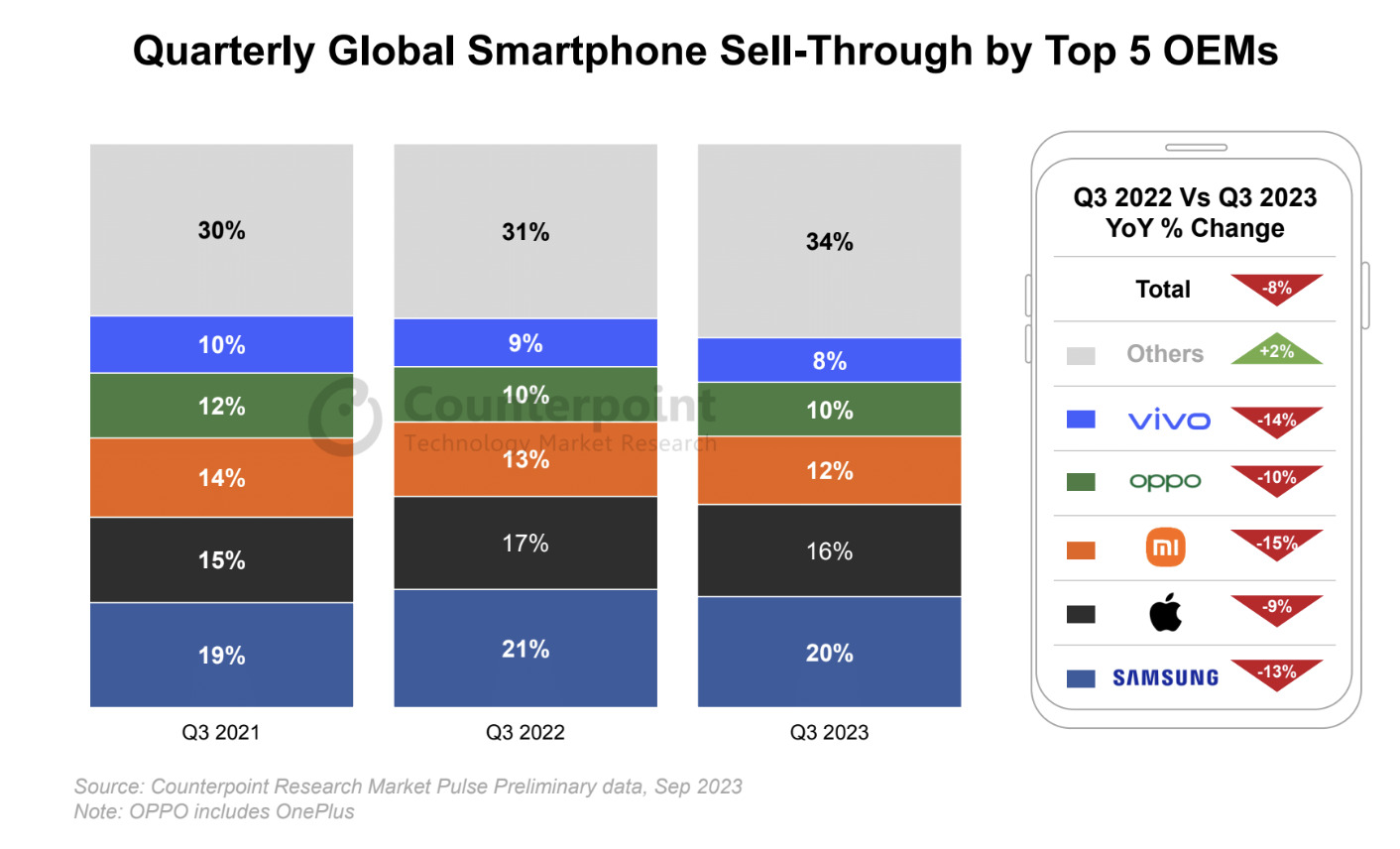

- Global smartphone sell-through declined 8% YoY but grew 2% QoQ in Q3 2023.

- Samsung led the market but declined YoY to reach its lowest quarterly level in the last decade.

- A shorter period of iPhone 15 availability in Q3 led to a shift in demand to the next quarter.

- The top five brands’ cumulative share declined in Q3 as challengers’ share grew.

- HONOR, Huawei and Transsion Group were among the only top brands to record YoY growth

Global smartphone sell-through volumes fell 8% YoY in Q3 2023, the ninth consecutive quarter to record a decline, but grew 2% QoQ, according to the latest research from Counterpoint’s Market Pulse service. Volumes declined YoY largely due to slower than expected recovery in consumer demand. But the market’s QoQ growth, especially the positive performance in September despite one full week less of sales of the new iPhones, is likely a sign of positive news ahead.

Samsung continued to lead the global market, capturing a fifth of the total sales in Q3. The new generation of foldables received a mixed response, with the Flip 5 outselling its counterpart by nearly twice as much. However, Samsung’s A-series models remained market leaders in mid-price bands. Apple came in second with a 16% market share despite the limited availability of iPhone 15 series, which has been received well so far.

Xiaomi, OPPO and vivo rounded off the top five, with the three recording YoY declines. In Q3, all these brands worked towards strengthening their positions in key markets like China and India, while continuing to slow down expansionary efforts in overseas markets.

HONOR, Huawei and Transsion Group gained share and were among the only brands to record YoY growth in Q3. Huawei grew driven by the launch of the Mate 60 series in China, while HONOR’s growth was led by strong overseas performance. Transsion brands continued to expand while also benefiting from the recovery in the Middle East and Africa (MEA) market.

MEA was the only region to record YoY growth in Q3, owing to improvements in macroeconomic indicators. Most developed markets, like North America, Western Europe and South Korea, recorded steep declines. However, we expect most developed markets to grow in Q4 largely due to the delayed effect of the iPhone launch.

Following a strong September, we expect the momentum to continue till the year-end, beginning with the full impact of the iPhone 15 series along with the arrival of the festive season in India, followed by the 11.11 sales event in China and ending with the Christmas and end-of-year promotions across regions. In Q4 2023, we expect the market to halt its series of YoY declines.

However, the market is expected to decline for the full year of 2023, reaching its lowest level in the decade largely due to a shift in device replacement patterns, particularly in developed markets. Notably, the recovery of emerging markets before the global market and the growth of brands outside of the top five indicate the shifting dynamics and opportunities in the global smartphone market.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Counterpoint Research

press(at)counterpointresearch.com