- Ericsson, Nokia and Samsung reported a slump in 2023 revenue after hitting a peak in 2022.

- Operators worldwide have been judicious in their spending and inventory management.

- Uncertainty remains as the industry shows no immediate signs of revival in 2024.

Ericsson, Nokia and Samsung each announced a drop in overall 2023 sales in their earnings calls, citing macroeconomic challenges and a shrinking mobile network infrastructure market, as well as lower spending by operators, particularly in North America.

India was a silver lining for the Nordic vendors, as the unprecedentedly quick rollouts boosted their overall numbers. However, there was a slowdown among Indian operators during Q4 2023, as they plan to normalize their investments in 2024 following a capex-intensive 2023.

In 2023, suppliers made significant strategic decisions to reduce losses caused by external factors and transfer attention back to their core capabilities and cash-generating business sectors.

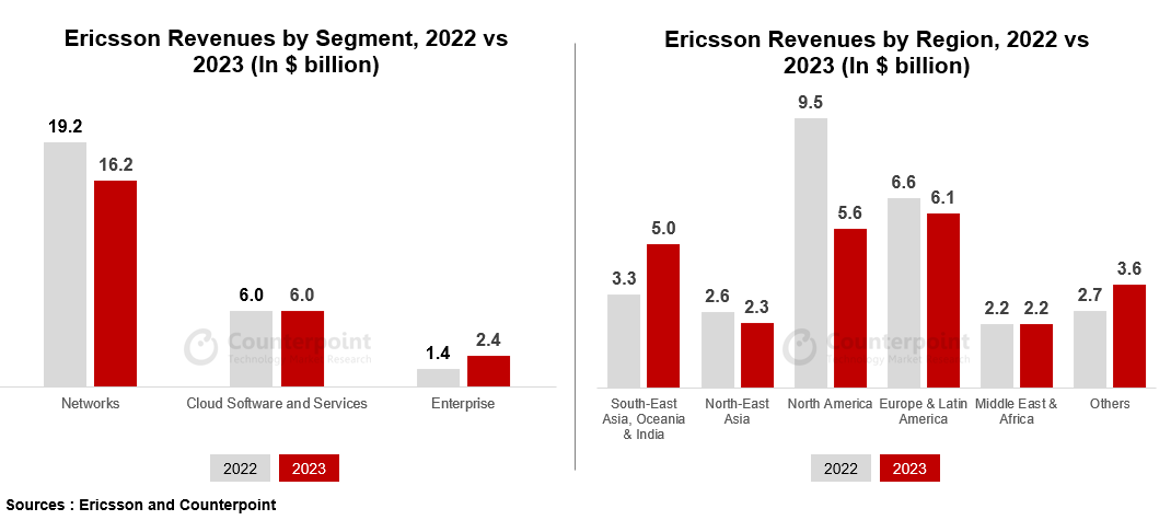

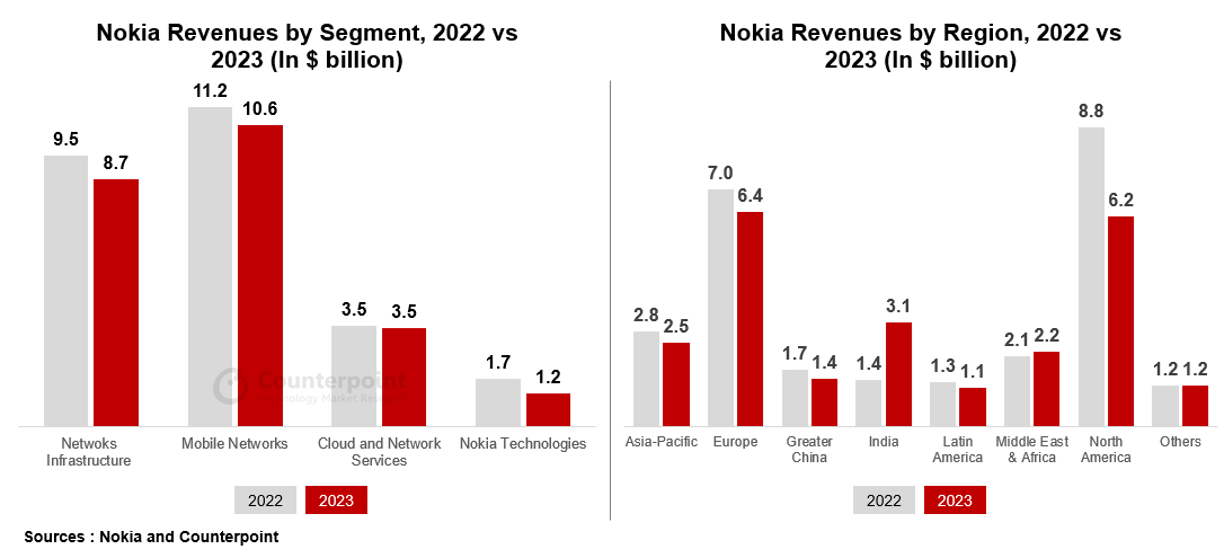

For the year 2023, Ericsson generated nearly $24.8 billion in revenue while its Finnish counterpart Nokia generated $24.1 billion in revenue. Samsung’s network division sales stood at $2.9 billion. Due to the changes in the business mix, its margin remained deflated.

Ericsson

- Early adopters of 5G technology saw decreased sales, leading to a reported decline in revenue for Ericsson. MNOs in these areas continued to digest inventory and remained cautious with their spending.

- Ericsson maintained its leadership in 5G Standalone deployments. Meanwhile, its cloud and network services business revenue remained unchanged YoY as the increase was offset in part by the decreased managed service revenues because of descoping and contract exits.

Enterprise Wireless Solutions (Cradlepoint) and the newly acquired Global Communication Platform Vonage helped drive growth in the enterprise category. Ericsson’s expansion into Enterprises will continue as it has made investments toward the development of the Global Networks Platform for Network APIs, which is viewed as a critical component in opening new revenue streams for customers.

Nokia

- Nokia’s Mobile Network business had aimed for a resilient performance in 2023, despite the uncertain and challenging conditions in the worldwide RAN market. By the end of 2023, gross margin had improved significantly due to a shift in product mix towards software.

- Nokia’s Cloud and Network Services business’ net sales were flat for the year but operating profit and margin improved due to digital asset sales and hedging. Nokia ranked second behind Ericsson in terms of the number of 5G Standalone core deployments.

- The Network Infrastructure segment too saw revenue declines due to macroeconomic uncertainty and client inventory digestion. There was an increase in order intake in Q4 2023, which will be critical going into 2024. The performance of fixed, IP, and submarine networks deteriorated in 2023, while optical networks experienced small single-digit gains. Nokia anticipates some relief in H2 2024.

- In 2023, revenue from enterprise customers increased by about 15% to $2.46 billion, with 151 new clients joining. Momentum in private networks continued with Nokia catering to more than 710 private wireless clients.

Samsung

- In 2023, the South Korean technological leader reported $2.9 billion in revenue, down from $4.2 billion a year ago.

- Samsung saw similar consequences as its Nordic peers, but it remains optimistic about landing key deals for vRAN and Open RAN networks in 2024. Samsung has been a big player in this area with a few greenfield and brownfield deployments in North America and Japan.

Key Takeaways

2023 was a challenging year for network equipment makers. Operators around the world are exercising extreme prudence and judiciousness when it comes to network expenditure.

The industry also saw a big event at the end of the year, with Ericsson signing a $14 billion deal with AT&T to become the provider of its Open RAN-compliant equipment, effectively reducing Nokia’s market share in the NAM region.

Suppliers are certain that demand will rise and market spending will stabilize as a result of capacity requirements, emerging use-cases, more data traffic, and the integration of more mid-band radios, but the timeline remains uncertain.

Operators and manufacturers are also putting a lot of effort toward enabling 5G Standalone, incorporating Open architecture into their network infrastructure, and monetizing 5G services. Tier-1 MNOs in several countries have risen to prominence as 5G FWA has grown in popularity, but they are yet to capitalize on URLLC or mMTC use cases.

Another significant aspect that has been identified as critical in effectively monetizing 5G networks is the ability to provide users with premium access while also improving their experience through network slicing and enhanced UE Route Selection Policy. However, these are actionable items for the future that will provide results in the long run.

The short-term gains will come from efficient cost reductions and relevant automation that can standardize operations to make them more efficient, continued investments in and divestitures from core competencies, and attempts to capture any new emerging markets that may open as a result of geopolitical sanctions on Chinese vendors.

On the other hand, operators will undoubtedly play a critical role in recovering the RAN market. However, these operators currently show no signs of an early revival in their market forecasts as they wait for the ecosystem to further develop before deploying their infrastructure.