- DUV and EUV revenue grew 60% and 30% YoY respectively in 2023.

- Revenue from shipments to China tripled in 2023 driven by increased demand for mid-critical and mature nodes.

- Memory will be bigger in 2024 due to the DRAM technology node transition to support HBM and DDR5 driven by AI.

- EUV will drive gross margin improvements in the long term.

Record sales in Q4 2023 drove ASML’s 2023 revenue to an all-time high of €27.6 billion, despite the semiconductor industry going through a cyclical downturn during the year. The growth was further supported by the higher revenue from service and upgrades, with logic growing 60% YoY and memory growing 9% YoY.

Increased confidence in high-NA tools being the most cost-effective solution

Commenting on the most sophisticated high-NA tool, ASML CEO Peter Wennink said, “Confidence in high-NA tools being the most cost-effective solution, both in memory and logic, has increased over the years. Our customers are convinced that high-NA is a more cost-effective solution as compared to multiple patterning using low-NA tools, evident with the order intake received.”

Analysis:

High-NA tools are expected to be launched in 2024 but the industry is still in the initial phase of establishing a high-NA-enabling ecosystem. Chipmakers will have to order these tools now as these tools have a longer lead time and will have to overcome the many challenges around enabling a high-NA ecosystem before being adopted in high-volume manufacturing (HVM).

Logic companies will leverage their manufacturing and advanced packaging expertise till they cease to derive significant improvements in terms of power, performance, area, density, and cost before adopting high-NA.

The use of high-NA EUV, where large chips are harder to make because of the smaller exposure field, may push the trade-off between the cost of the advanced packaging and the cost savings due to making chipsets more in the direction of smaller chips being used together with high-performance packaging and further delay adoption of high-NA.

Increased adoption of EUV in memory, a significant growth driver and AI-related demand driving customers.

CEO Peter Wennink said, “The introduction of high-NA will be in the same time frame for both Logic and Memory.”

Analysis:

AI is now one of the top priorities for chipmakers as it is turning into a healthy technology transition. A rebound in memory chipmakers’ spending commitments drove ASML’s fourth-quarter bookings to a new high.

Chipmakers have prioritized DDR5 and HBM in anticipation of a surge in demand from generative AI. Memory companies are developing next-generation process nodes, increasing the number of EUV layers to create the smallest possible DRAM node and leveraging EUV technology to drive patterning innovations to overcome obstacles associated with scaling to future memory nodes. The increased adoption of EUV technology to accommodate most applications that require higher energy consumption, speed, and increased packing density for overall productivity is driving the demand for these tools and will help overall revenue growth in the long term.

Further, as the industry scales to 12 and 16 stacks in HBM, chipmakers will need to leverage EUV technology critical to deliver the performance needed for connected devices to meet the growing demand.

Result Summary

- Revenue Highlights

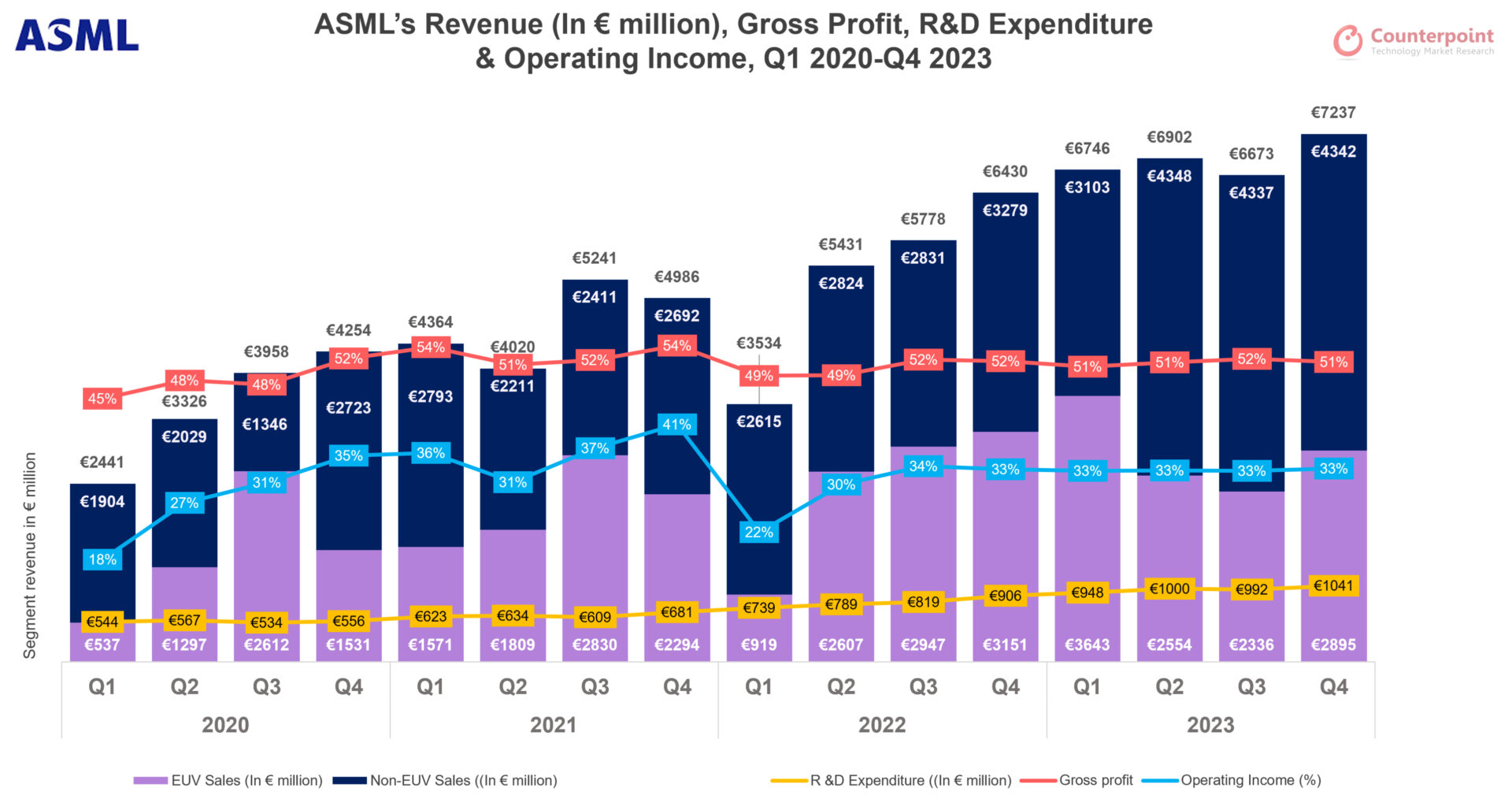

- ASML’s Q4 2023 revenue rose 13% QoQ and 8% YoY to reach €7.2 billion. The sequential increase was mainly due to the higher installed base business.

- Annual sales grew by 30% YoY on their previous best in 2022 to reach €27.6 billion. R&D investments increased 22% YoY to €4 billion, accounting for 14% of total revenue.

- Taiwan, China, and South Korea accounted for around 85% of ASML’s total revenue in 2023.

- ASML recorded its highest-ever quarterly sales revenue of €2 billion in Q4 2023.

- Recorded highest-ever quarterly order intake of €9.2 billion with €5.6 billion in EUV bookings.

- Revenue from shipments to China tripled in 2023: China accounted for 29% of ASML’s net system sales in 2023, up from 15% in 2022, driven by increased demand for mid-critical and mature nodes. During Q4 2023, China accounted for 39% of ASML’s sales. China’s strong demand for chip-making tools bolstered the company’s net sales, despite the imposition of tough US trade sanctions. China will remain a key market for global semiconductor tool makers in the coming years.

- High-NA EUV: ASML shipped the first modules of the maiden high-NA EUV system, EXE:5000, to a customer in 2023. The shift to high-NA systems is set to enable feature shrinking and an increase in transistor density.

- 2024 is a Transition Year: ASML expects limited growth in 2024 as the pace of recovery is unclear. Customers have been navigating through the downside of the cycle and export control regulations despite seeing positive signs in the chip industry. Strong demand from China for mid-critical and mature nodes will continue. Gross margin is expected to dip slightly in 2024 as ASML plans to ramp up investment in capacity and technology for an anticipated industry recovery in 2025.

- Strong acceleration expected in 2025: The operational commencement of new fabs across the globe, increasing use of litho, healthy order book and introduction of high-NA tools both in logic and memory will drive long-term growth revenue. Gross margin is expected to be between 54% and 56% due to higher sales volume, move to higher margin EUV systems, transitioning to high margin high-NA EUV systems and improved EUV service margins.