Marvell reported a slight increase in revenue in Q4 2024, up 1% sequentially to $1.43 billion. However, the highlight of the quarter was the high growth recorded in its data centre business, which benefited from increased AI spending. Compared to Q3, data centre revenues increased 38% and were up 54% on a YoY basis. Overall fiscal 2024 revenue totalled $5.5 billion with strong growth in the H2 driven by AI demand. However, Marvell posted a $392.7 million net loss, a lot worse than the $15.4 million it posted in the previous year.

For Q1 2025, Marvell is forecasting total revenues of $1.15 billion with weak demand expected to continue in the carrier, enterprise and consumer segments. However, the company expects that revenues in these segments will stabilise after Q1 2025, with a recovery expected in H2 2025.

Data Centre Segment

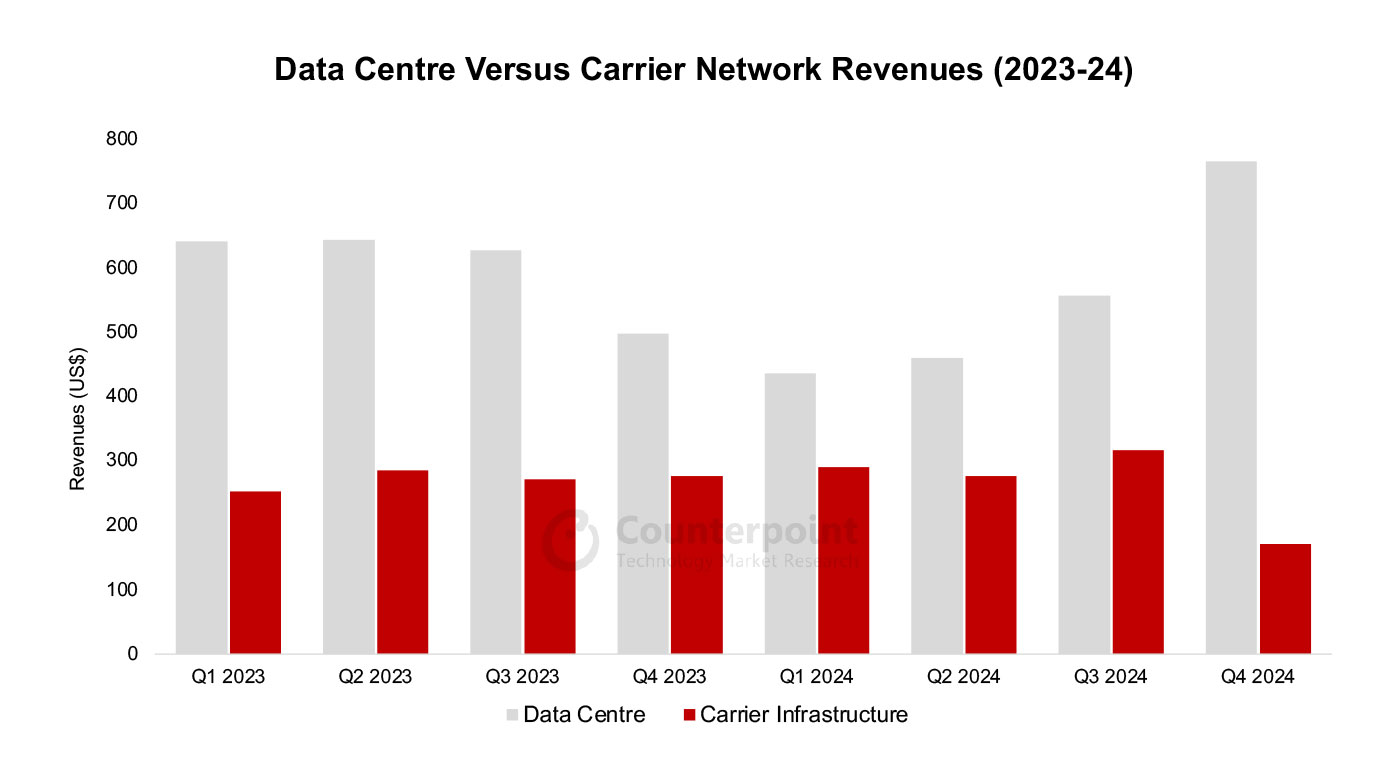

Data centre revenue reached $765 million in Q4 with cloud services being a significant contributor while revenue from AI-driven optics exceeded $200 million (Exhibit 1). In fact, data centre revenue – particularly AI-driven optics – accelerated throughout the year, increasing from around one-third of total revenue in Q1 to more than half at the end of Q4. Clearly, the acquisition of Inphi is proving to be a major strategic asset.

Demand for its cloud-optimized silicon solutions is up, driven by the increase in AI and accelerated computing investment. The chip vendor has successfully executed several 5nm designs in the last two years and expects initial shipments for its two 5nm AI compute programs to start in Q1 2025. Marvell believes that it is on track for a very substantial ramp-up in H2 2025.

Marvell reported that it is also heavily engaged with cloud customers on new 3nm opportunities and remains confident of its 3nm funnel and design win rates. In addition, AI is increasing the cadence of new chip releases, and this plays well to Marvell’s strength as a key partner for its cloud customers with a proven ASIC platform.

The company also announced an extension of its long-standing collaboration with TSMC to develop the industry’s first technology platform to produce 2nm chips optimized for accelerated infrastructure. This new platform will enable Marvell to deliver substantial advancements in performance, power and area, which will be critical for next-generation accelerated workloads.

Carrier and Enterprise Networking

Carrier and enterprise markets have been experiencing a period of weak industry demand for several months. As a result, revenues at both segments were down sequentially in Q4. Marvell expects further sequential declines in Q1 of approximately 50% for carrier networking and 40% for enterprise. Beyond Q1, Marvell expects these markets to stabilise and forecasts a recovery in fiscal H2 2025.

At their peak during the pandemic, the carrier and enterprise networking market contributed a total of $2.5 billion to Marvell’s revenue. Looking forward, Marvell expects both of these markets to contribute over $1 billion each in revenue on an annual basis once demand normalizes. Both these businesses have very long product life cycles – typically seven years in production. In particular, Marvell stresses that it has not lost business or market share, with the lower revenues being attributable to demand softness and inventory corrections. In fact, the company maintains that its up-coming product upgrades will drive up revenues as both these cyclical markets recover over the next few years.

Analyst Viewpoint

Marvell is a critical enabler of accelerated infrastructure for AI with a full suite of solutions across data centre interconnect, switching and compute plus in-house expertise to integrate all these technologies together. Essentially, the company is a one-stop shop for data centres. As a result, Counterpoint Research believes that the company is well positioned to capitalise on the massive AI-based technology build-out as it continues to gain momentum during 2024.

Growth in generative AI applications is driving cloud providers to build new data centres. As a result, Marvell is experiencing an increase in design wins in AI, custom silicon and networking optics. This is providing good opportunities, particularly in custom silicon. However, this is not a zero-sum game with both the merchant and custom silicon expected to benefit. Also, the on-going transformation of data centre architectures is resulting in increased investment in inferencing, which drives more bandwidth between data centres, resulting in more demand for Marvell’s data centre interconnect products.

In Q1 of fiscal 2025, Marvell expects continued sequential growth in its data centre revenues with initial shipments of its cloud-optimized silicon programmes for AI complementing its electro-optics products. Carrier, enterprise and consumer markets are expected to bottom out in Q1 – representing a cyclical trough – which limits any downside. With a healthy gross margin of 42.1% and focus on high-growth areas (and clear view of demand for fiscal 2025 and 2026), Counterpoint Research believes that Marvell is set for recovery and a profitable fiscal 2025.