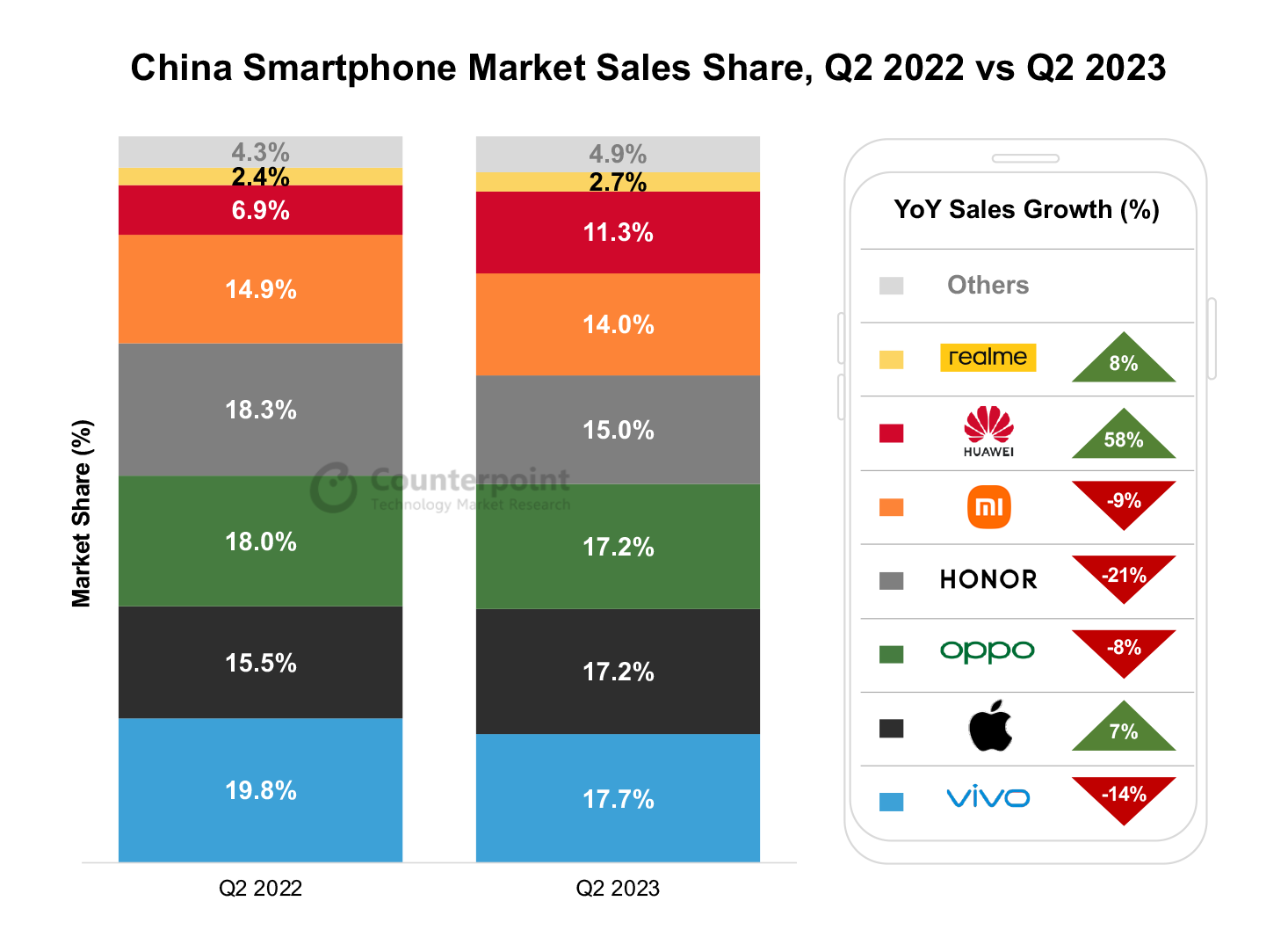

- Smartphone sales in China fell 4% YoY in Q2 2023. The sales continued to decline in April and May, while the 618 e-commerce festival provided a boost in June.

- Among OEMs, vivo reclaimed its leadership position with a 17.7% market share. OPPO (including OnePlus) and Apple were in a tie in Q2, each capturing 17.2%.

- Apple, Huawei and realme managed to achieve positive YoY growth. Huawei’s smartphone sales grew 58% YoY driven by a bigger product portfolio.

- Apple’s sales increased 7% YoY as its position in the premium segment remained unchallenged.

Beijing, New Delhi, Hong Kong, London, San Diego, Buenos Aires, Seoul – July 28, 2023

China’s smartphone sales fell 4% YoY in Q2 2023, reaching the lowest Q2 sales figure since 2014, according to Counterpoint’s Market Pulse Service. The macro headwinds, both internal and external, took a toll on Chinese consumer sentiment.

In April and May, smartphone sales remained weak, while the 618 e-commerce festival provided a boost in June, resulting in a 25% MoM growth. However, despite the sequential increase in June, the relatively weak performance observed during the 618 sales period (June 1 to June 18), with an 8% YoY decline according to Counterpoint’s 618 Sales Period Thematic Report, ultimately led to a 6% YoY decline for the full month of June.

Among OEMs, Apple, Huawei and realme managed to achieve positive YoY growth. Apple maintained excellent sales performance with 7% YoY growth as its position in the premium segment remained unchallenged. The premium segment has proven to be more resilient during economic headwinds. Even within Apple, the sales share of the more premium Pro models grew from around one-third in Q2 2022 to around half in Q2 2023.

Sales of OEMs excluding Apple dropped 5.5% YoY, with all major Android OEMs except Huawei and realme seeing YoY declines. In terms of market share, vivo reclaimed its leadership position with a 17.7% share driven by a strong performance of the Y35 series, Y8 series and the newly launched S17 series. OPPO (including OnePlus) and Apple were in a tie in Q2, each capturing a 17.2% share.

Notably, OnePlus managed to maintain its strong growth momentum from Q1 2023 and achieved YoY growth of 254% in Q2 on the back of channel support from OPPO. On the other hand, OnePlus played an important role in compensating for OPPO’s limited online presence by using its online-centric business model to effectively tap into the segment.

Huawei’s smartphone sales grew 58% YoY in Q2 2023 as the brand managed to resume normal product launches this year. Leveraging its well-established brand image and strong offline footprint, especially in top-tier cities, Huawei witnessed a surge in sales after resolving its product shortages.

HONOR and Xiaomi saw their market shares drop in Q2 2023 on escalating competition. But HONOR has been catching up in offline presence in China.

With a disappointing performance in H1 2023, we have revised downwards our 2023 forecast for China’s smartphone market – from flat growth to a low single-digit YoY decrease. While we anticipate an improvement in smartphone sales during H2 when compared to H1, a strong rebound does not seem to be on the horizon as challenges that affected the performance in H1 are likely to persist.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Follow Counterpoint Research

press(at)counterpointresearch.com