- Thailand’s Smartphone market up 2% YoY in 2023 due to improved consumer sentiment towards year-end.

- The <$200 budget segment grew by 17% YoY in 2023 while all other price ranges showed a decline.

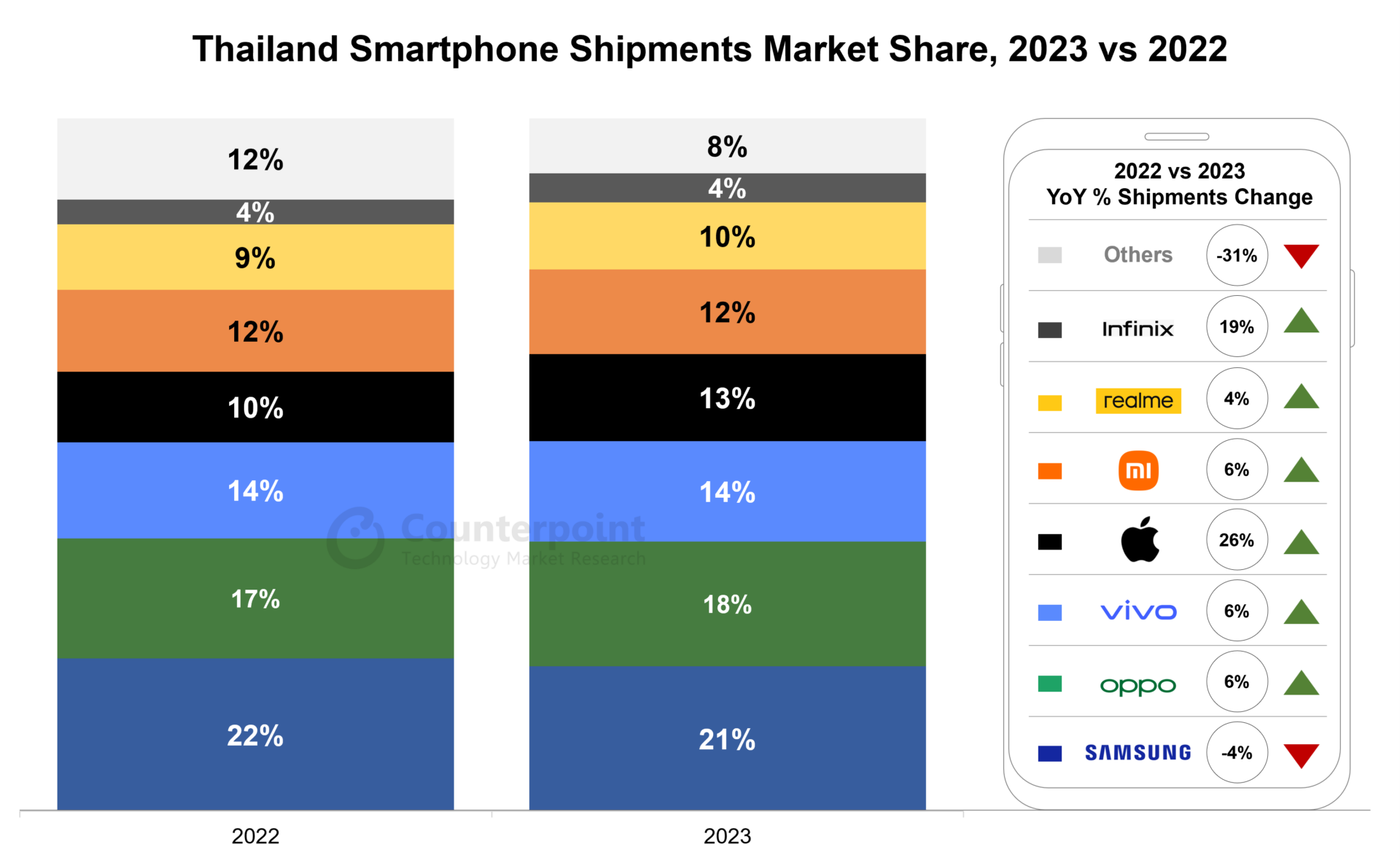

- Samsung led the smartphone market with a 21% market share, but the overall brand shipments were down 4%.

- 5G smartphones witnessed a 139% increase in the <$200 segment.

Jakarta, Hong Kong, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – February 27, 2024

Thailand’s smartphone market inched up 2% YoY in 2023, according to Counterpoint Research’s Southeast Asia Monthly Smartphone Tracker. While other SEA markets declined, Thailand was the only one to see marginal growth in a harsh 2023 market as it was helped by the strong performance of the budget segment.

Commenting on the country’s economic situation, Senior Analyst Glen Cardoza said, “The budget segment (<$200) smartphones showed a remarkable improvement in the Thai market and the overall bleak economic situation was a driving factor. The initial political uncertainty in Thailand and a consistently subdued economy discouraged consumers from making big spends. However, this changed as the labour market began showing signs of recovery and average wages increased, giving consumers a respite. This, in turn, contributed towards increasing demand for smartphones, especially among price-conscious consumers.”

Samsung led the Thailand smartphone market with a 21% market share. However, its shipments declined by 4% YoY in 2023. The brand’s focus on mid- to high-end smartphones cost them some share in the budget segment. Chinese players like Xiaomi, OPPO, vivo, and realme have all shown single-digit growth due to their focus on the promising <$200 budget segment.

However, Apple enjoyed the biggest growth in volumes, rising 26% YoY, despite belonging to the premium category. Operators saw strong demand for iPhones throughout the year with volumes rising further following the launch of the 15 series.

Smartphones across price ranges fared differently as well. The <$200 budget segment grew by 17% YoY in 2023 while all other price ranges registered a decline. Compared to other countries in the region, Thailand has been showing more receptiveness towards 5G smartphones in the budget segment.

Commenting on 5G and Apple’s success in Thailand, Cardoza said, “5G share was affected due to lower shipments of mid- to high-end smartphones but 5G smartphones witnessed a 139% increase in the <$200 segment in 2023. This jump can be attributed to the ease with which consumers can get 5G and how affordable prepaid and postpaid 5G plans can be in Thailand. Operators are also seeing an uptick in trade-ins and package deals especially for Apple iPhones. The iPhone 14 and 15 series sold well through operators like AIS and TRUE in 2023.”

Cardoza added, “As the economy further improves, consumers across price tiers will look to upgrade and 5G smartphone shipments in Thailand will increase further. The <$200 segment will be the key here as these smartphones will sell more than any other segment.”

Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com