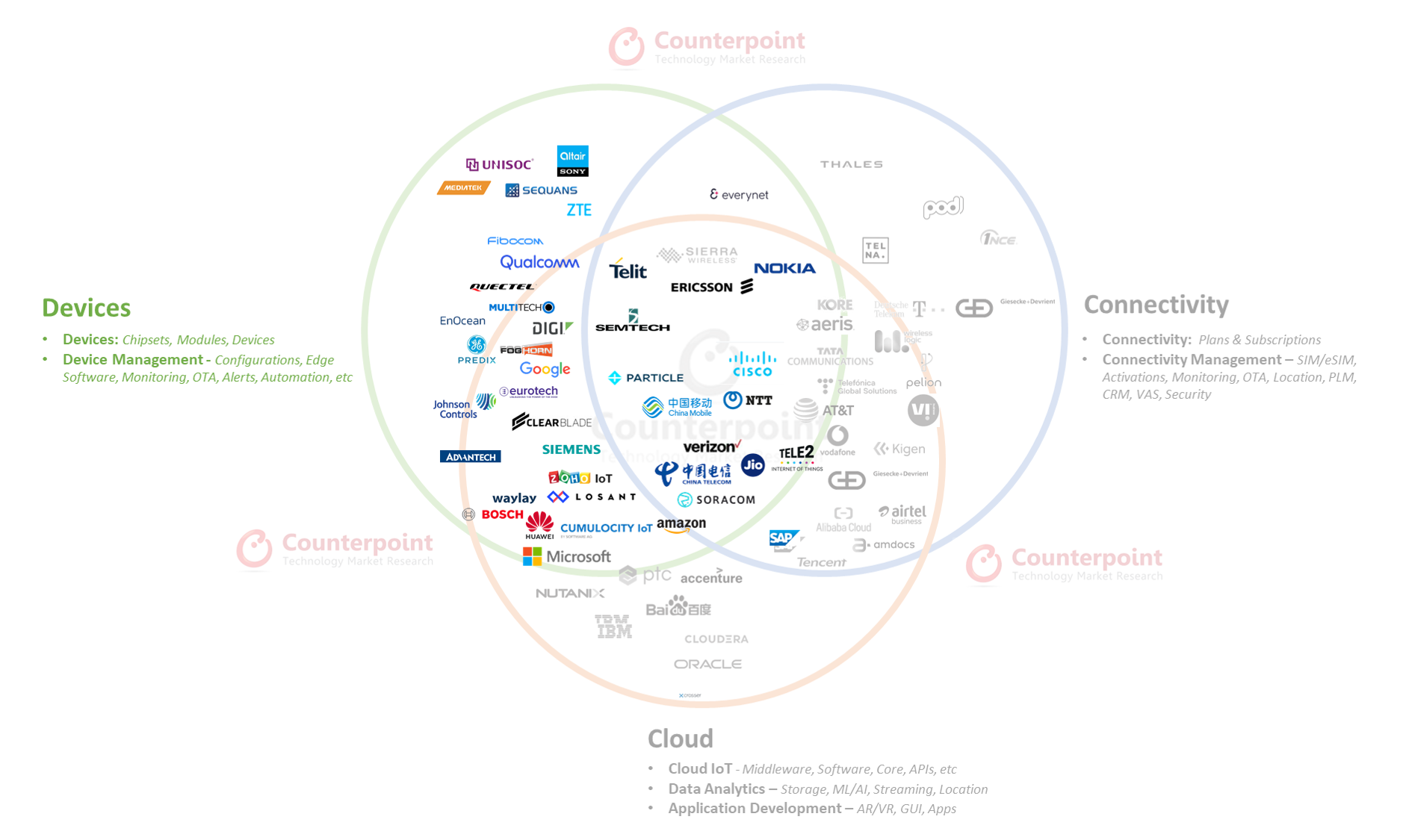

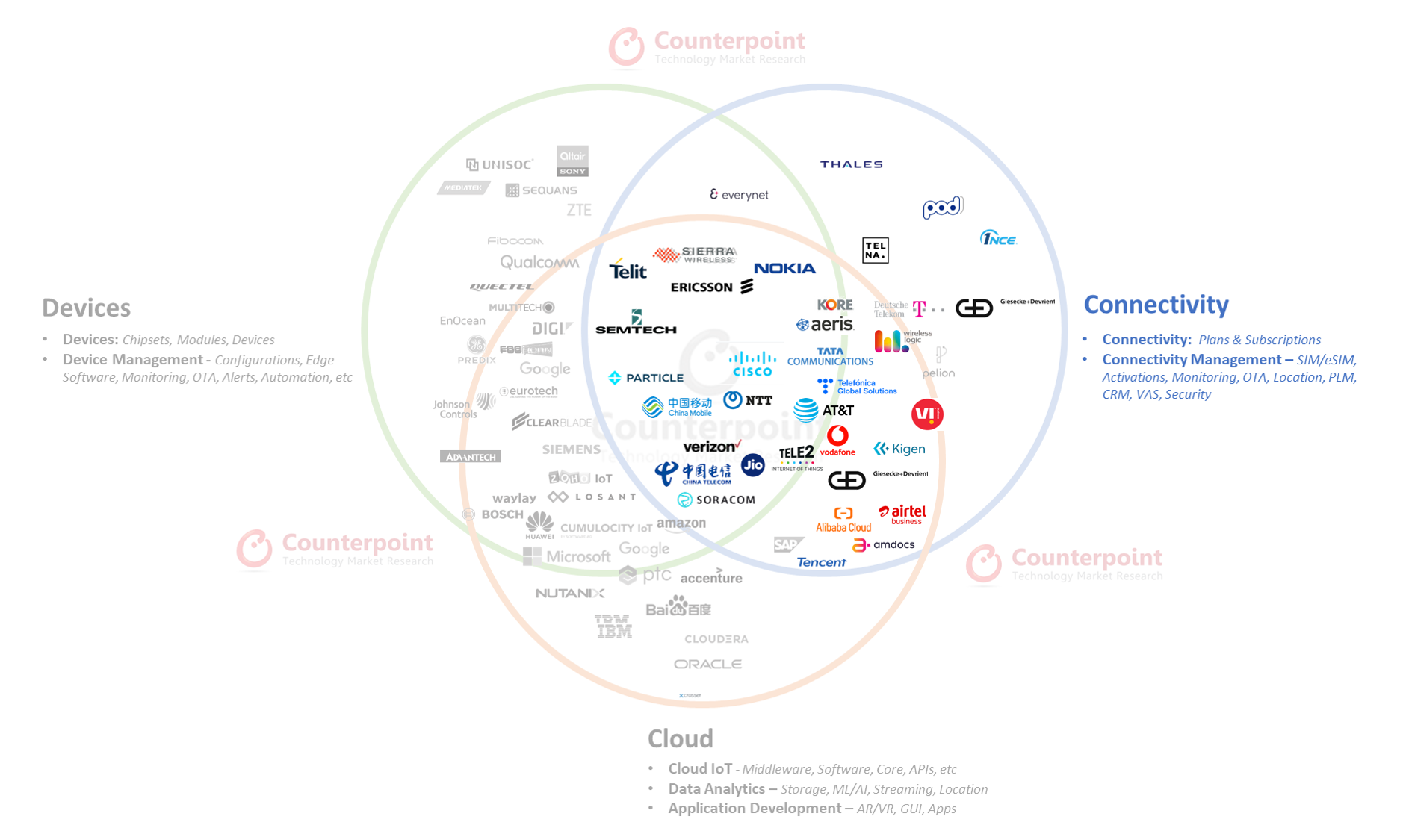

Connecting “everything” to the cloud and internet and ensuring the flow of data and insights back and forth intelligently, which is also called the internet of things (IoT), is the key digital transformation enabler.

Digital transformation is a blue ocean opportunity for every company in the technology space, helping improve products, manpower and processes. Still in nascent stages, this transformation is inevitable across societies, industries, verticals and enterprises. Every entity will take this journey at different times, at a different pace and with different partners.

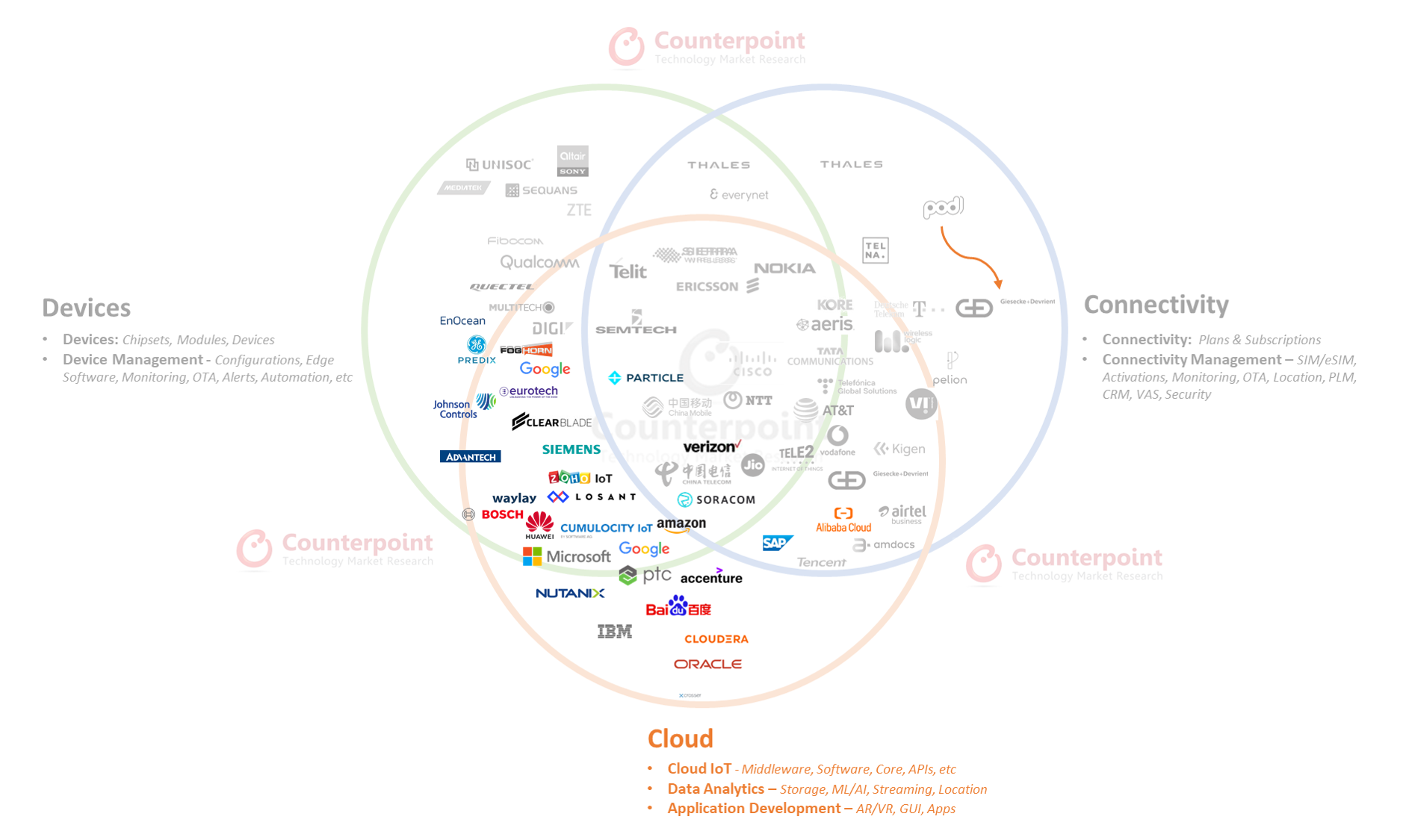

The evolution of software, semiconductors, connectivity and cloud technologies over the last two decades has been pivotal to this ongoing transformation. We have seen a plethora of companies proliferating, especially in devices, software-cloud and connectivity domains. The IoT market, as a result, has become fragmented when we look at these three key domains. This intense fragmentation, in turn, is causing a massive consolidation to generate scale and attain operational profitability.

Devices (Components, Devices & Management)

This segment of the value chain includes the companies offering chipsets, modules and devices equipped with sensors to the solutions such as device management.

Source: Counterpoint Research IoT Practice – Devices, December 2022

Source: Counterpoint Research IoT Practice – Devices, December 2022

The chipset market has seen some consolidation (cellular) and fragmentation (because of LPWA – NB-IoT, LTE-M, Wi-Fi and Bluetooth) cycles.

The IoT module market (analysis here) provides the key metrics here to understand the greenfield and brownfield IoT growth opportunities across applications such as automotive, smart meters, CPEs, asset tracking, telematics, sensors and cameras.

The overall number of players in this segment rose until 2021 but started seeing a big wave of consolidation in 2022 to capture more value with value-added services, software and integration of connectivity and cloud either via partnerships or vertical integration. We believe more consolidation is on the cards in 2023 when some module or device vendors will either exit or be acquired.

🎯Telit Acquires Thales Digital Identity and Security (ex Gemalto) Module business (analysis here)

🎯Semtech acquires Sierra Wireless (analysis here from Soumen Mandal)

🎯Automotive NAD module market also has seen consolidation, with many established vendors (e.g. Telit, Sierra, Thales divesting their automotive module business with few players now dominating the market (analysis here)

In terms of devices, we are witnessing rising number of gateways, CPEs vendors to capitalize on 5G or Fiber connected home, premises or enterprise boom. We believe, this segment will undergo consolidation starting 2024. The other vertical devices market players such as smart meters, POS, cameras, industrial sensors, etc will see some consolidation as many will find it challenging to ride on the 5G wave over the next few years.

Connectivity (Data Plans & Management)

Source: Counterpoint Research IoT Practice – Connectivity, December 2022

Source: Counterpoint Research IoT Practice – Connectivity, December 2022

The connectivity pie has been dominated by:

- Established integrated CSPs such as Verizon, AT&T, Tele2, Vodafone Idea, Airtel, Telefonica, Jio, China Mobile, China Telecom, NTT DOCOMO and T-Mobile.

- MVNEs/specialists such as KORE Wireless, Cisco Jasper, Tata Communications, 1NCE, Aeris Communications, Ericsson and Nokia.

- eSIM/SIM providers such as Giesecke+Devrient (+ Pod Group – A Giesecke+Devrient Company), Thales and Kigen.

- Others such as Alibaba Group, Amazon, Tencent and NTT are also offering some form of connectivity bundled with cloud and IoT platforms.

The connectivity management and managed services companies have also seen consolidation with every wave of cellular “G”, from CISCO-Jasper to Kore Wireless-Wyless and now the biggest news of 2022 – Ericsson exiting this space by offloading the IoT Accelerator platform and managed connectivity relationships to Aeris Communications.

Ericsson-Aeris Deal Reflects Broader IoT Market Trends (analysis here from Mohit Agrawal)

- Ericsson has been one of the earliest vendors focusing on managed IoT and eSIM connectivity. With its strong relationships with CSPs and enterprises, Ericsson built a platform to manage close to 100 million IoT devices (automotive formed a major chunk). The same has been the case with other similar players. The vision for the IoT Accelerator platform had been great but the capabilities and focus diluted over time.

- Further, the scale which Ericsson achieved was not enough to remain profitable. The overall cellular IoT market is close to 3 billion and is estimated to double in the next five years according to our forecasts.

- Ericsson also tried to expand its offerings with an eSIM management SM-DP+ RSP platform to complement its Entitlement Servers; a partnership with Thales Digital Identity and Security (ex Gemalto) as well (learn more about eSIM ecosystem) and leveraging of tight relationships with CSPs. However, the timing was a bit unfortunate.

- This coincided with the 5G deployment wave (Ericsson’s key focus area), COVID-19 pandemic and tough macroeconomic climate, which put serious pressure on operational metrics and forced its hand to divest the platform to Aeris Communications.

We continue to believe that the market has tremendous room to grow, but to remain profitable, the companies will either need a greater scale or a more integrated approach to cross-sell other services to capture maximum value. So, the IoT market is still ripe for exits, consolidations and new bigger entrants.

Cloud (IoT platforms, data & applications)

This is the most interesting part of the value chain. It is here that most value is created & captured in an IoT solution. Our estimates put this value at more than half.

Source: Counterpoint Research IoT Practice – Cloud Platforms, December 2022

Source: Counterpoint Research IoT Practice – Cloud Platforms, December 2022

Significant numbers have been seen in the entry of players offering IoT platforms, from edge to the cloud, to ingest the data from the edge/endpoint devices/sensors at the edge or in the cloud, run analytics on the data and convert them into actionable insights via an app, GUI or digital twin.

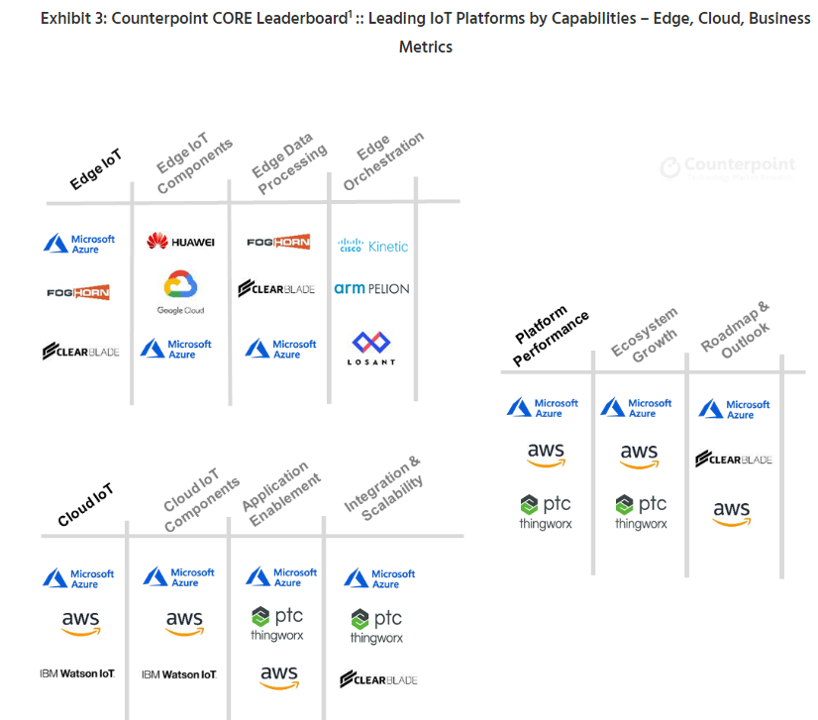

We analyzed the world’s leading IoT platforms before the COVID-19 pandemic and highlighted which platform vendors were ahead or behind and how the industry was ripe for consolidation or exits.

Microsoft, Amazon, Huawei Lead Overall IoT Platform Landscape in Completeness; ClearBlade, FogHorn Emerge as Leading Edge-Focused IoT Platforms (analysis here)

Source: Counterpoint Research IoT Practice, May 2020

A lot has changed since then. The consolidation has already started in this space as many companies are finding their IoT businesses highly unprofitable due to projects not going beyond the POC stages, mounting costs, integration and interoperability issues, lack of platform vendor capabilities, change in focus of the end customer, or macroeconomic environments. Some of the casualties include:

- In by far the biggest exit in the cloud IoT platform space, Google decommissioned its Cloud IoT Core. We highlighted in a report how far is Google behind the established Microsoft Azure IoT, Amazon Web Services (AWS) IoT, PTC and upstarts such as ClearBlade, Losant and FogHorn Systems (now Johnson Controls).

- SAP gave up its Leonardo IoT & Connectivity 360 initiatives (having pledged $2.2 billion in investments in 2017 and onwards).

- IBM retired its Watson IoT platform after spending almost a decade building different components to complement its cloud and strong enterprise business offerings.

- FogHorn Systems, one of the fast-growing edge AI and IoT platform players with a strong footing in the industrial IoT segment, was acquired by Johnson Controls earlier this year. Johnson Controls looks to integrate the FogHorn capabilities into its OpenBlue suite of tailored, AI-powered service solutions such as remote diagnostics, predictive maintenance, compliance monitoring, and advanced risk assessments.

- Pelion (earlier Arm), now an independent company, also pivoted to become an IoT MVNO with more emphasis on connectivity.

Therefore, IoT platforms are the most fragmented IoT domains or part of the value chain. Some platforms have end-to-end capabilities from edge to cloud to applications, whereas some are specialists and will be acquired or exit in the coming years.

Conclusion

The IoT opportunity is significant but also challenging to capitalize if a vendor lacks capabilities, scale, right partnerships and focus to self- or co-create value. The complexity and scale benefits are different for every application and vertical, and the vendors need to be prudent to prioritize and partner. The fragmented nature of the IoT ecosystem will see waves of consolidation and growth. As a IoT player always be ready to pivot or have an exit plan!