

| vivo | 35.5 | 32.5 | 33.7 | 29.3 | 24.8 | 25.5 | 26.0 | 23.4 |

| Others | 96.8 | 98.0 | 108.5 | 112.7 | 98.1 | 92.3 | 92.4 | 89.4 |

| Total Market | 354.9 | 323.1 | 342.0 | 371.4 | 326.4 | 294.5 | 301.9 | 303.9 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

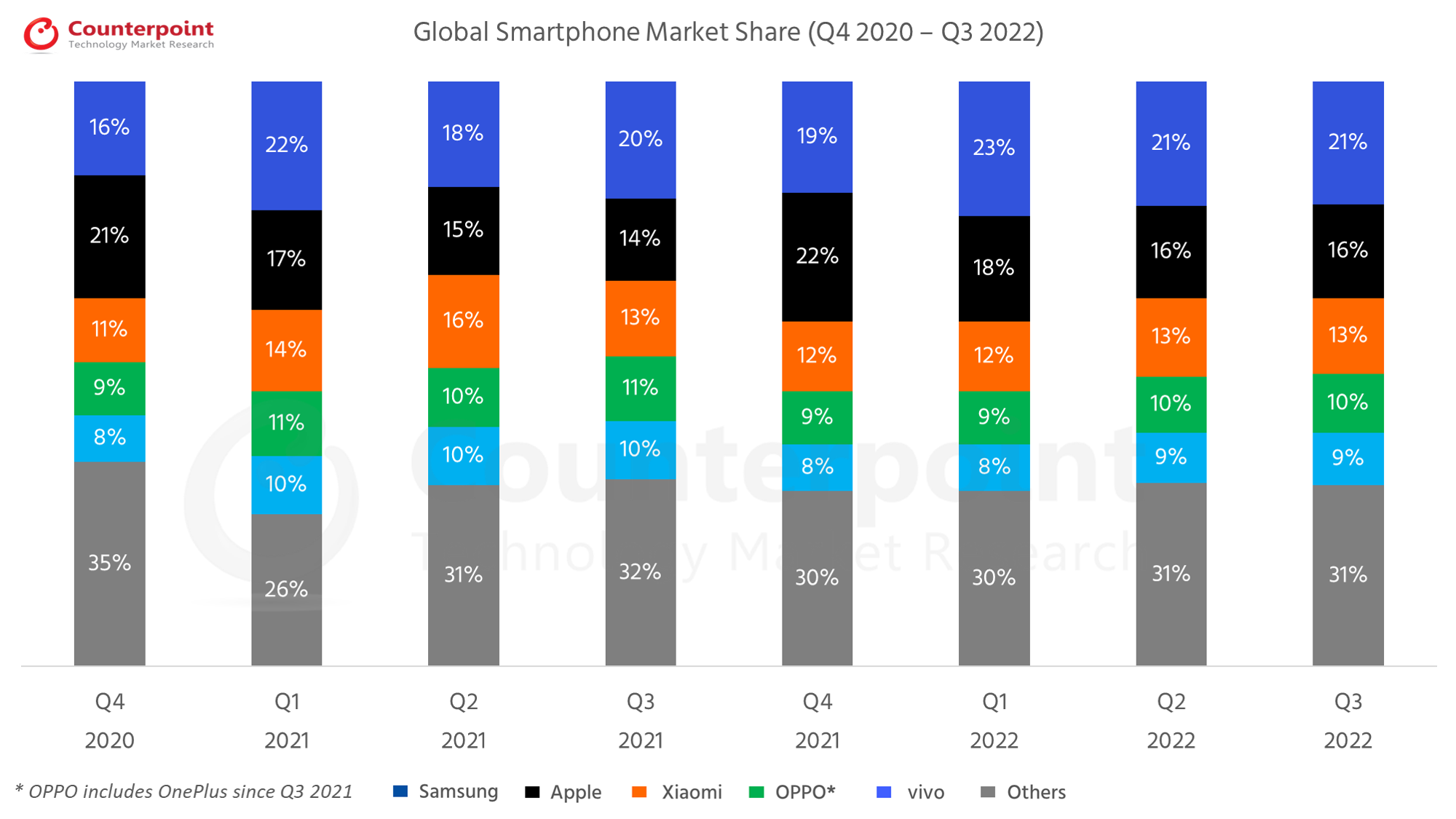

Published Date: December 20, 2022

Market Highlights

| Brands | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 |

| Samsung | 16% | 22% | 18% | 20% | 19% | 23% | 21% | 21% |

| Apple | 21% | 17% | 15% | 14% | 22% | 18% | 16% | 16% |

| Xiaomi | 11% | 14% | 16% | 13% | 12% | 12% | 13% | 13% |

| OPPO* | 9% | 11% | 10% | 11% | 9% | 9% | 10% | 10% |

| vivo | 8% | 10% | 10% | 10% | 8% | 8% | 9% | 9% |

| Others | 35% | 26% | 31% | 32% | 30% | 30% | 31% | 31% |

| Brands | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 |

| Samsung | 62.5 | 76.6 | 57.6 | 69.3 | 69.0 | 74.5 | 62.5 | 64.3 |

| Apple | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 | 59.0 | 46.5 | 49.2 |

| Xiaomi | 43.0 | 48.5 | 52.5 | 44.4 | 45.0 | 39.0 | 39.5 | 40.5 |

| OPPO* | 34.0 | 38 | 33.6 | 38.1 | 33.9 | 30.9 | 28.2 | 29.5 |

| vivo | 33.4 | 35.5 | 32.5 | 33.7 | 29.3 | 24.8 | 25.2 | 26.0 |

| Others | 139.8 | 96.8 | 98.0 | 108.5 | 112.7 | 98.1 | 92.3 | 92.4 |

| Total Market | 394.6 | 354.9 | 323.1 | 342.0 | 371.4 | 326.4 | 294.5 | 301.9 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

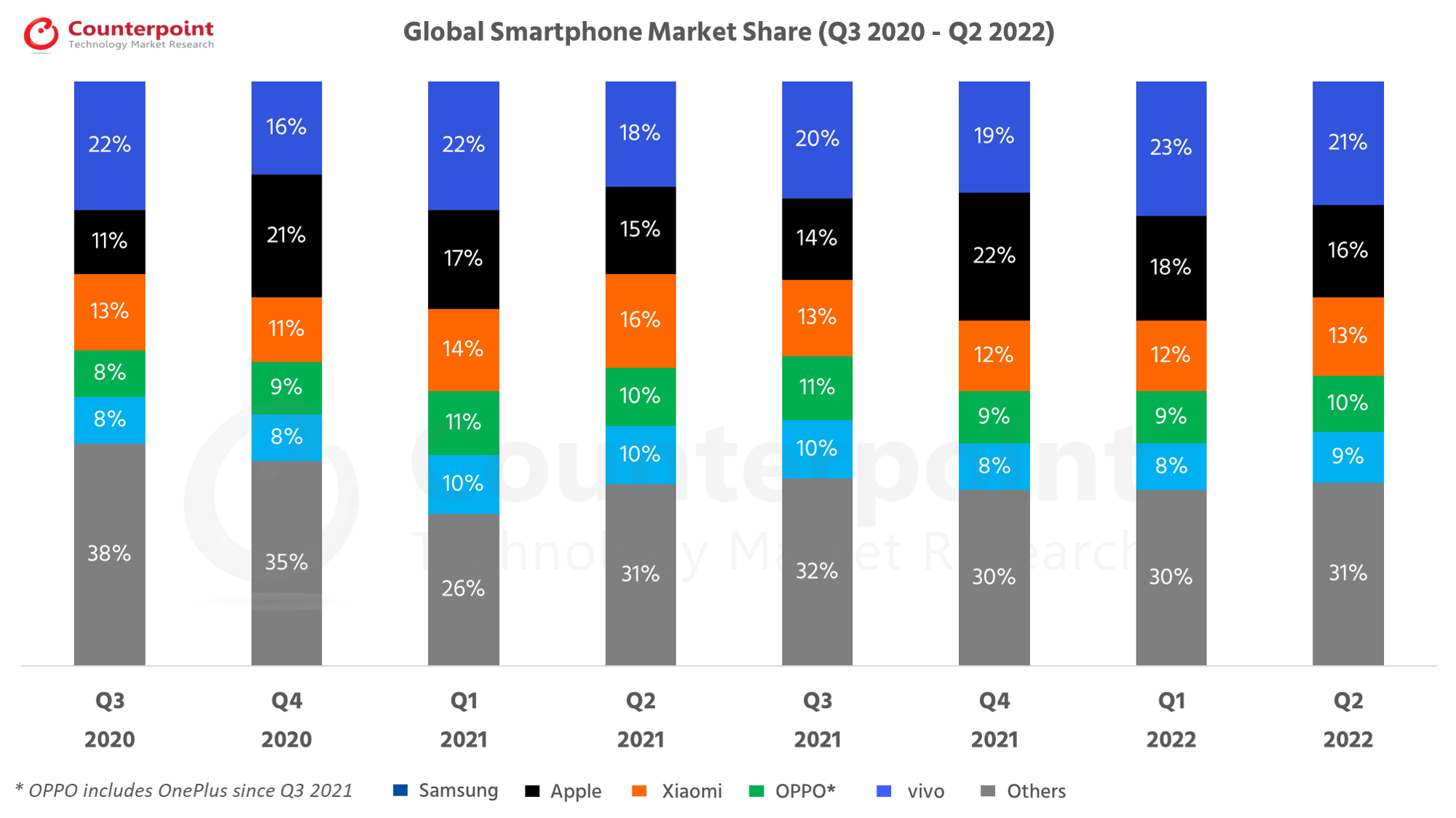

Published Date: August 16, 2022

Market Highlights

• The global smartphone market growth saw a decline of 9% YoY and 10% QoQ to 294.5 million units in Q2 2022.

• Global smartphone market share carries on consolidation, with top three brands commanding 50% share for three consecutive quarters.

• This was the first time quarterly shipments dropped below 300 million units since Q2 2020 during the early part of the COVID-19 pandemic.

• Samsung was the only top-five smartphone brand to grow YoY, increasing shipments by 8% YoY and growing market share by three percentage points to 21%.

• Apple market share declined by 5% YoY in Q2 2022, although its share increased in a diminished market.

• iPhone shipment market share continues to edge upwards, with Apple reaching its highest Q2 2022 shipment share ever

• The Android vs iOS market share battle, traditionally contested by Apple in the US, Europe and Japan, is intensifying in markets like China, which is becoming a significant driver of iOS installed based globally.

• Xiaomi, OPPO* and vivo, hit by China lockdowns, suffered double digit YoY declines in their respective shipments.

| Brands | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 |

| Samsung | 22% | 16% | 22% | 18% | 20% | 19% | 23% | 21% |

| Apple | 11% | 21% | 17% | 15% | 14% | 22% | 18% | 16% |

| Xiaomi | 13% | 11% | 14% | 16% | 13% | 12% | 12% | 13% |

| OPPO* | 8% | 9% | 11% | 10% | 11% | 9% | 9% | 10% |

| vivo | 8% | 8% | 10% | 10% | 10% | 8% | 8% | 9% |

| Others | 38% | 35% | 26% | 31% | 32% | 30% | 30% | 31% |

| Brands | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 |

| Samsung | 80.4 | 62.5 | 76.6 | 57.6 | 69.3 | 69.0 | 74.5 | 62.5 |

| Apple | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 | 59.0 | 46.5 |

| Xiaomi | 46.5 | 43.0 | 48.5 | 52.5 | 44.4 | 45.0 | 39.0 | 39.5 |

| OPPO* | 31.0 | 34.0 | 38.0 | 33.6 | 38.1 | 33.9 | 30.9 | 28.2 |

| vivo | 31.0 | 33.4 | 35.5 | 32.5 | 33.7 | 29.3 | 24.8 | 25.5 |

| Others | 135.0 | 139.8 | 96.8 | 98.0 | 108.5 | 112.7 | 98.2 | 92.3 |

| Total Market | 365.6 | 394.6 | 354.9 | 323.1 | 342.0 | 371.4 | 326.4 | 294.5 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

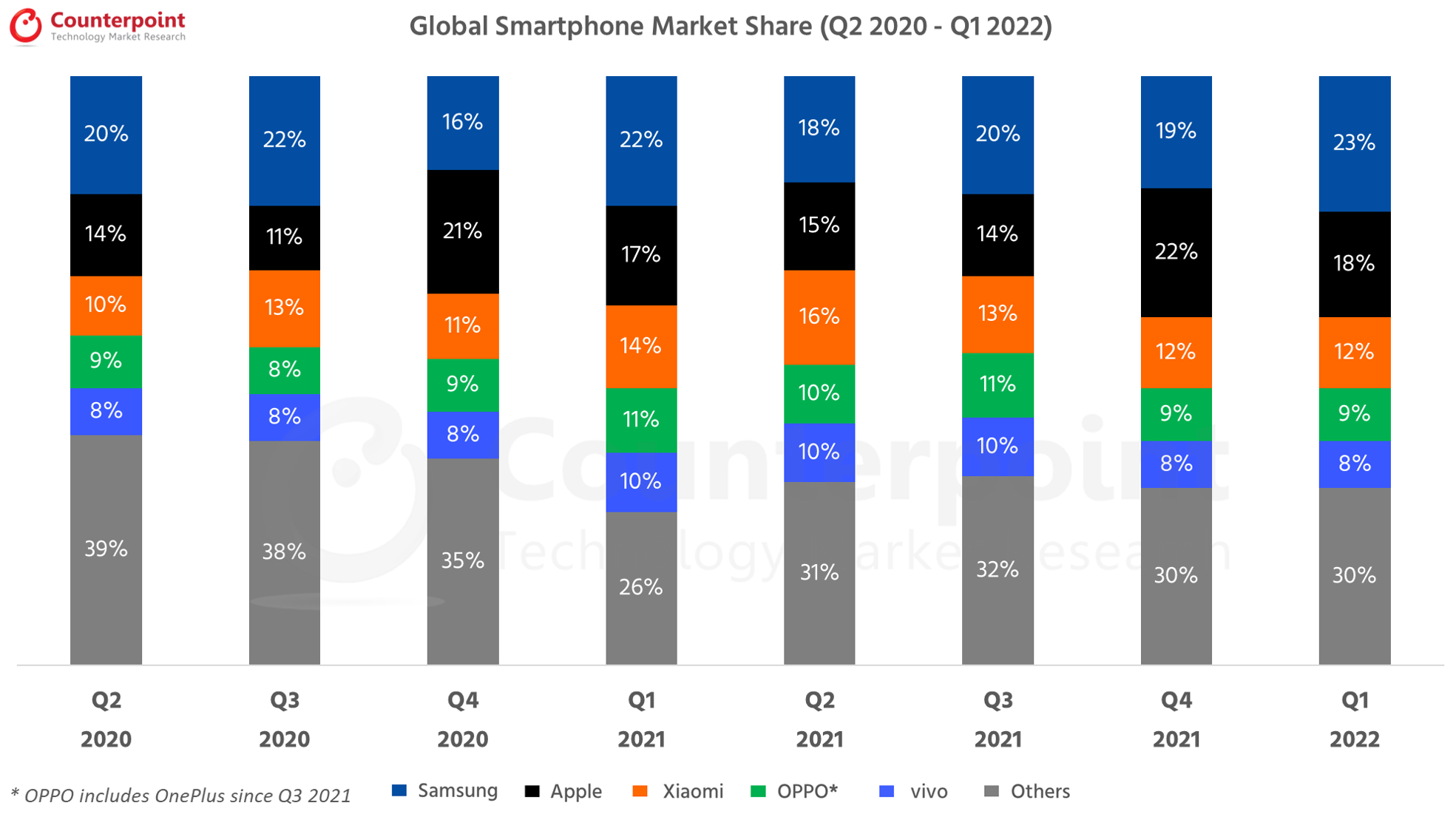

Published Date: May 16, 2022

Market Highlights

• The global smartphone market declined by 7% YoY and 12% QoQ to 328 million units in Q1 2022.

• While Samsung’s shipments declined 3% YoY, it was the only top-five smartphone brand to grow QoQ. Its market share rose to 23% from 19% last quarter, resulting in Samsung taking the top spot from Apple in Q1 2022.

• Apple’s shipments declined by 1% annually to reach 59 million units in Q1 2022. This was after an expected seasonal quarterly shipment decline of 28%.

• Xiaomi, OPPO* and vivo’s component struggles continued, causing a quarterly and annual decline in their respective shipments.

| Brands | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 |

| Samsung | 20% | 22% | 16% | 22% | 18% | 20% | 19% | 23% |

| Apple | 14% | 11% | 21% | 17% | 15% | 14% | 22% | 18% |

| Xiaomi | 10% | 13% | 11% | 14% | 16% | 13% | 12% | 12% |

| OPPO* | 9% | 8% | 9% | 11% | 10% | 11% | 9% | 9% |

| vivo | 8% | 8% | 8% | 10% | 10% | 10% | 8% | 8% |

| Others | 39% | 38% | 35% | 26% | 31% | 32% | 30% | 30% |

| Brands | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 |

| Samsung | 54.2 | 80.4 | 62.5 | 76.6 | 57.6 | 69.3 | 69.0 | 74.5 |

| Apple | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 | 59.0 |

| Xiaomi | 26.5 | 46.5 | 43.0 | 48.5 | 52.5 | 44.4 | 45.0 | 39.0 |

| OPPO | 24.5 | 31.0 | 34.0 | 38.0 | 33.6 | 38.1 | 33.9 | 30.9 |

| vivo | 22.5 | 31.0 | 33.4 | 35.5 | 32.5 | 33.7 | 29.3 | 24.8 |

| Others | 110.9 | 135.0 | 139.8 | 96.8 | 98.0 | 108.5 | 112.7 | 98.1 |

| Total Market | 276.1 | 365.6 | 394.6 | 354.9 | 323.1 | 342.0 | 371.4 | 326.4 |

The global smartphone market growth saw a decline of 7% YoY, shipping 328 million units in Q1 2022 caused by the ongoing component shortages, as well as COVID resurgence at the beginning of the quarter and the Russia-Ukraine war towards the end. The global smartphone market also, as expected, had a seasonal decline of 12% QoQ. The component supply crunch was felt more severely by major Chinese OEMs such as Xiaomi, OPPO* and vivo as compared with Samsung, which seems to have overcome component shortages that affected its supply last year, as evidenced by higher-than-expected growth in its shipments despite a late flagship launch.

Consequently, Samsung regained the top spot from Apple which had emerged as the biggest smartphone vendor globally in Q4 2021 thanks to its latest iPhone 13 series.

With its share at around 22.5% of the global smartphone shipments in Q1 2022, China remains the world’s biggest smartphone market. This is down from around 25.6% in Q1 2021 as China’s economy grew slower than expected due to COVID-related lockdowns and shipment volumes declined by over 19% YoY. While China’s share of global smartphone market growth (shipments) remains flat QoQ thanks to a small peak in demand during Chinese New Year and as the global smartphone market declined QoQ due to seasonality, in terms of absolute shipments, China saw a quarterly decline of over 12%.

HONOR has emerged as the biggest smartphone player in China, chipping into vivo and OPPO*’s shares and stepping into the position previously held by Huawei from which it recently separated. Although vivo did not succeed in regaining the top position due to HONOR’s rise at a time when it is itself facing component shortages, it did recover somewhat thanks to its newly launched mid-end S12 series that is popular with younger customers and the affordable the Y series which showed strong performance in the quarter.

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

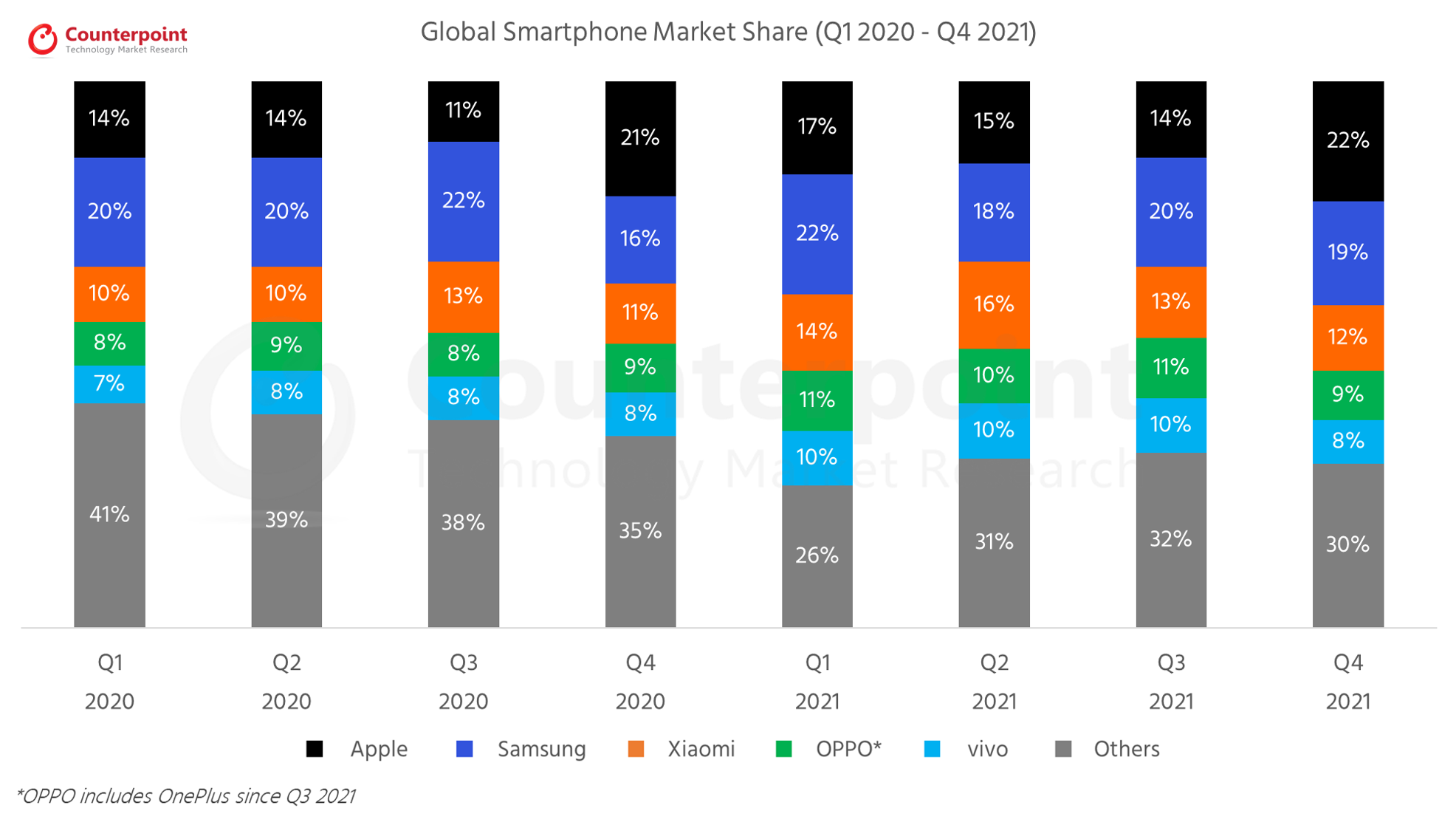

Published Date: February 16, 2022

Market Highlights

• Global smartphone market growth saw an increase of 4% YoY to reach 1.39 billion units in 2021. Q4 2021 shipments declined 6% YoY to reach 371 million units.

• Samsung led the global smartphone market in 2021 with annual shipments of 272 million units.

• Apple, Xiaomi, OPPO^ and vivo recorded their highest-ever annual shipments.

• The top five brands gained share due to a significant decline by Huawei, and LG’s exit from the market.

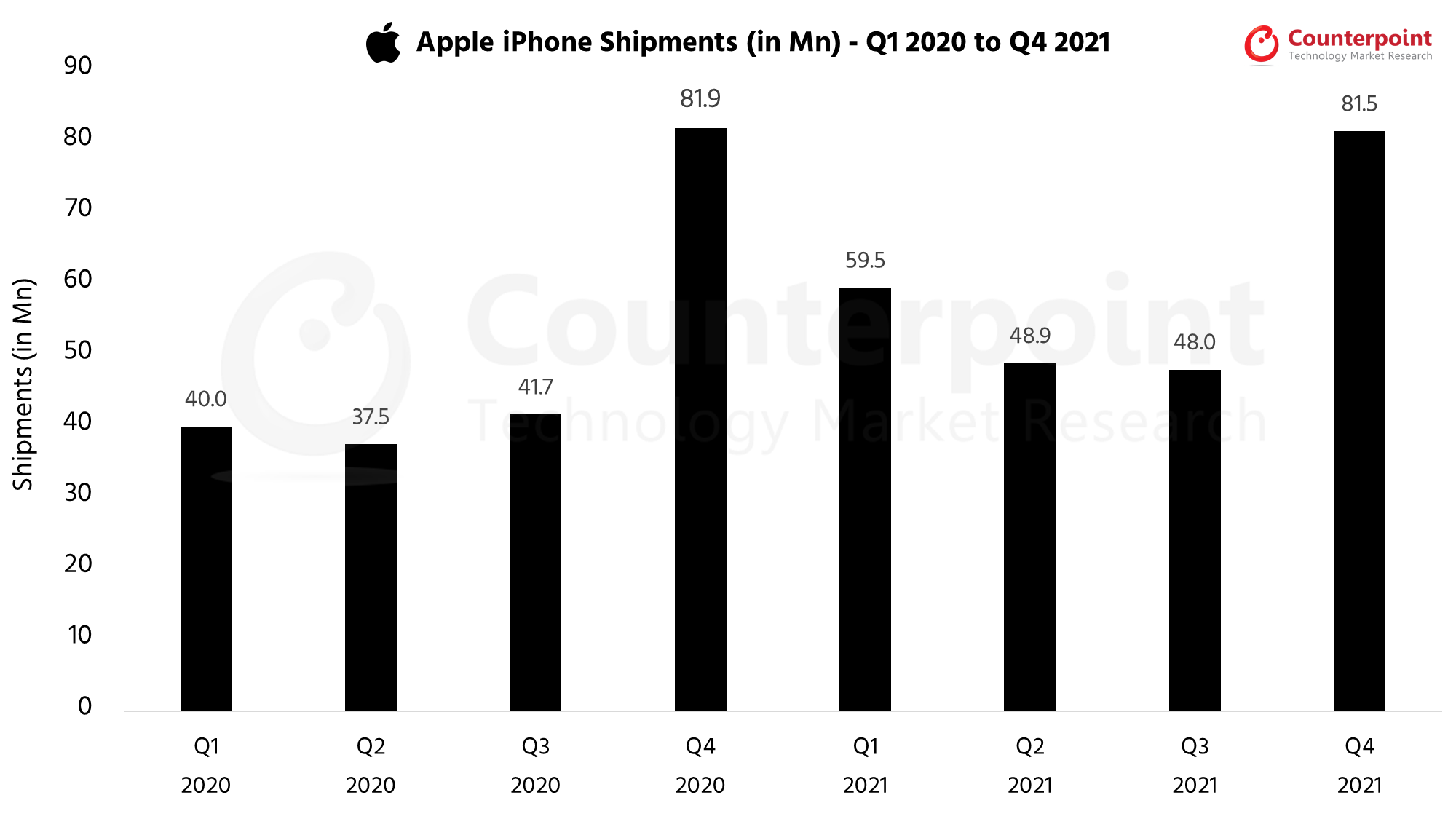

• Apple surpassed Samsung to take the number one spot in Q4 2021 with smartphone shipments increasing by 70% QoQ to 81.5 million units in Q4 2021, despite remaining flat YoY.

• Apple recorded their highest-ever annual shipments of 237.9 million units in 2021 driven by successful launch of iPhone 13 series and consistent performance of iPhone 12 series.

| Brands | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 |

| Apple | 14% | 14% | 11% | 21% | 17% | 15% | 14% | 22% |

| Samsung | 20% | 20% | 22% | 16% | 22% | 18% | 20% | 19% |

| Xiaomi | 10% | 10% | 13% | 11% | 14% | 16% | 13% | 12% |

| OPPO* | 8% | 9% | 8% | 9% | 11% | 10% | 11% | 9% |

| vivo | 7% | 8% | 8% | 8% | 10% | 10% | 10% | 8% |

| Others | 41% | 39% | 38% | 35% | 26% | 31% | 32% | 30% |

| Brands | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 |

| Apple | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 |

| Samsung | 58.6 | 54.2 | 80.4 | 62.5 | 76.6 | 57.6 | 69.3 | 69.0 |

| Xiaomi | 29.7 | 26.5 | 46.5 | 43.0 | 48.5 | 52.5 | 44.4 | 45.0 |

| OPPO* | 22.3 | 24.5 | 31.0 | 34.0 | 38.0 | 33.6 | 38.1 | 33.9 |

| vivo | 21.6 | 22.5 | 31.0 | 33.4 | 35.5 | 32.5 | 33.7 | 29.3 |

| Others | 122.8 | 110.9 | 135.0 | 139.8 | 96.8 | 98.0 | 108.5 | 112.7 |

| Total Market | 295.0 | 276.1 | 365.6 | 394.6 | 354.9 | 323.1 | 342.0 | 371.4 |

| Quarter | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 |

| Ship-ments (in Mn) | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 | 81.5 |

*OPPO includes OnePlus since Q3 2021

**Ranking is according to the latest quarter.

Published Date: November 16, 2021

Market Highlights

• The global smartphone market growth saw an increase of 6% QoQ but declined by 6% YoY in Q3 2021, clocking global shipments of 342 million units, down from 365.6 million in Q3 2020.

• Samsung retained the number one spot in Q3 2021 with smartphone shipments increasing by 20% QoQ to 69.3 million units in Q3 2021.

• Xiaomi shipped 44.4 million units in Q3 2021, down 5% YoY and 15% QoQ as it was severely hit by the ongoing component shortages.

• vivo grew 8% YoY and 3% QoQ to reach 33.7 million units. vivo continued to lead China’s smartphone market with 17.3 million units in Q3 2021.

• realme achieved its highest-ever shipment performance with 16.2 million units in Q3 2021. The record quarter came at a time when component shortages were at their peak.

• Global handset market wholesale revenue grew 10% YoY and 6% QoQ in Q3 2021 to reach over $103 billion.

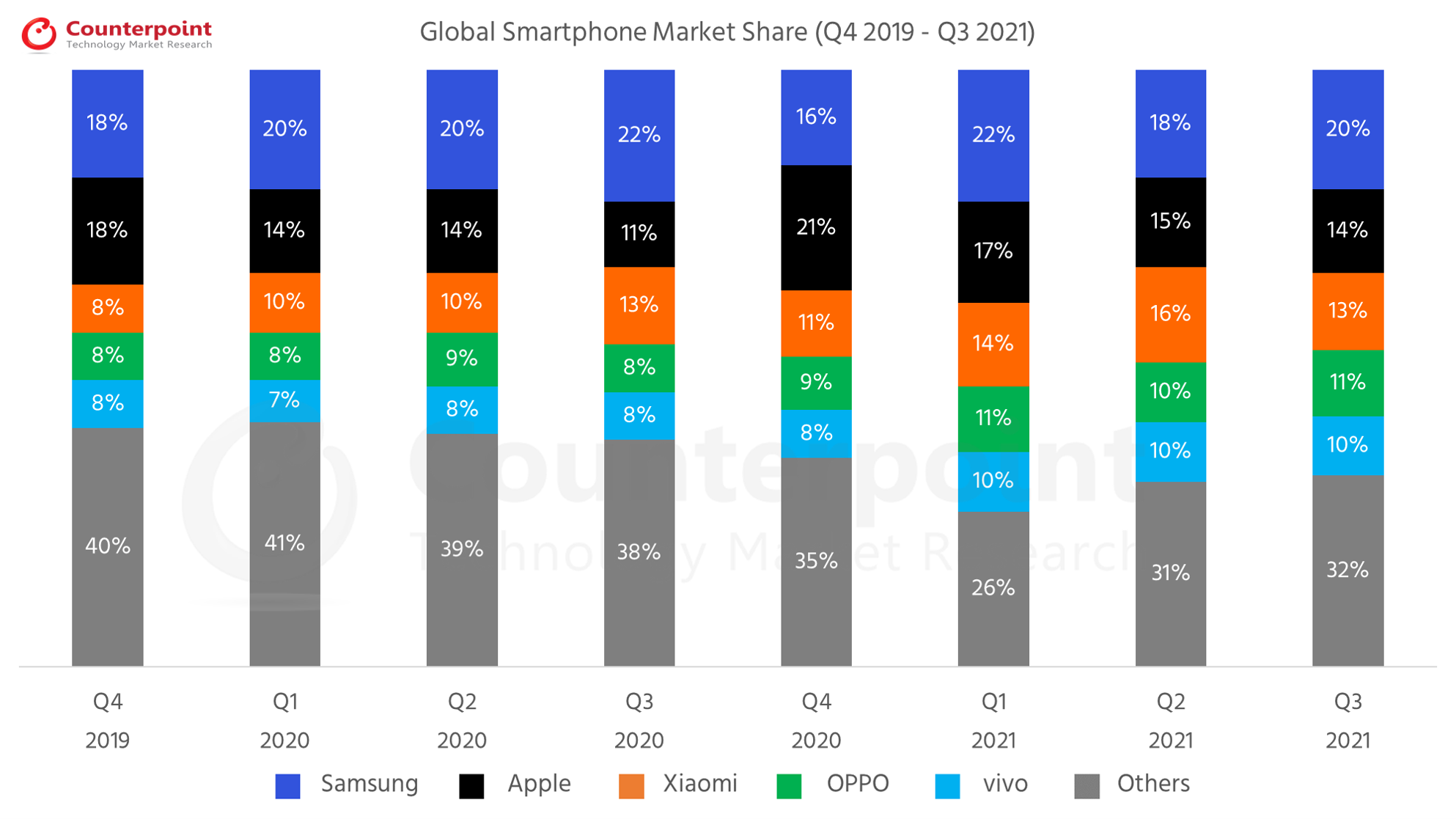

| Brands | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 |

| Samsung | 18% | 20% | 20% | 22% | 16% | 22% | 18% | 20% |

| Apple | 18% | 14% | 14% | 11% | 21% | 17% | 15% | 14% |

| Xiaomi | 8% | 10% | 10% | 13% | 11% | 14% | 16% | 13% |

| OPPO | 8% | 8% | 9% | 8% | 9% | 11% | 10% | 11% |

| vivo | 8% | 7% | 8% | 8% | 8% | 10% | 10% | 10% |

| Others | 40% | 41% | 39% | 38% | 35% | 26% | 31% | 32% |

| Brands | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 |

| Samsung | 70.4 | 58.6 | 54.2 | 80.4 | 62.5 | 76.6 | 57.6 | 69.3 |

| Apple | 72.3 | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 | 48.0 |

| Xiaomi | 32.9 | 29.7 | 26.5 | 46.5 | 43.0 | 48.5 | 52.5 | 44.4 |

| OPPO | 30.7 | 22.3 | 24.5 | 31.0 | 34.0 | 38.0 | 33.6 | 38.1 |

| vivo | 31.5 | 21.6 | 22.5 | 31.0 | 33.4 | 35.5 | 32.5 | 33.7 |

| Others | 163.4 | 122.8 | 110.9 | 135.0 | 139.8 | 96.8 | 98.0 | 108.5 |

| Total Market | 401.1 | 295.0 | 276.1 | 365.6 | 394.6 | 354.9 | 323.1 | 342.0 |

*Ranking is according to the latest quarter.

Published Date: August 16, 2021

Market Highlights

• Global smartphone market grew 19% YoY but declined by 7% QoQ as 323 million units were shipped, led by Samsung.

• Xiaomi eclipses 52 million smartphones, becoming the world’s second-largest smartphone brand for the first time ever.

• Samsung retained the number one spot with shipments reaching 58 million units in Q2 2021, however, its market share declined to 18% as compared to 22% in Q1 2021 as its shipments declined by 24% QoQ.

• realme grew by 135% YoY and 17% QoQ, crossing cumulative shipments of 100 million smartphones since its entry into the smartphone market.

• Global smartphone shipment revenues grew by 25% YoY to $96 billion in Q2 2021 setting a second-quarter record.

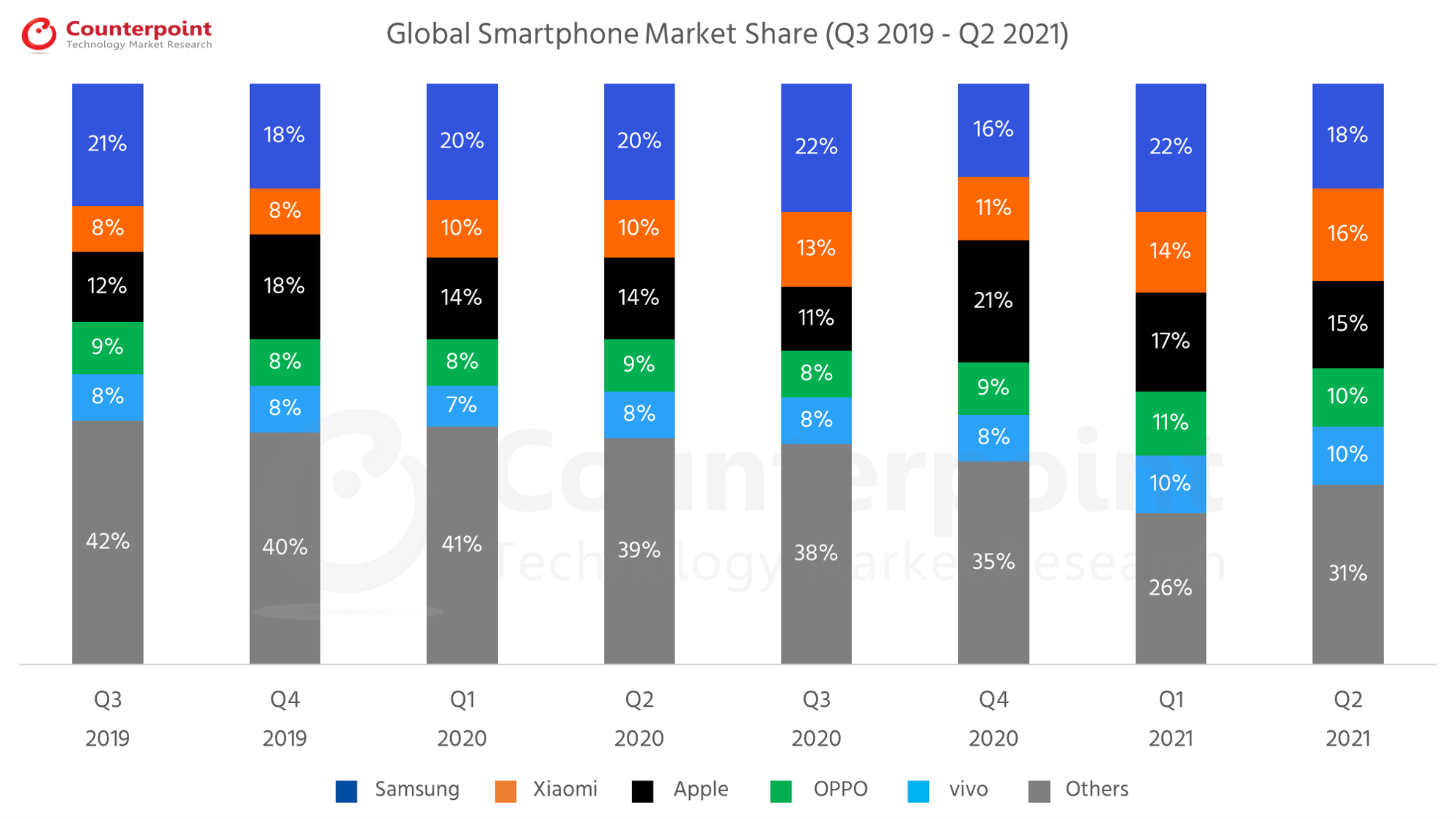

| Brands | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 |

| Samsung | 21% | 18% | 20% | 20% | 22% | 16% | 22% | 18% |

| Xiaomi | 8% | 8% | 10% | 10% | 13% | 11% | 14% | 16% |

| Apple | 12% | 18% | 14% | 14% | 11% | 21% | 17% | 15% |

| OPPO | 9% | 8% | 8% | 9% | 8% | 9% | 11% | 10% |

| vivo | 8% | 8% | 7% | 8% | 8% | 8% | 10% | 10% |

| Others | 42% | 40% | 41% | 39% | 38% | 35% | 26% | 31% |

| Brands | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 |

| Samsung | 78.2 | 70.4 | 58.6 | 54.2 | 80.4 | 62.5 | 76.6 | 57.9 |

| Xiaomi | 31.7 | 32.9 | 29.7 | 26.5 | 46.2 | 43.0 | 48.5 | 52.5 |

| Apple | 44.8 | 72.3 | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 | 48.9 |

| OPPO | 32.3 | 31.4 | 22.3 | 24.5 | 31.0 | 34.0 | 38.0 | 33.6 |

| vivo | 31.3 | 31.5 | 21.6 | 22.5 | 31.0 | 33.4 | 35.5 | 32.5 |

| Others | 161.7 | 162.6 | 122.8 | 110.9 | 135.3 | 139.8 | 96.8 | 97.7 |

Total Market | 380.0 | 401.1 | 295.0 | 276.1 | 365.6 | 394.6 | 354.9 | 323.1 |

*Ranking is according to the latest quarter.

Published Date: May 16, 2021

Market Highlights

• Global smartphone shipment revenue crossed the $100 billion mark for the first time for a March-ending quarter to reach $113 billion.

• Global shipments grew 20% YoY, reaching 354 million units, led by OPPO, vivo, Xiaomi and Apple.

• Samsung regained its top spot as the world’s biggest OEM, with shipments reaching 76.8 million units in Q1 2021.

• Apple iPhone active installed base reached a new high this quarter.

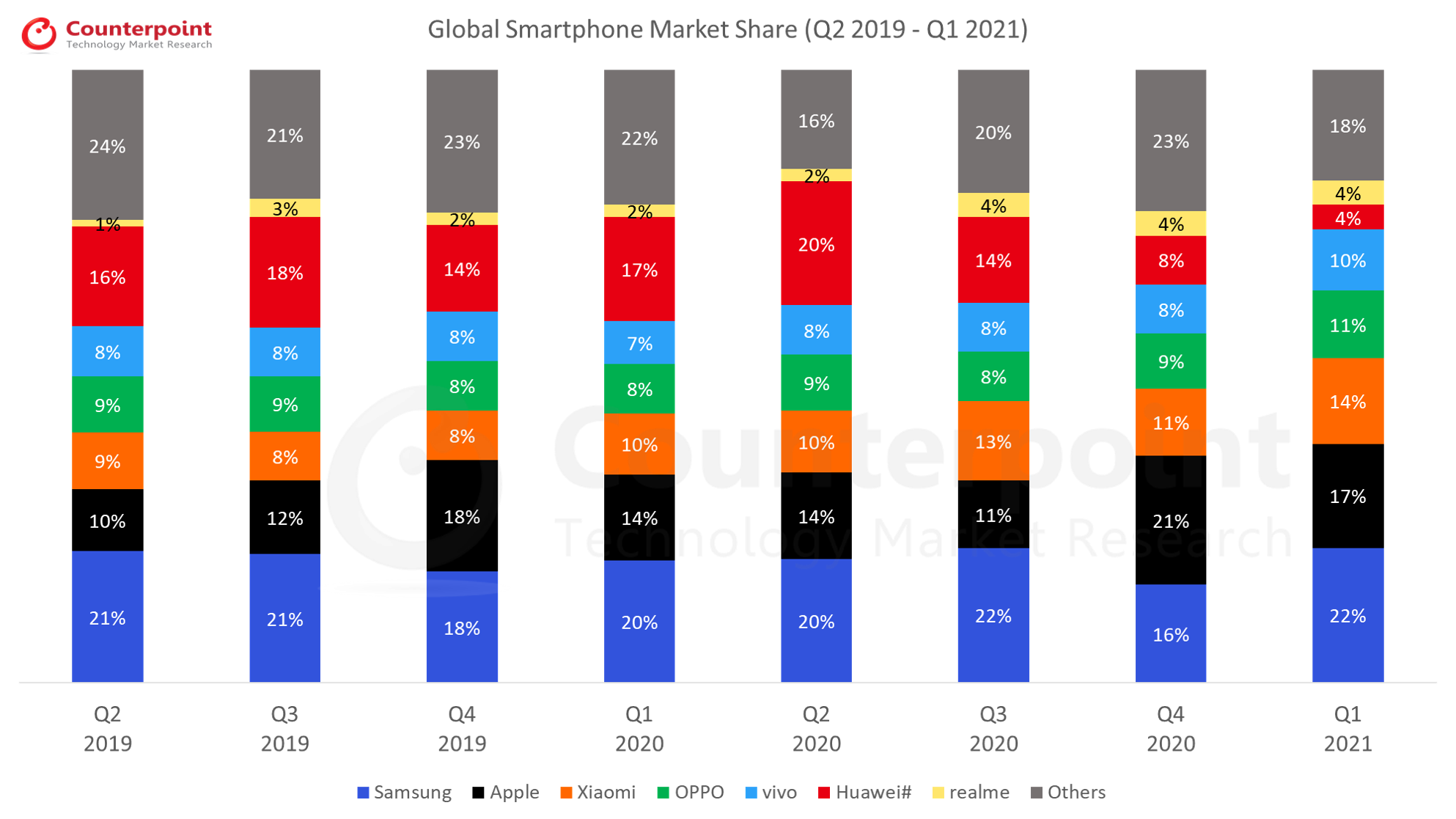

| Brands | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 |

| Samsung | 21% | 21% | 18% | 20% | 20% | 22% | 16% | 22% |

| Apple | 10% | 12% | 18% | 14% | 14% | 11% | 21% | 17% |

| Xiaomi | 9% | 8% | 8% | 10% | 10% | 13% | 11% | 14% |

| OPPO | 9% | 9% | 8% | 8% | 9% | 8% | 9% | 11% |

| vivo | 8% | 8% | 8% | 7% | 8% | 8% | 8% | 10% |

| Huawei# | 16% | 18% | 14% | 17% | 20% | 14% | 8% | 4% |

| realme | 1% | 3% | 2% | 2% | 2% | 4% | 4% | 4% |

| Others | 24% | 21% | 23% | 22% | 16% | 20% | 23% | 18% |

| Brands | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 |

| Samsung | 76.3 | 78.2 | 70.4 | 58.6 | 54.2 | 80.4 | 62.5 | 76.6 |

| Apple | 36.5 | 44.8 | 72.3 | 40.0 | 37.5 | 41.7 | 81.9 | 59.5 |

| Xiaomi | 32.3 | 31.7 | 32.9 | 29.7 | 26.5 | 46.2 | 43.0 | 48.5 |

| OPPO | 30.6 | 32.3 | 31.4 | 22.3 | 24.5 | 31.0 | 34.0 | 38.0 |

| vivo | 27.0 | 31.3 | 31.5 | 21.6 | 22.5 | 31.0 | 33.4 | 35.5 |

| Huawei# | 56.6 | 66.8 | 56.2 | 49.0 | 54.8 | 50.9 | 33.0 | 15.0 |

| realme | 5.0 | 10.2 | 7.8 | 7.2 | 6.4 | 14.8 | 14.0 | 12.8 |

| Others | 92.8 | 84.7 | 98.6 | 66.6 | 49.7 | 69.6 | 92.8 | 69.0 |

Total Market | 357.1 | 380.0 | 401.1 | 295.0 | 276.1 | 365.6 | 394.6 | 354.9 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR in all quarters except Q1 2021 reflecting the separation of the two brands.

Published Date: February 16, 2021

Market Highlights

• The global smartphone market continued to recover in Q4 2020, rebounding 8% QoQ to 395.9 million units.

• Apple’s 8% YoY and 96% QoQ growth helped it lead the market in Q4 2020.

• Samsung slipped to the second spot with 62.5 million units in Q4 2020, However, it led the overall market in CY 2020.

• For the first time, OPPO and vivo surpassed Huawei to capture the fourth and fifth spots respectively, Huawei slipped to the sixth spot.

• realme emerged as the fastest growing brand in CY 2020 with 65% YoY growth.

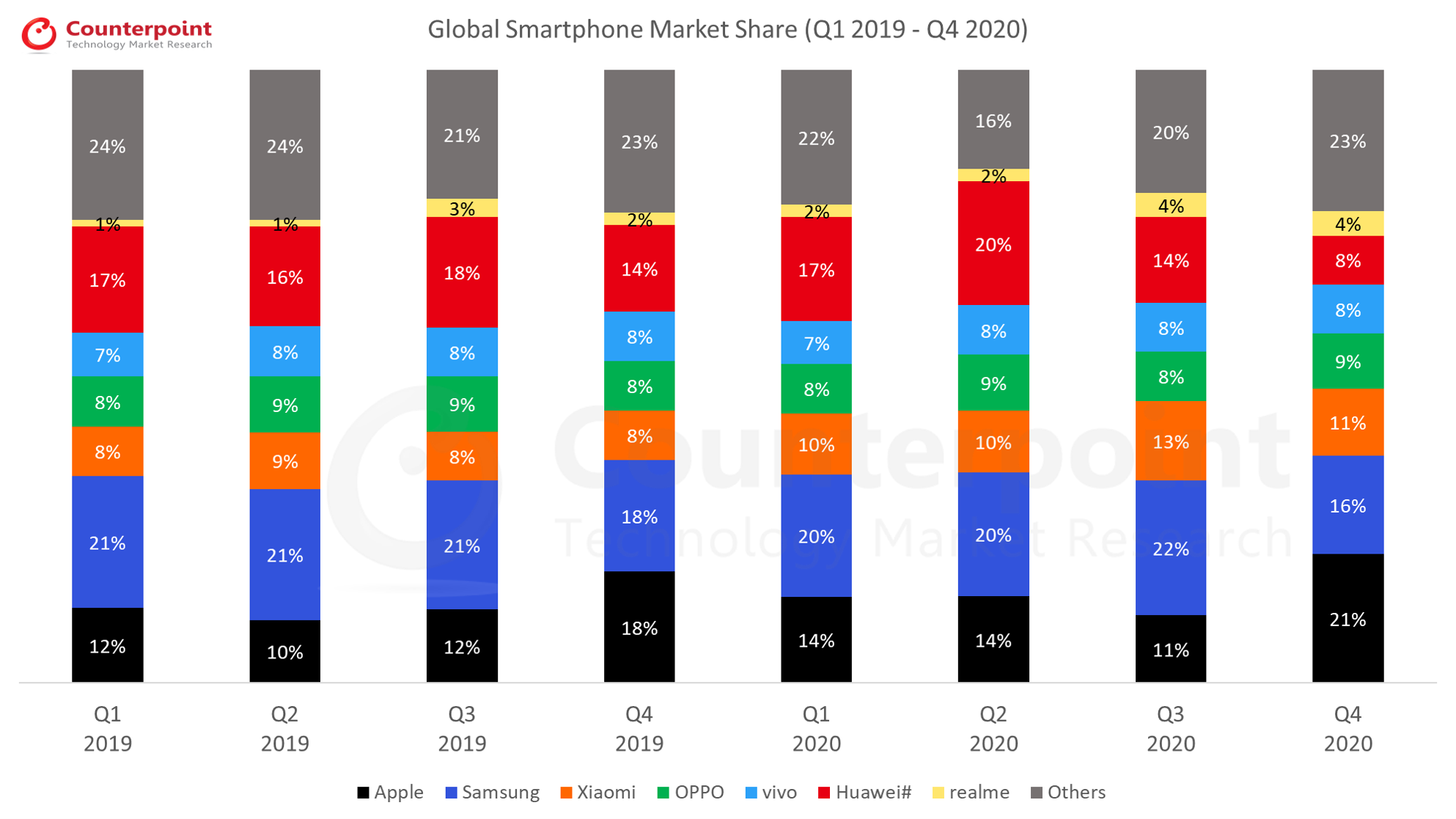

| Brands | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 |

| Apple | 12% | 10% | 12% | 18% | 14% | 14% | 11% | 21% |

| Samsung | 21% | 21% | 21% | 18% | 20% | 20% | 22% | 16% |

| Xiaomi | 8% | 9% | 8% | 8% | 10% | 10% | 13% | 11% |

| OPPO | 8% | 9% | 9% | 8% | 8% | 9% | 8% | 9% |

| vivo | 7% | 8% | 8% | 8% | 7% | 8% | 8% | 8% |

| Huawei# | 17% | 16% | 18% | 14% | 17% | 20% | 14% | 8% |

| realme | 1% | 1% | 3% | 2% | 2% | 2% | 4% | 4% |

| Others | 24% | 24% | 21% | 23% | 22% | 16% | 20% | 23% |

| Brands | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 |

| Apple | 42.0 | 36.5 | 44.8 | 72.3 | 40.0 | 37.5 | 41.7 | 81.9 |

| Samsung | 72.0 | 76.3 | 78.2 | 70.4 | 58.6 | 54.2 | 80.4 | 62.5 |

| Xiaomi | 27.8 | 32.3 | 31.7 | 32.9 | 29.7 | 26.5 | 46.2 | 43.0 |

| OPPO | 25.7 | 30.6 | 32.3 | 31.4 | 22.3 | 24.5 | 31.0 | 34.0 |

| vivo | 23.9 | 27.0 | 31.3 | 31.5 | 21.6 | 22.5 | 31.0 | 33.4 |

| Huawei# | 59.1 | 56.6 | 66.8 | 56.2 | 49.0 | 54.8 | 50.9 | 33.0 |

| realme | 2.8 | 5.0 | 10.2 | 7.8 | 7.2 | 6.4 | 14.8 | 14.0 |

| Others | 87.7 | 92.8 | 84.7 | 98.6 | 66.6 | 49.7 | 69.6 | 92.8 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

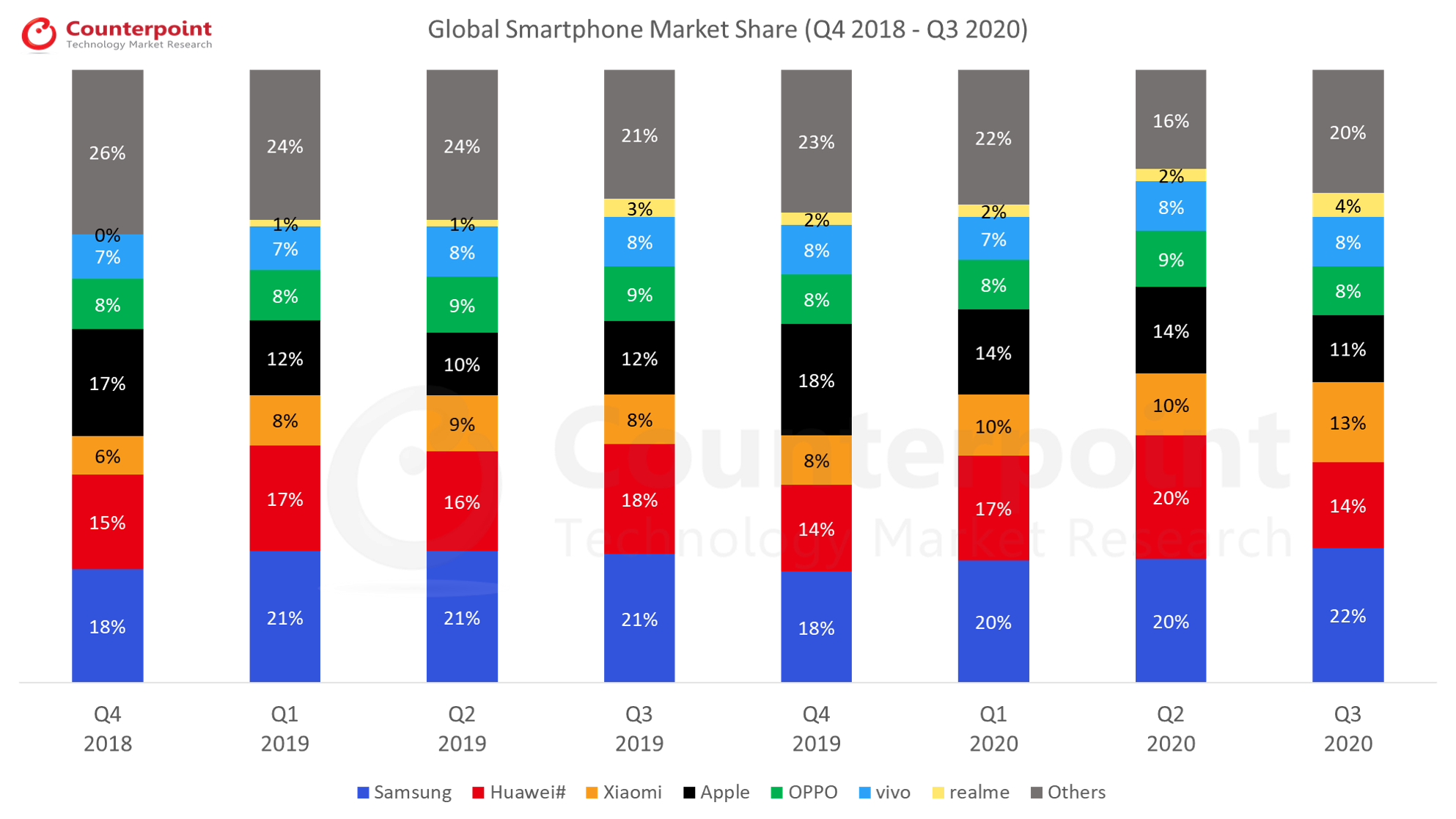

Market Highlights

| Brands | Q4 2018 | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 |

| Samsung | 18% | 21% | 21% | 21% | 18% | 20% | 20% | 22% |

| Huawei# | 15% | 17% | 16% | 18% | 14% | 17% | 20% | 14% |

| Xiaomi | 6% | 8% | 9% | 8% | 8% | 10% | 10% | 13% |

| Apple | 17% | 12% | 10% | 12% | 18% | 14% | 14% | 11% |

| OPPO | 8% | 8% | 9% | 9% | 8% | 8% | 9% | 8% |

| vivo | 7% | 7% | 8% | 8% | 8% | 7% | 8% | 8% |

| realme | – | 1% | 1% | 3% | 2% | 2% | 2% | 4% |

| Others | 26% | 24% | 24% | 21% | 23% | 22% | 16% | 20% |

| Brands | Q4 2018 | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 | Q3 2020 |

| Samsung | 69.8 | 72.0 | 76.3 | 78.2 | 70.4 | 58.6 | 54.2 | 80.4 |

| Huawei# | 59.7 | 59.1 | 56.6 | 66.8 | 56.2 | 49.0 | 54.8 | 50.9 |

| Xiaomi | 25.6 | 27.8 | 32.3 | 31.7 | 32.9 | 29.7 | 26.5 | 46.2 |

| Apple | 65.9 | 42.0 | 36.5 | 44.8 | 72.3 | 40.0 | 37.5 | 41.7 |

| OPPO | 31.3 | 25.7 | 30.6 | 32.3 | 31.4 | 22.3 | 24.5 | 31.0 |

| vivo | 26.5 | 23.9 | 27.0 | 31.3 | 31.5 | 21.6 | 22.5 | 31.0 |

| realme | – | 2.8 | 5.0 | 10.2 | 7.8 | 7.2 | 6.4 | 14.8 |

| Others | 115.8 | 87.7 | 92.8 | 84.7 | 98.6 | 66.6 | 48.6 | 69.6 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

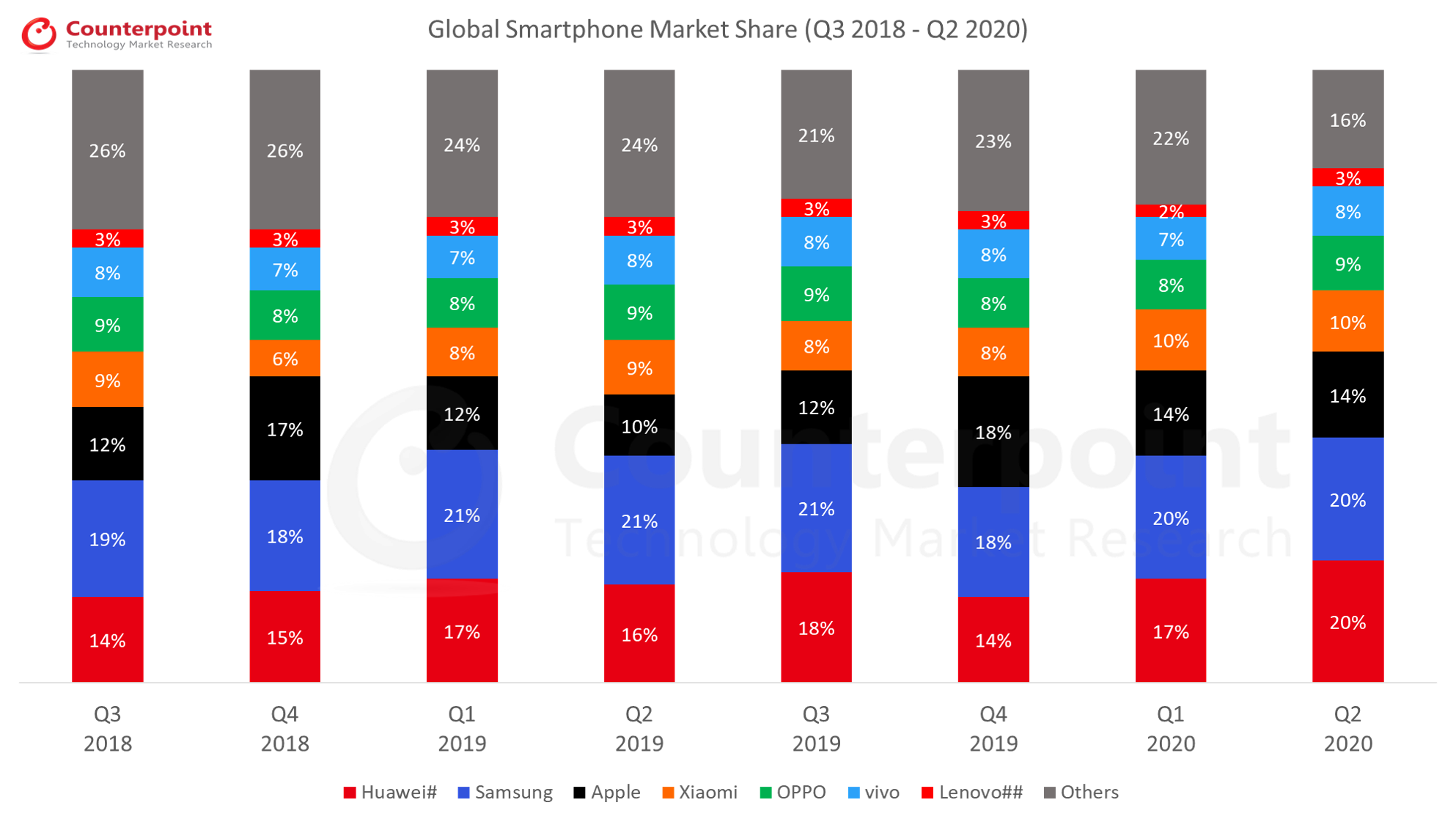

Market Highlights

| Brands | Q3 2018 | Q4 2018 | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 |

| Huawei# | 14% | 15% | 17% | 16% | 18% | 14% | 17% | 20% |

| Samsung | 19% | 18% | 21% | 21% | 21% | 18% | 20% | 20% |

| Apple | 12% | 17% | 12% | 10% | 12% | 18% | 14% | 14% |

| Xiaomi | 9% | 6% | 8% | 9% | 8% | 8% | 10% | 10% |

| OPPO | 9% | 8% | 8% | 9% | 9% | 8% | 8% | 9% |

| vivo | 8% | 7% | 7% | 8% | 8% | 8% | 7% | 8% |

| Lenovo## | 3% | 3% | 3% | 3% | 3% | 3% | 2% | 3% |

| Others | 26% | 26% | 24% | 24% | 21% | 23% | 22% | 16% |

| Brands | Q3 2018 | Q4 2018 | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 | Q2 2020 |

| Huawei# | 52.0 | 59.7 | 59.1 | 56.6 | 66.8 | 56.2 | 49.0 | 54.8 |

| Samsung | 72.3 | 69.8 | 72.0 | 76.3 | 78.2 | 70.4 | 58.6 | 54.2 |

| Apple | 46.9 | 65.9 | 42.0 | 36.5 | 44.8 | 72.3 | 40.0 | 37.5 |

| Xiaomi | 33.3 | 25.6 | 27.8 | 32.3 | 31.7 | 32.9 | 29.7 | 26.5 |

| OPPO | 33.9 | 31.3 | 25.7 | 30.6 | 32.3 | 31.4 | 22.3 | 24.5 |

| vivo | 30.5 | 26.5 | 23.9 | 27.0 | 31.3 | 31.5 | 21.6 | 22.5 |

| Lenovo## | 11.0 | 10.1 | 9.5 | 9.5 | 10.0 | 11.7 | 5.9 | 7.5 |

| Others | 110.9 | 115.8 | 87.7 | 92.8 | 84.7 | 98.6 | 66.6 | 48.6 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

##Lenovo includes Motorola.

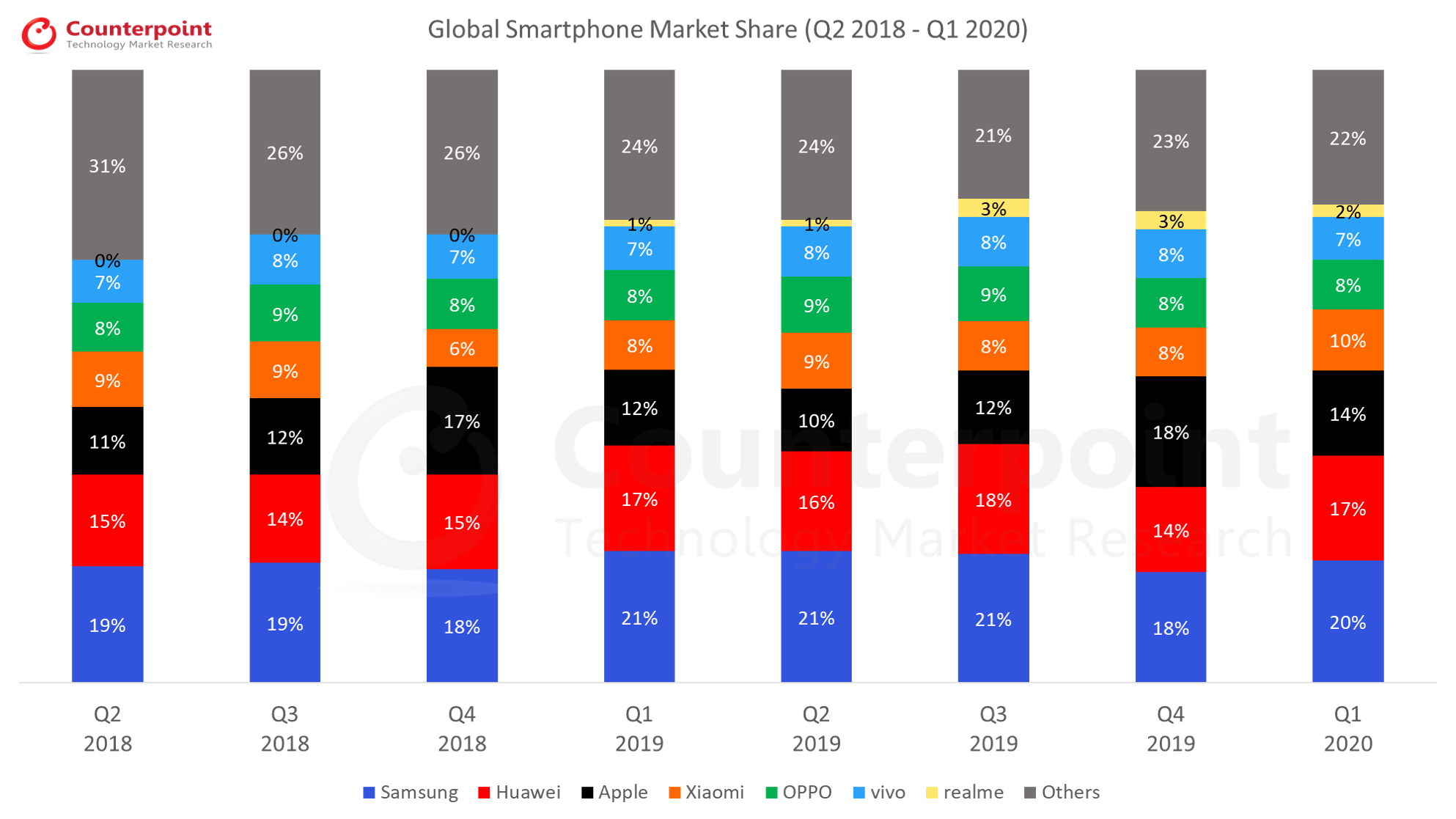

Market Highlights

| Brands | Q2 2018 | Q3 2018 | Q4 2018 | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 |

| Samsung | 19% | 19% | 18% | 21% | 21% | 21% | 18% | 20% |

| Huawei | 15% | 14% | 15% | 17% | 16% | 18% | 14% | 17% |

| Apple | 11% | 12% | 17% | 12% | 10% | 12% | 18% | 14% |

| Xiaomi | 9% | 9% | 6% | 8% | 9% | 8% | 8% | 10% |

| OPPO | 8% | 9% | 8% | 8% | 9% | 9% | 8% | 8% |

| vivo | 7% | 8% | 7% | 7% | 8% | 8% | 8% | 7% |

| realme | 0% | 0% | 0% | 1% | 1% | 3% | 3% | 2% |

| Others | 31% | 26% | 26% | 24% | 24% | 21% | 23% | 22% |

| Brands | Q2 2018 | Q3 2018 | Q4 2018 | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 | Q1 2020 |

| Samsung | 71.5 | 72.3 | 69.8 | 72.0 | 76.3 | 78.2 | 70.4 | 58.6 |

| Huawei | 54.2 | 52.0 | 59.7 | 59.1 | 56.6 | 66.8 | 56.2 | 49.0 |

| Apple | 41.3 | 46.9 | 65.9 | 42.0 | 36.5 | 44.8 | 72.3 | 40.0 |

| Xiaomi | 32.0 | 33.3 | 25.6 | 27.8 | 32.3 | 31.7 | 32.9 | 29.7 |

| OPPO | 29.6 | 33.9 | 31.3 | 25.7 | 30.6 | 32.3 | 31.4 | 22.3 |

| vivo | 26.5 | 30.5 | 26.5 | 23.9 | 27.0 | 31.3 | 31.5 | 21.6 |

| realme | – | – | – | 2.8 | 5.0 | 10.2 | 7.8 | 7.2 |

| Others | 113.3 | 110.9 | 115.8 | 87.7 | 92.8 | 84.7 | 98.6 | 66.6 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

Market Highlights

| Brands | Q3 2018 | Q4 2018 | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 |

| Apple | 12% | 17% | 12% | 10% | 12% | 18% |

| Samsung | 19% | 18% | 21% | 21% | 21% | 18% |

| Huawei | 14% | 15% | 17% | 16% | 18% | 14% |

| Xiaomi | 9% | 6% | 8% | 9% | 8% | 8% |

| vivo | 8% | 7% | 7% | 8% | 8% | 8% |

| OPPO | 9% | 8% | 8% | 9% | 9% | 8% |

| Lenovo | 3% | 3% | 3% | 3% | 3% | 3% |

| Others | 26% | 26% | 24% | 24% | 21% | 23% |

| Brands | Q3 2018 | Q4 2018 | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 |

| Apple | 46.9 | 65.9 | 42.0 | 36.5 | 44.8 | 72.3 |

| Samsung | 72.3 | 69.8 | 72.0 | 76.3 | 78.2 | 70.4 |

| Huawei | 52.0 | 59.7 | 59.1 | 56.6 | 66.8 | 56.2 |

| Xiaomi | 33.3 | 25.6 | 27.8 | 32.3 | 31.7 | 32.9 |

| vivo | 30.5 | 26.5 | 23.9 | 27.0 | 31.3 | 31.5 |

| Oppo | 33.9 | 31.3 | 25.7 | 30.6 | 32.3 | 31.4 |

| Lenovo | 11.0 | 10.1 | 9.5 | 9.5 | 10.0 | 11.7 |

| Others | 99.9 | 105.7 | 81.0 | 88.2 | 84.9 | 94.7 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

Market Highlights

| Brands | 2018 Q3 | 2018 Q4 | 2019 Q1 | 2019 Q2 | 2019 Q3 |

| Samsung | 19% | 18% | 21% | 21% | 21% |

| Huawei# | 14% | 15% | 17% | 16% | 18% |

| Apple | 12% | 17% | 12% | 10% | 12% |

| Oppo | 9% | 8% | 8% | 9% | 9% |

| Xiaomi | 9% | 6% | 8% | 9% | 8% |

| vivo | 8% | 7% | 7% | 8% | 8% |

| Realme | 0% | 1% | 1% | 1% | 3% |

| Others | 29% | 28% | 26% | 26% | 21% |

| Brands | 2018Q3 | 2018Q4 | 2019Q1 | 2019Q2 | 2019Q3 |

| Samsung | 72.3 | 69.8 | 72.0 | 76.3 | 78.2 |

| Huawei# | 52.0 | 59.7 | 59.1 | 56.6 | 66.8 |

| Apple | 46.9 | 65.9 | 42.0 | 36.5 | 44.8 |

| Oppo | 33.9 | 31.3 | 25.7 | 30.6 | 32.3 |

| Xiaomi | 33.3 | 25.6 | 27.8 | 32.3 | 31.7 |

| vivo | 30.5 | 26.5 | 23.9 | 27.0 | 31.3 |

| Realme | 1.2 | 3.3 | 2.8 | 5.0 | 10.2 |

| Others | 109.7 | 112.6 | 87.7 | 92.8 | 84.7 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

Market Highlights

| Brands | 2018 Q2 | 2018 Q3 | 2018 Q4 | 2019 Q1 | 2019 Q2 |

| Samsung | 20% | 19% | 18% | 21% | 21% |

| Huawei# | 15% | 14% | 15% | 17% | 16% |

| Apple | 11% | 12% | 17% | 12% | 10% |

| Xiaomi | 9% | 9% | 6% | 8% | 9% |

| Oppo | 8% | 9% | 8% | 8% | 9% |

| vivo | 7% | 8% | 7% | 7% | 8% |

| Lenovo** | 2% | 3% | 3% | 3% | 3% |

| Others | 31% | 28% | 26% | 24% | 24% |

| Brands | 2018 Q2 | 2018 Q3 | 2018 Q4 | 2019 Q1 | 2019 Q2 |

| Samsung | 71.5 | 72.3 | 69.8 | 72.0 | 76.3 |

| Huawei# | 54.2 | 52.0 | 59.7 | 59.1 | 56.6 |

| Apple | 41.3 | 46.9 | 65.9 | 42.0 | 36.5 |

| Xiaomi | 32.0 | 33.3 | 25.6 | 27.8 | 32.3 |

| Oppo | 29.6 | 33.9 | 31.3 | 25.7 | 30.6 |

| vivo | 26.5 | 30.5 | 26.5 | 23.9 | 27.0 |

| Lenovo** | 9.0 | 11.0 | 10.1 | 9.5 | 9.5 |

| Others | 100.2 | 99.9 | 105.7 | 81.0 | 85.2 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

Market Highlights

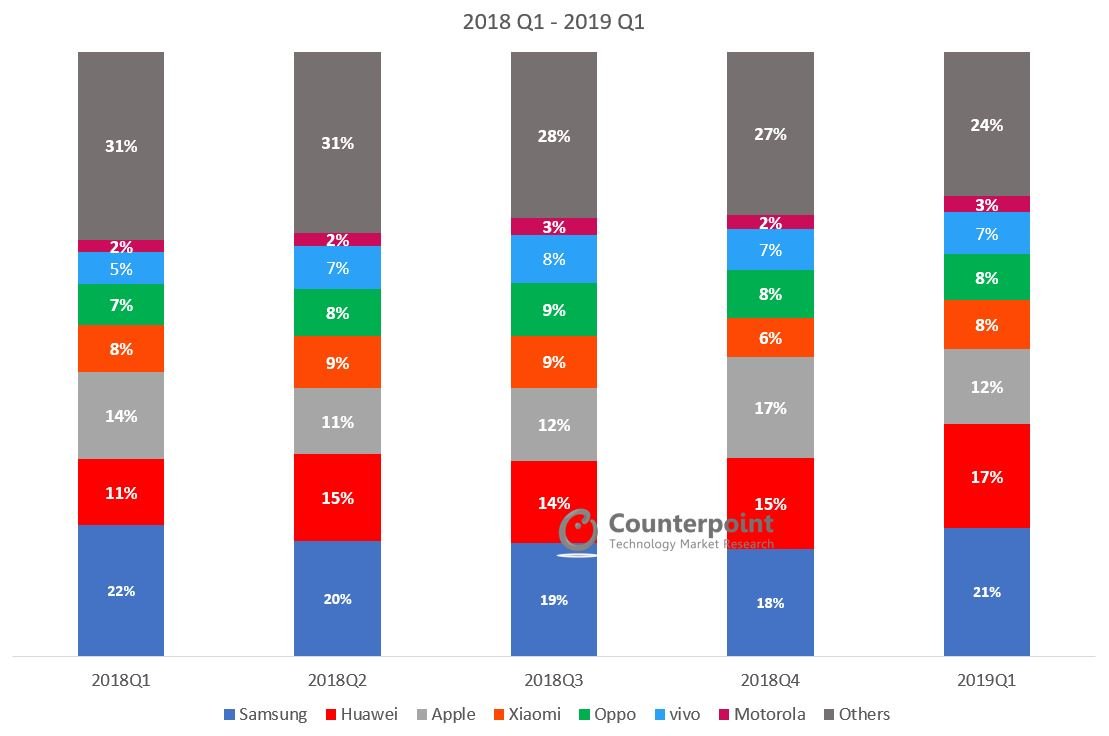

| Brands | 2018 Q1 | 2018 Q2 | 2018 Q3 | 2018 Q4 | 2019 Q1 |

| Samsung | 22% | 20% | 19% | 18% | 21% |

| Huawei# | 11% | 15% | 14% | 15% | 17% |

| Apple | 14% | 11% | 12% | 17% | 12% |

| Xiaomi | 8% | 9% | 9% | 6% | 8% |

| Oppo | 7% | 8% | 9% | 8% | 8% |

| vivo | 5% | 7% | 8% | 7% | 7% |

| Motorola | 2% | 2% | 3% | 2% | 3% |

| Others | 31% | 31% | 28% | 27% | 24% |

| Global Smartphone Shipments | 2018 Q1 | 2018 Q2 | 2018 Q3 | 2018 Q4 | 2019 Q1 |

| Samsung | 78.2 | 71.5 | 72.3 | 69.8 | 72.0 |

| Huawei# | 39.3 | 54.2 | 52.0 | 59.7 | 59.1 |

| Apple | 52.2 | 41.3 | 46.9 | 65.9 | 42.0 |

| Xiaomi | 28.1 | 32.0 | 33.3 | 25.6 | 27.8 |

| Oppo | 24.2 | 29.6 | 33.9 | 31.3 | 25.7 |

| vivo | 18.9 | 26.5 | 30.5 | 26.5 | 23.9 |

| Motorola | 7.6 | 8.3 | 10.6 | 9.5 | 8.9 |

| Others | 113.1 | 100.9 | 100.4 | 106.4 | 81.6 |

*Ranking is according to the latest quarter.

#Huawei includes HONOR.

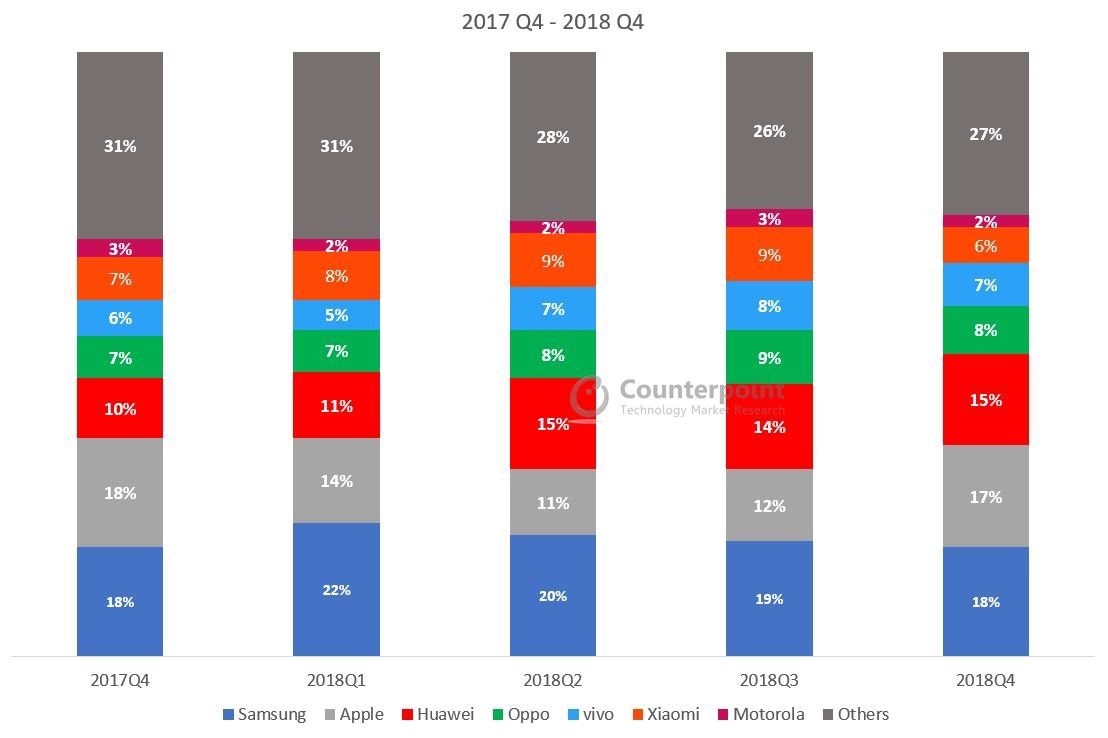

Market Highlights

| Brands | 2017 Q4 | 2018 Q1 | 2018 Q2 | 2018 Q3 | 2018 Q4 |

| Samsung | 18% | 22% | 20% | 19% | 18% |

| Apple | 18% | 14% | 11% | 12% | 17% |

| Huawei | 10% | 11% | 15% | 14% | 15% |

| Oppo | 7% | 7% | 8% | 9% | 8% |

| vivo | 6% | 5% | 7% | 8% | 7% |

| Xiaomi | 7% | 8% | 9% | 9% | 6% |

| Motorola | 3% | 2% | 2% | 3% | 2% |

| Others | 31% | 31% | 28% | 26% | 27% |

| Brands | 2017 Q4 | 2018 Q1 | 2018 Q2 | 2018 Q3 | 2018 Q4 |

| Samsung | 74.4 | 78.2 | 71.5 | 72.3 | 69.8 |

| Apple | 77.3 | 52.2 | 41.3 | 46.9 | 65.9 |

| Huawei | 41.0 | 39.3 | 54.2 | 52.0 | 59.7 |

| Oppo | 30.7 | 24.2 | 29.6 | 33.9 | 31.3 |

| vivo | 24.0 | 18.9 | 26.5 | 30.5 | 26.5 |

| Xiaomi | 31.0 | 28.1 | 32.0 | 33.3 | 25.6 |

| Motorola | 10.9 | 7.6 | 8.3 | 10.6 | 9.5 |

| Others | 134.8 | 113.1 | 100.9 | 100.4 | 106.4 |

*Ranking is according to the latest quarter.

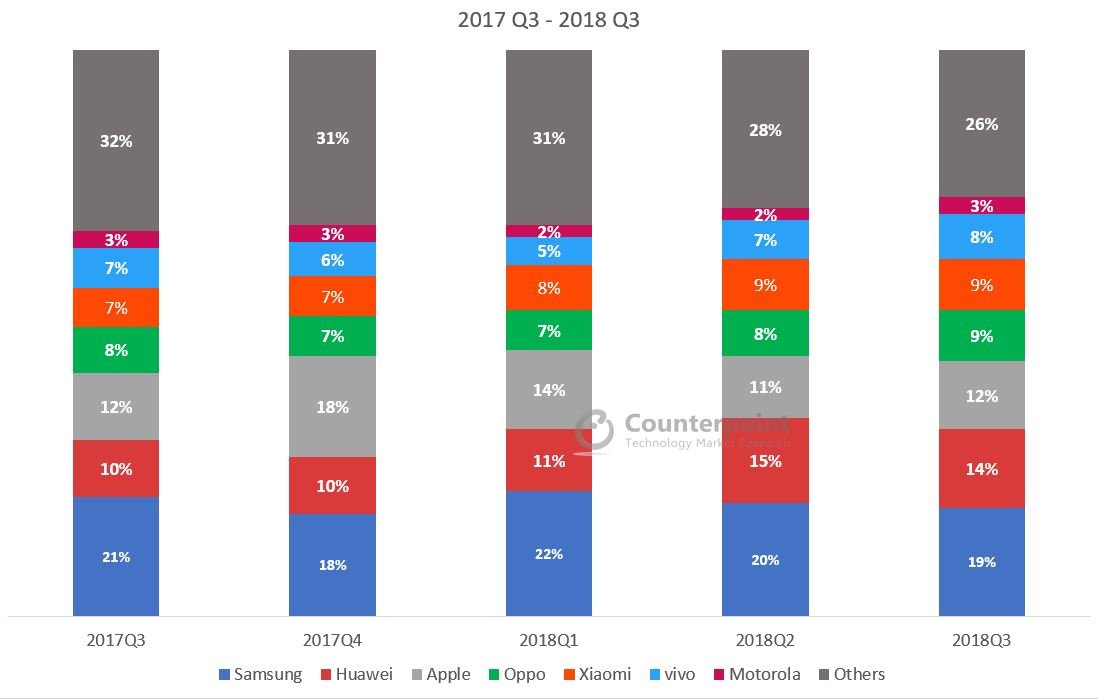

Market Highlights

| Brands | 2017 Q3 | 2017 Q4 | 2018 Q1 | 2018 Q2 | 2018 Q3 |

| Samsung | 21% | 18% | 22% | 20% | 19% |

| Huawei | 10% | 10% | 11% | 15% | 14% |

| Apple | 12% | 18% | 14% | 11% | 12% |

| Oppo | 8% | 7% | 7% | 8% | 9% |

| Xiaomi | 7% | 7% | 8% | 9% | 9% |

| vivo | 7% | 6% | 5% | 7% | 8% |

| Motorola | 3% | 3% | 2% | 2% | 3% |

| Others | 32% | 31% | 31% | 28% | 26% |

| Global Smartphone Shipments | 2017 Q3 | 2017 Q4 | 2018 Q1 | 2018 Q2 | 2018 Q3 |

| Samsung | 83.3 | 74.4 | 78.2 | 71.5 | 72.3 |

| Huawei | 39.1 | 41.0 | 39.3 | 54.2 | 52.0 |

| Apple | 46.7 | 77.3 | 52.2 | 41.3 | 46.9 |

| Oppo | 32.5 | 30.7 | 24.2 | 29.6 | 33.9 |

| Xiaomi | 28.5 | 31.0 | 28.1 | 32.0 | 33.3 |

| vivo | 28.6 | 24.0 | 18.9 | 26.5 | 30.5 |

| Motorola | 12.5 | 10.9 | 7.6 | 8.3 | 10.6 |

| Others | 127.6 | 134.8 | 113.1 | 101.0 | 100.4 |

*Ranking is according to the latest quarter.

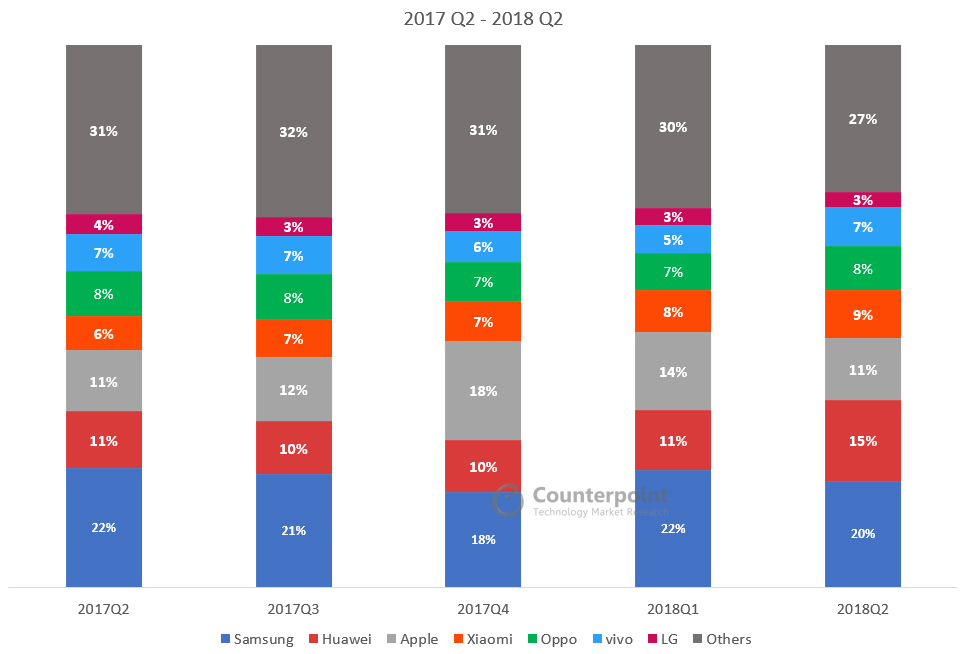

Market Highlights

| Brands | 2017 Q2 | 2017 Q3 | 2017 Q4 | 2018 Q1 | 2018 Q2 |

| Samsung | 22% | 21% | 18% | 22% | 20% |

| Huawei | 11% | 10% | 10% | 11% | 15% |

| Apple | 11% | 12% | 18% | 14% | 11% |

| Xiaomi | 6% | 7% | 7% | 8% | 9% |

| Oppo | 8% | 8% | 7% | 7% | 8% |

| vivo | 7% | 7% | 6% | 5% | 7% |

| LG | 4% | 3% | 3% | 3% | 3% |

| Others | 31% | 32% | 31% | 30% | 27% |

| Global Smartphone Shipments | 2017 Q2 | 2017 Q3 | 2017 Q4 | 2018 Q1 | 2018 Q2 |

| Samsung | 80.4 | 83.3 | 74.4 | 78.2 | 71.5 |

| Huawei | 38.5 | 39.1 | 41.0 | 39.3 | 54.2 |

| Apple | 41.0 | 46.7 | 77.3 | 52.2 | 41.3 |

| Xiaomi | 23.1 | 28.5 | 31.0 | 28.1 | 32.0 |

| Oppo | 30.5 | 32.5 | 30.7 | 24.2 | 29.6 |

| vivo | 24.8 | 28.6 | 24.0 | 18.9 | 26.5 |

| LG | 13.3 | 13.9 | 13.9 | 11.4 | 9.8 |

| Others | 113.9 | 126.3 | 131.8 | 109.3 | 99.5 |

*Ranking is according to the latest quarter.

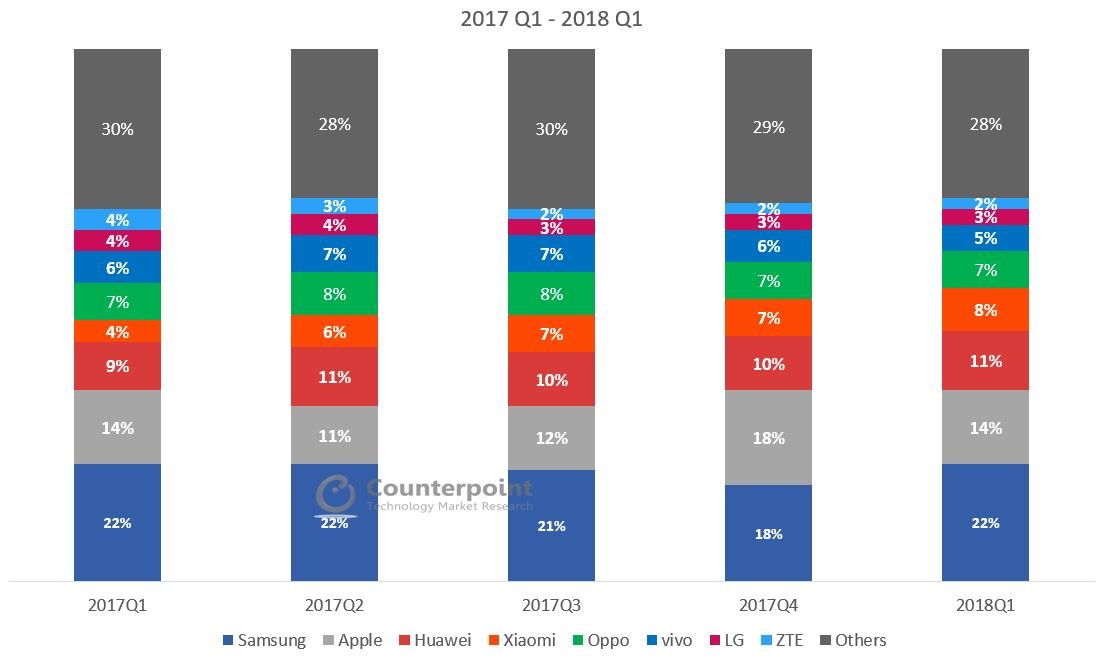

Market Highlights

| Brands | 2017 Q1 | 2017 Q2 | 2017 Q3 | 2017 Q4 | 2018 Q1 |

| Samsung | 22% | 22% | 21% | 18% | 22% |

| Apple | 14% | 11% | 12% | 18% | 14% |

| Huawei | 9% | 11% | 10% | 10% | 11% |

| Xiaomi | 4% | 6% | 7% | 7% | 8% |

| Oppo | 7% | 8% | 8% | 7% | 7% |

| vivo | 6% | 7% | 7% | 6% | 5% |

| LG | 4% | 4% | 3% | 3% | 3% |

| ZTE | 4% | 3% | 2% | 2% | 2% |

| Others | 30% | 28% | 30% | 29% | 28% |

| Brands | 2017 Q1 | 2017 Q2 | 2017 Q3 | 2017 Q4 | 2018 Q1 |

| Samsung | 80.0 | 80.4 | 83.3 | 74.4 | 78.2 |

| Apple | 50.8 | 41.0 | 46.7 | 77.3 | 52.2 |

| Huawei | 34.6 | 38.5 | 39.1 | 41.0 | 39.3 |

| Xiaomi | 13.4 | 23.1 | 28.5 | 31.0 | 28.1 |

| Oppo | 26.1 | 30.5 | 32.5 | 30.7 | 24.2 |

| vivo | 22.8 | 24.8 | 28.6 | 24.0 | 18.9 |

| LG | 14.8 | 13.3 | 13.9 | 13.9 | 11.4 |

| ZTE | 13.3 | 12.2 | 9.8 | 9.4 | 7.1 |

| Others | 115.4 | 101.8 | 116.5 | 122.5 | 102.2 |

*Ranking is according to the latest quarter.

Copyright ⓒ Counterpoint Technology Market Research | All rights reserved