- Cloud service providers’ capex is expected to grow by around 8% YoY in 2023 due to investments in AI and networking equipment.

- Microsoft and Amazon are among the highest spenders as they invest in data center development. Microsoft will spend over 13% of its capex on AI infrastructure.

- AI infrastructure can be 10x-30x more expensive than traditional general-purpose data center IT infrastructure.

- Chinese hyperscalers’ capex is decreasing due to their inability to access NVIDIA’s GPU chips, and decreasing cloud revenues.

New Delhi, Beijing, Seoul, Hong Kong, London, Buenos Aires, San Diego – July 25, 2023

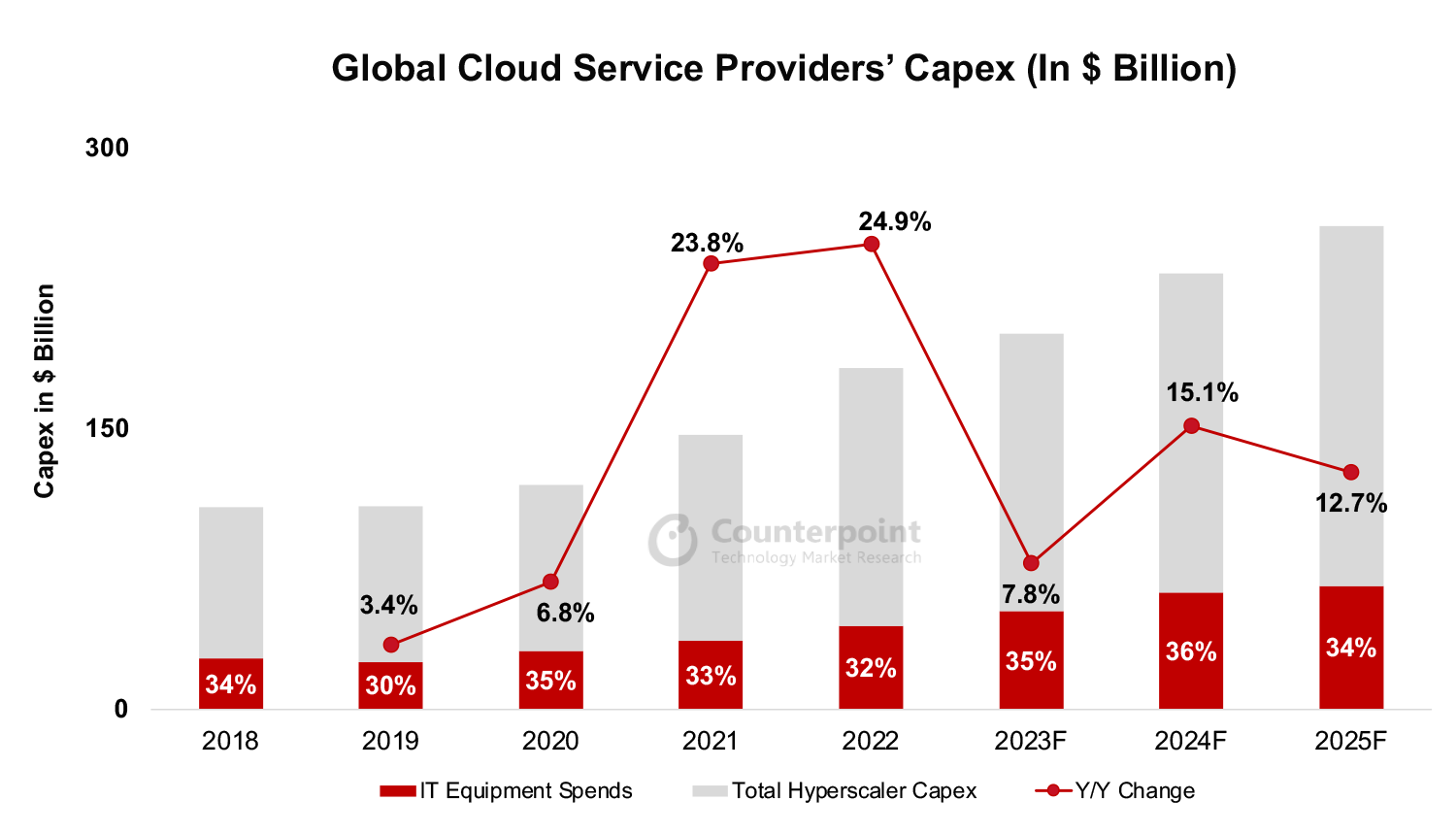

Global cloud service providers will grow capex by an estimated 7.8% YoY in 2023, according to the latest research from Counterpoint’s Cloud Service. Higher debt costs, enterprise spending cuts and muted cloud revenue growth are impacting infrastructure spend in data centers compared to 2022.

Commenting on the large cloud service providers’ 2023 plans, Senior Research Analyst Akshara Bassi said, “Hyperscalers are increasingly focusing on ramping up their AI infrastructure in data centers to cater to the demand for training proprietary AI models, launching native B2C generative AI user applications, and expanding AIaaS (Artificial Intelligence-as-a-Service) product offerings”.

According to Counterpoint’s estimates, around 35% of the total cloud capex for 2023 is earmarked for IT infrastructure including servers and networking equipment compared to 32% in 2022.

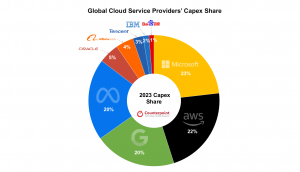

In 2023, Microsoft and Amazon (AWS) will account for 45% of the total capex. US-based hyperscalers will contribute to 91.9% of the overall global capex in 2023.

Chinese hyperscalers are spending less due to slower growth in cloud revenues amid a weak economy and difficulties in acquiring the latest NVIDIA GPU chips for AI due to US bans. The scaled-down version – A800 of the flagship A100/H100 chips – that NVIDIA has been supplying to Chinese players may also come under the purview of the ban, further reducing access to AI silicon for Chinese hyperscalers.

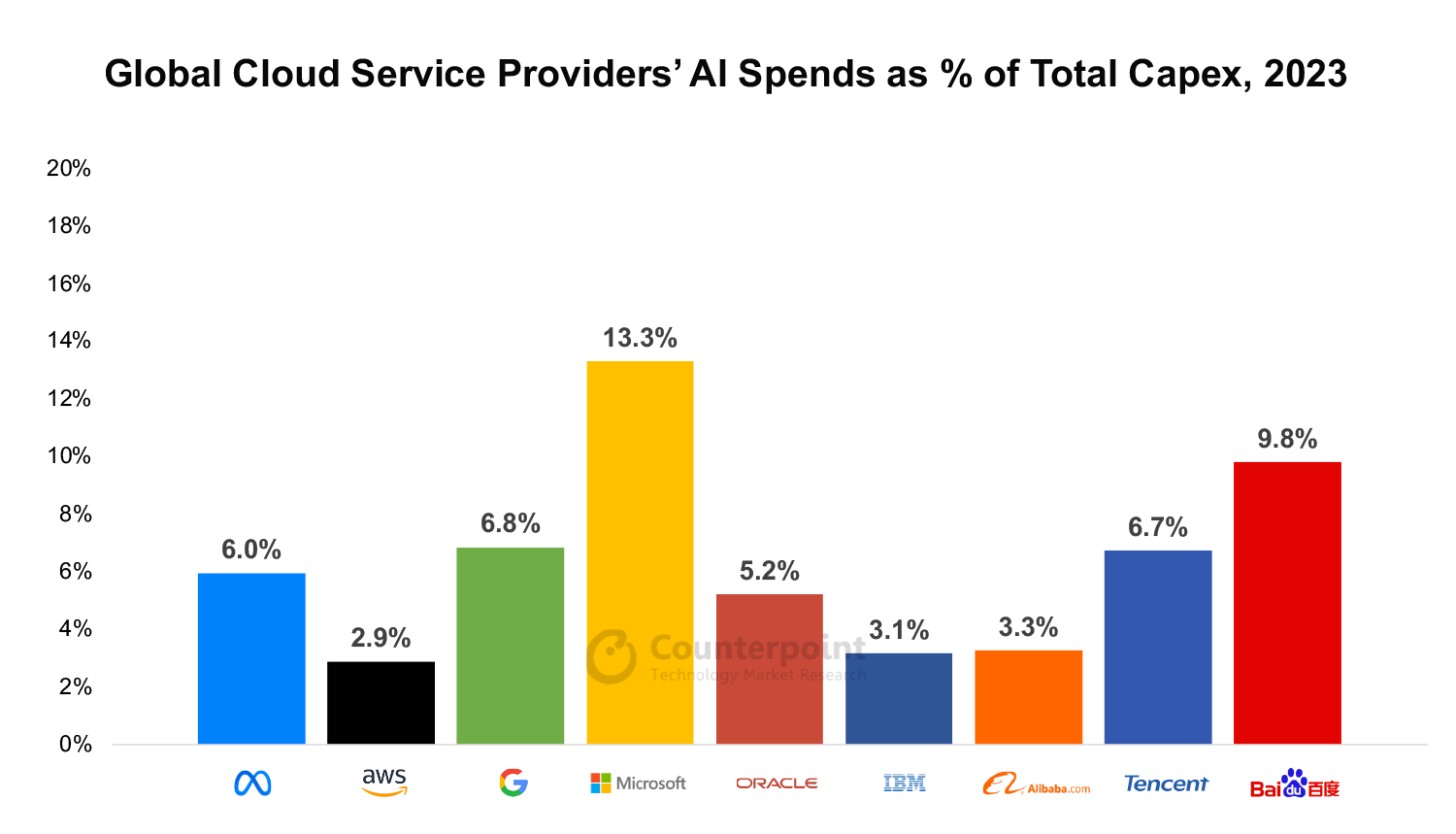

Based on Counterpoint estimates, Microsoft will spend proportionally the most on AI-related infrastructure with 13.3% of its capex directed towards AI, followed by Google at around 6.8% of its capex. Microsoft has already announced its intention to integrate AI within its existing suite of products.

AI infrastructure can be 10x-30x more expensive than traditional general-purpose data center IT infrastructure.

Though Chinese players are investing a larger portion of their spends towards AI, the amount is significantly less than that of the US counterparts due to a lower overall capex.

The comprehensive and in-depth ‘Global Cloud Service Providers Capex’ report is available. Please contact Counterpoint Research to access the report.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Akshara Bassi

Peter Richardson

Neil Shah

Follow Counterpoint Research

press@counterpointresearch.com