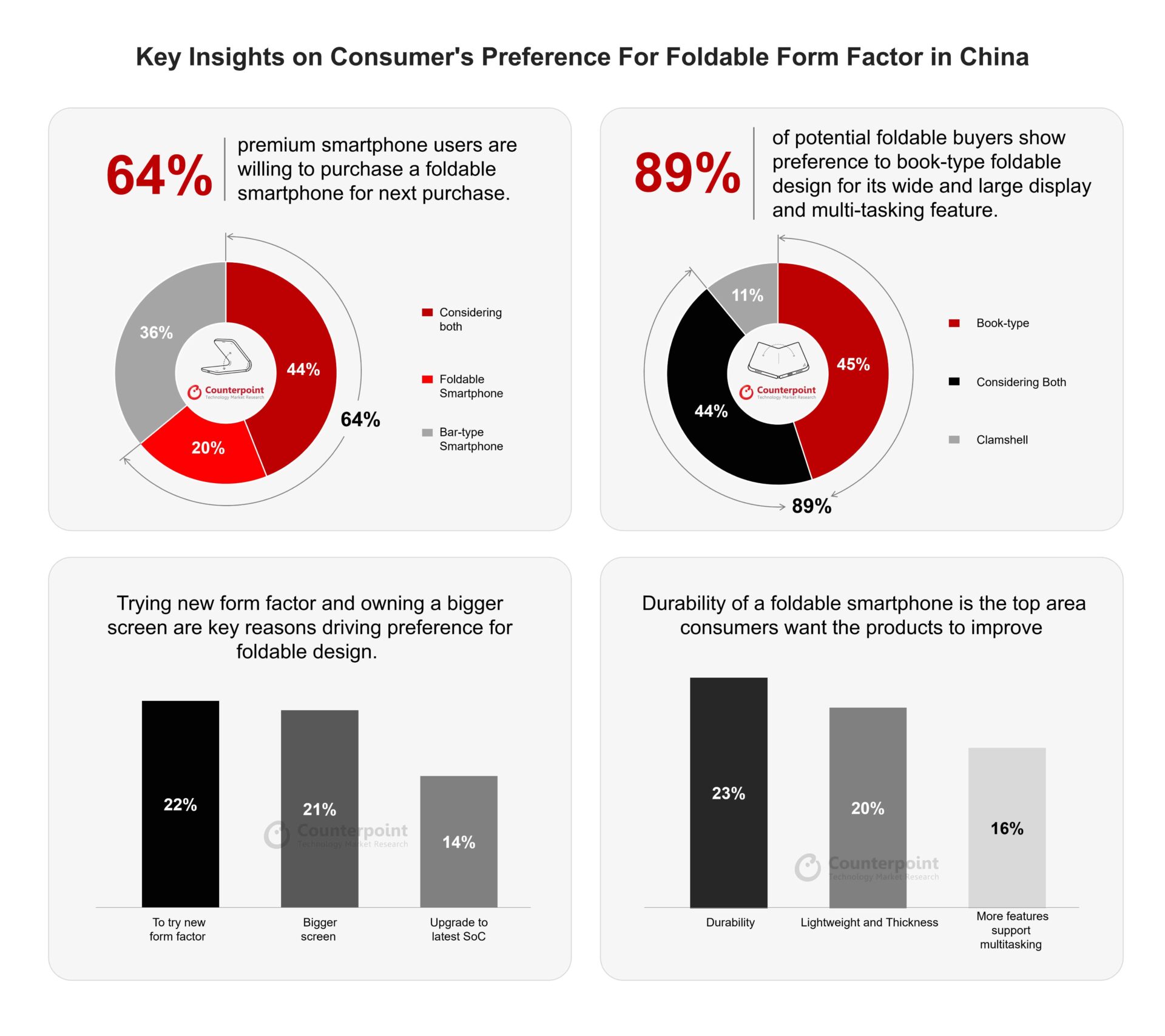

- 64% of high-end smartphone users in China are willing to purchase a foldable smartphone for their next purchase.

- Trying new form factor (22%) and owning a bigger screen (21%) are key reasons driving preference for foldable design.

- 89% of potential foldable buyers prefer book-type foldable design for its wide and large display and multi-tasking feature.

- Reputation and the latest technology are the key factors during brand selection.

- The durability of foldables is the top area of concern among people.

Beijing, New Delhi, London, Jakarta, Boston, Toronto, Taipei, Seoul – November 23, 2023

A recent consumer survey conducted by Counterpoint Research spotlights a strong interest in foldable smartphones among Chinese consumers. As many as 64% of smartphone users in the $400 and above price bracket in China are considering foldables for their next purchase, with 20% already committed to the idea and an additional 44% weighing it as an option.

Android users’ interest in foldable smartphones is higher at 71%, while it is 58% for iOS users. This interest in foldables is particularly pronounced among current foldable phone users in the survey, who are eager to continue their experience with the emerging technology.

Though the big screen size of foldables attracts smartphone users, this enthusiasm is tempered by concerns over durability, prominence of the crease and the bulkiness of the device when the screen is folded, which are seen as the main barriers to widespread adoption.

Senior Analyst Arushi Chawla said, “With the smartphone market maturing and hence becoming tough to compete on the software side of things, people are looking forward to the foldable category as a stand-out factor. Multiple brands coming up with newer foldable generations are also building confidence among consumers. As a result, a significant proportion of the respondents aspire to purchase foldable smartphones in the near future. However, now consumers have also become better informed due to their rising dependence on smartphones and, therefore, hold certain concerns about the foldable technology.”

Durability of foldables is the top area (23%) the respondents want the products to improve. Comments on Chinese social media highlight complaints about the high cost of repairing foldables and disappointment over the robustness of product designs. Therefore, reputation in terms of quality and after-sales service becomes the top factor in brand selection.

Research Analyst Archie Zhang said, “Chinese OEMs are leading innovations in the foldable sector, striving to create devices that are both slimmer and lighter and appeal to consumers accustomed to the standard premium phones. This evolution is supported by significant investments in research and development, focusing on the mechanics of foldable hinges and the materials used, which are key to decreasing the body size and weight and increasing robustness.”

The survey also explores consumer expectations from book-type foldables. About 70% think foldables’ weight should be similar to or lighter than the smartphones they are using. Regarding thickness, most respondents think book-type foldables should not exceed 10 mm-12 mm when folded. Also, most users are willing to pay a price in the RMB 7,000-RMB 8,000(about $947-$1113) range for this foldable device type.

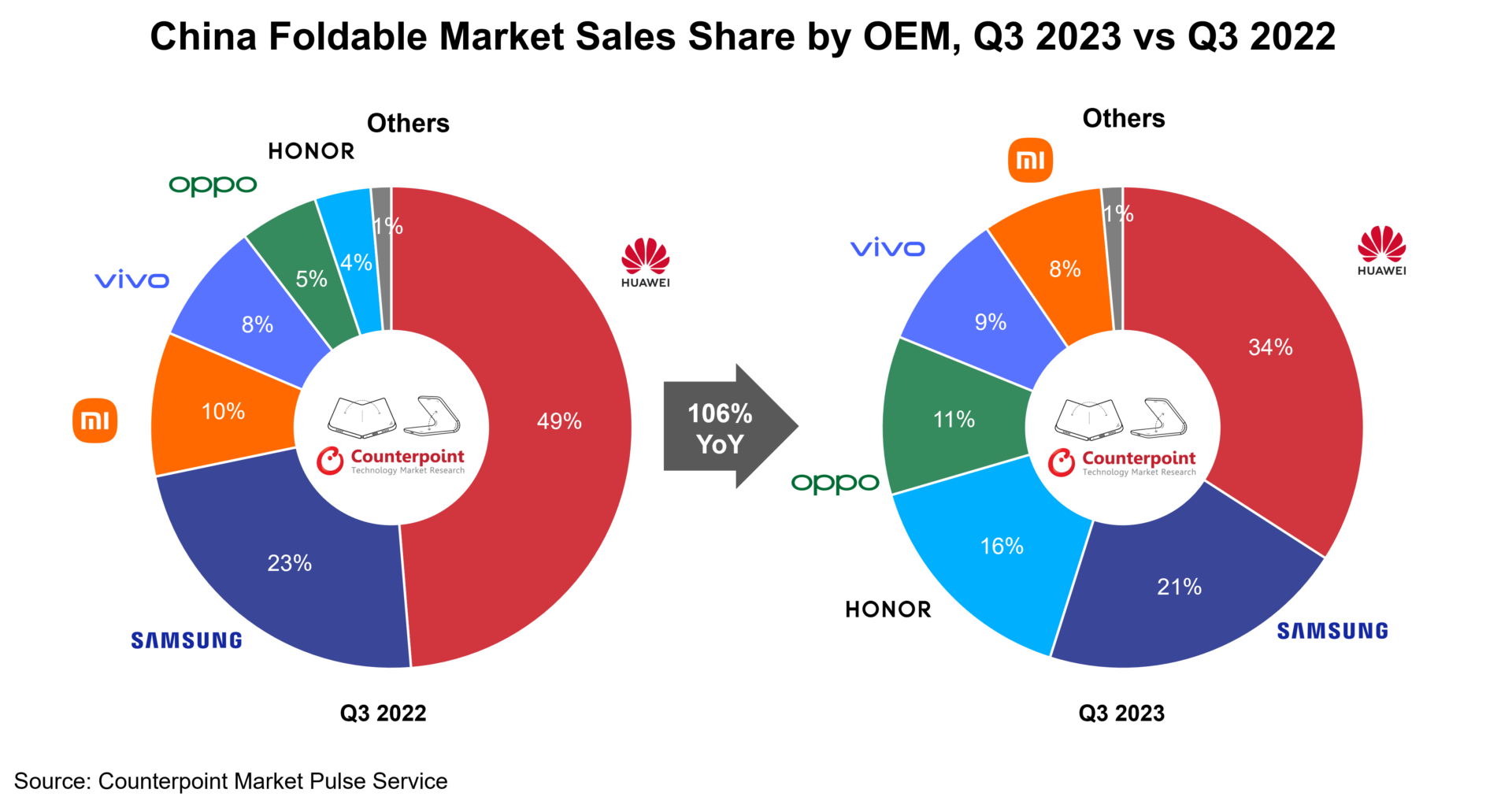

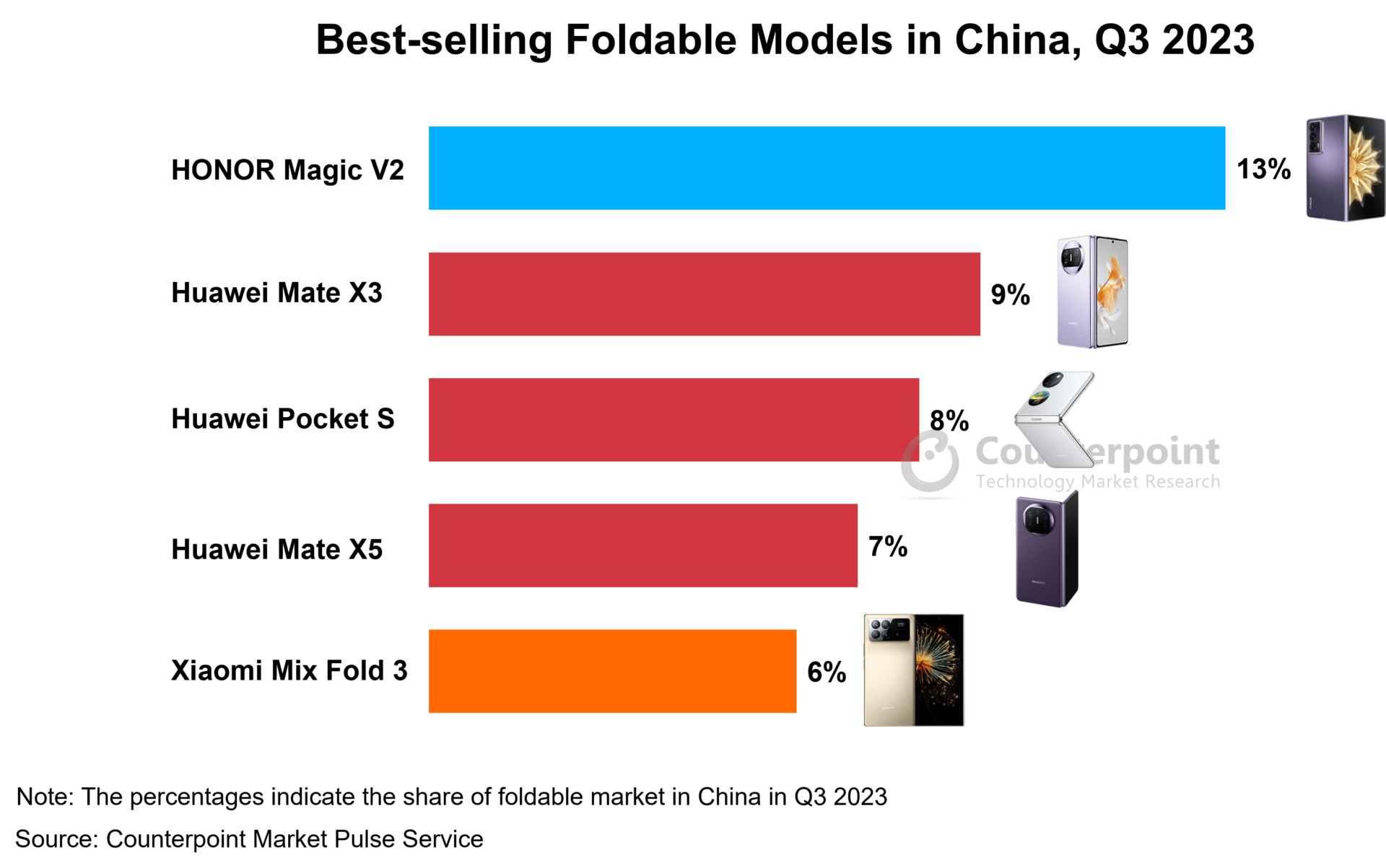

The Chinese foldable smartphone market has shown exponential growth this year, registering a 106% YoY increase in Q3. HONOR’s Magic V2 was the best-selling model in this quarter. From Q1 to Q3, the segment grew 90% with Huawei taking the biggest sales share.

HONOR and other Chinese OEMs have stepped up foldable shipments while aiming for faster growth in the premium segment globally. This will make the global foldable market more competitive.

HONOR and other Chinese OEMs have stepped up foldable shipments while aiming for faster growth in the premium segment globally. This will make the global foldable market more competitive.

Senior Research Analyst Mengmeng Zhang said, “The Chinese foldable smartphone market is poised for double-digit growth in 2023, even against an anticipated overall market contraction of less than 5% YoY. With OEMs enhancing the durability, design and affordability of foldables, these devices are set to captivate a broader consumer base. Besides, unique software capabilities like advanced multi-tasking and seamless inner-outer screen integration are expected to further boost the appeal of foldable smartphones.”

(This Counterpoint Research survey was sponsored by HONOR to understand the preference towards foldable smartphones among users in the $400 and above price band in China. The survey, having a sample size of more than 1,000 respondents, was conducted online in both English and Mandarin languages. We expect the survey results to have a statistical precision of +/- 4%.)

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.