- The company saw a slight growth in Q2 revenues due to the improving demand for 5G SoCs.

- Inventory came down to a relatively normal level.

- MediaTek and NVIDIA have tied up to develop a full-scale product roadmap for the automotive industry.

- Significant revenues are expected to be seen for MediaTek’s auto and custom ASIC segments from 2026.

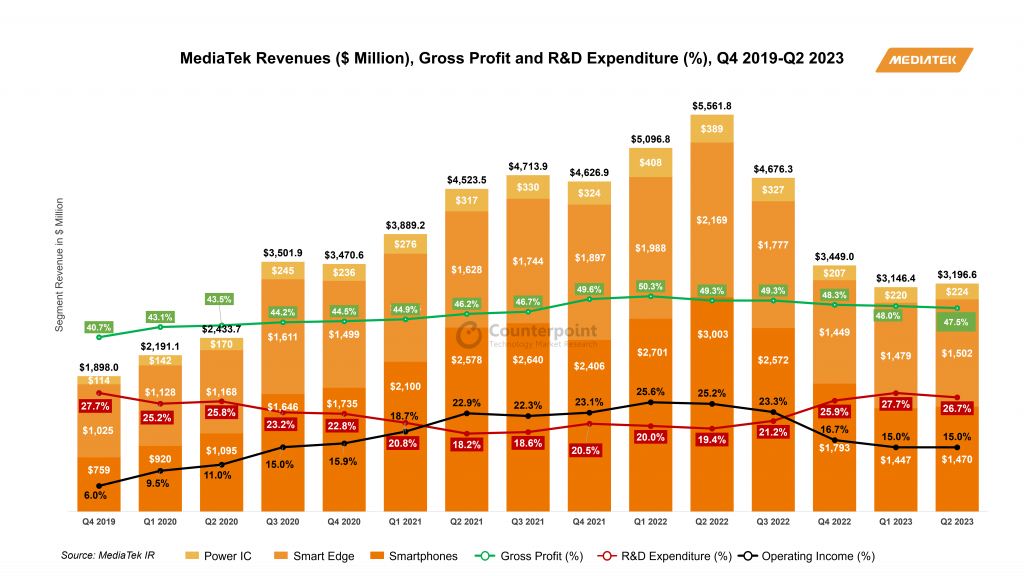

MediaTek’s revenues were slightly up sequentially but down 43% annually in Q2 2023. Inventory has gradually come down to a relatively normal level, but the demand for smartphones will remain slow due to the global macroeconomic situation and the refurbished smartphone market. Against this backdrop, MediaTek is diversifying its portfolio by focusing on the auto, smart edge and custom ASIC segments. The company is estimated to take over two years to get material revenues from these segments.

AI and ASIC Opportunity

CEO: “As for ASIC, we recently see growing enterprise ASIC business opportunities in AI and datacenter markets. With our strong IP and SoC integration capabilities, we aim to continue to grow this business in the future.”

Parv Sharma’s analyst take: “With the growth in generative AI, the demand for edge AI processing has accelerated. Being one of the top players in edge devices, MediaTek is well-positioned to benefit from this shift. The company will focus on winning enterprise ASIC projects but catching up with major players like Broadcom and Marvell will take time, as customers typically work with existing suppliers for repeat projects.”

Growing focus on auto and partnership with NVIDIA

CEO: “We’re very excited about the recently announced partnership between MediaTek and NVIDIA to develop a full-scale product roadmap for the automotive industry. We believe our industry-leading low-power processors and 5G, WiFi connectivity solutions, combined with NVIDIA’s strong capability in software and AI cloud, will help us become highly competitive in the future connected software-defined vehicles market and shorten our time to market to accelerate our growth.”

Shivani Parashar’s analyst take: “MediaTek launched Dimensity Auto to focus on cockpit and connectivity solutions. With its partnership with NVIDIA, the company aims to develop a full-scale product roadmap for the automotive industry. Auto design cycles are long so it will take some time (2026-2027) for the company to increase revenues from this segment. Overall, we can say the auto segment will become a long-term revenue growth driver for MediaTek.”

Customer and channel inventories come down

CEO: “We observed that customer and channel inventories across major applications have gradually reduced to a relatively normal level. Recent demand from our customers has shown certain level of stabilization. However, our customers are still managing their inventory cautiously as global consumer electronics end market demand remains soft. For the near-term, we expect our business to gradually improve in the second half of the year”

Shivani Parashar’s analyst take: “According to our supply chain checks, inventory levels are coming down and will get back to normal in the second half of 2023. OEMs will start restocking but will be cautious due to weak consumer demand and global macroeconomic conditions.” Result summary

Result summary

- Slight improvement in revenues: MediaTek recorded $3.2 billion in revenues in Q2 2023, a slight increase of 2% QoQ but a decrease of 43% YoY due to the weak global demand for end products and the second-hand smartphone market. Customer and channel inventories across major applications have come down to a relatively normal level.

- Maintained mobile segment revenue due to 5G SoCs: The mobile phone segment contributed 46% to the company’s revenue in Q2 2023, which declined by 51% YoY and increased by 2% QoQ. The demand for 5G SoCs improved during the quarter. The new flagship Dimensity SoC will be launched in the coming month.

- New opportunities for smart edge: The smart edge segment contributed 47% to the company’s revenue in Q2, growing 2% sequentially. The demand for connectivity remained stable in the quarter. Business opportunities are growing for the ASIC segment.

- Price discipline: MediaTek will focus on maintaining gross margin, following price discipline at a time of uncertainty in the global semiconductor industry.

- Favorable guidance: MediaTek guided Q3 revenues in the range of $3.3 to $3.5 billion, growing 4%-11% sequentially. Gross margins are expected to be around 47% while the operating expense ratio is expected to be around 32% in Q2 2023. The smartphone, connectivity and PMIC segments will see revenue growth. The smart TV segment will witness declining revenues in the third quarter due to excess inventory.

- Auto segment is picking up: Automotive will contribute $200 to $300 million to MediaTek’s revenue in 2023. More significant revenue can be seen from 2026. The current auto design pipeline revenue for MediaTek is over $1 billion.

Related posts

- Weak Q4 2022 for MediaTek; Revenues to Further Decline in Q1 2023

- Qualcomm Revenue Declines on Demand Weakness Across Handsets, IoT products

- Global Smartphone AP-SOC Shipment & Forecast Tracker by Model – Q1 2023

- Global smartphone AP Shipment tracker by the top 20 best-selling Chipset Models in Q1 2023

- LG Electronics Operating Profit Stumbles in Q4 2022

- NXP Reports Record Revenue in 2022, Automotive Shines

- BoM Analysis – Samsung Accounts for More Than 50% of BoM Cost in Google’s Pixel 7 Pro

- China Smartphone Sales in 2022 Reach Lowest Level in a Decade; Apple Becomes #2 Brand for First Time

- Infographic: Q3 2022 | Semiconductors, Foundry Share and Smartphone AP Share

- MediaTek Targets Diverse Technology Verticals With 4 New Chipsets

- Qualcomm Delivers Record Revenues Amid Challenging Macro Environment

- MediaTek Weather’s Macroeconomic Headwinds With 9% YoY Revenue Growth

- Quarterly Firsts: India Smartphone Shipments Show YoY Q3 Decline, iPhone Model Tops India Shipment Chart

- MediaTek records impressive quarter, strong growth from 5G flagships

- MediaTek Unveils Three Smartphone SOCs

- Entry Into Flagship Segment, 5G AP/SOCs Lead to Strong Growth for MediaTek in Q1 2022