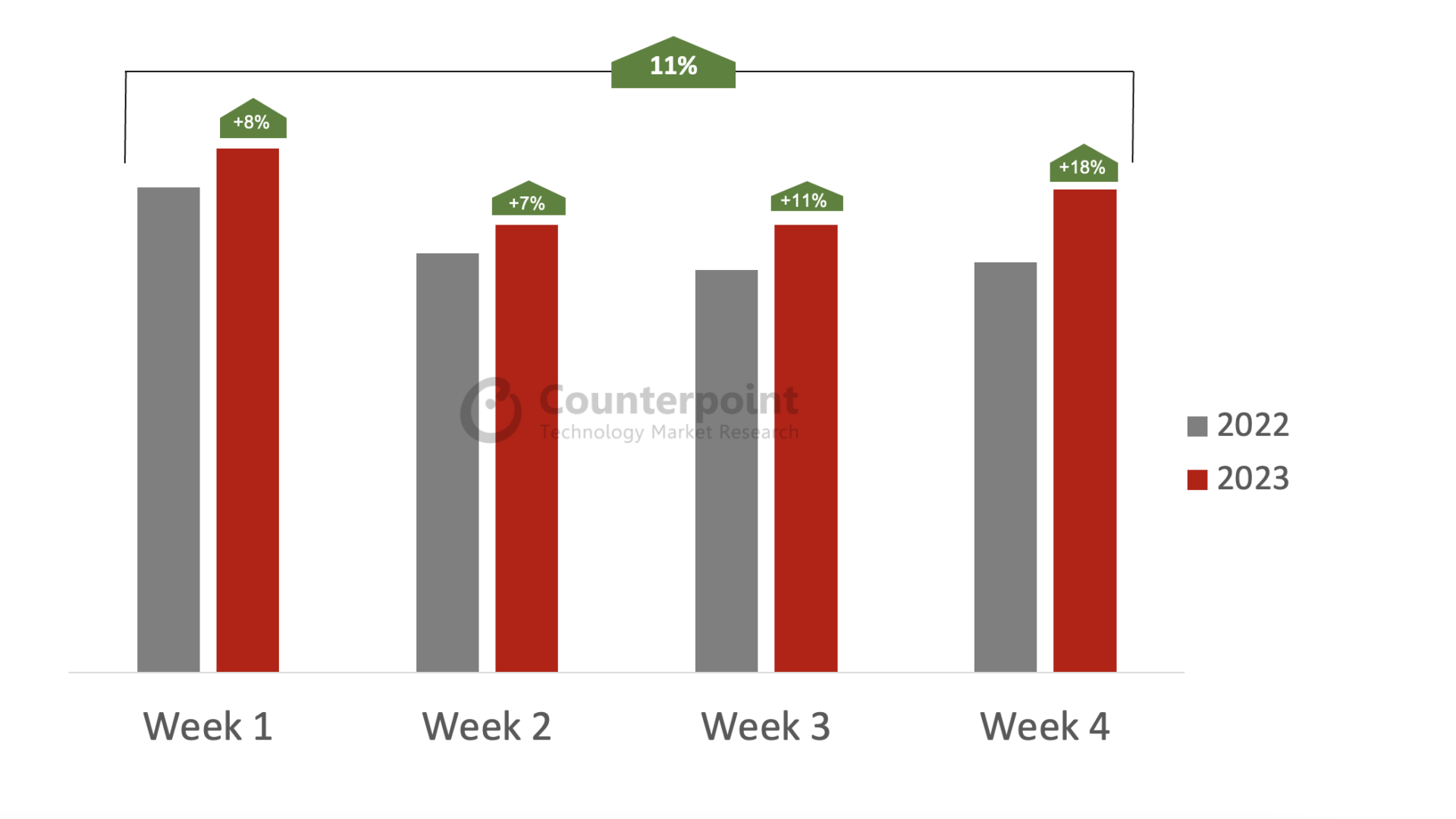

- Growth: China’s YoY smartphone sales growth for the first four weeks of October averaged 11%

- Growth: WoW figures heading into 11.11 sales period highlight stronger momentum than 2022

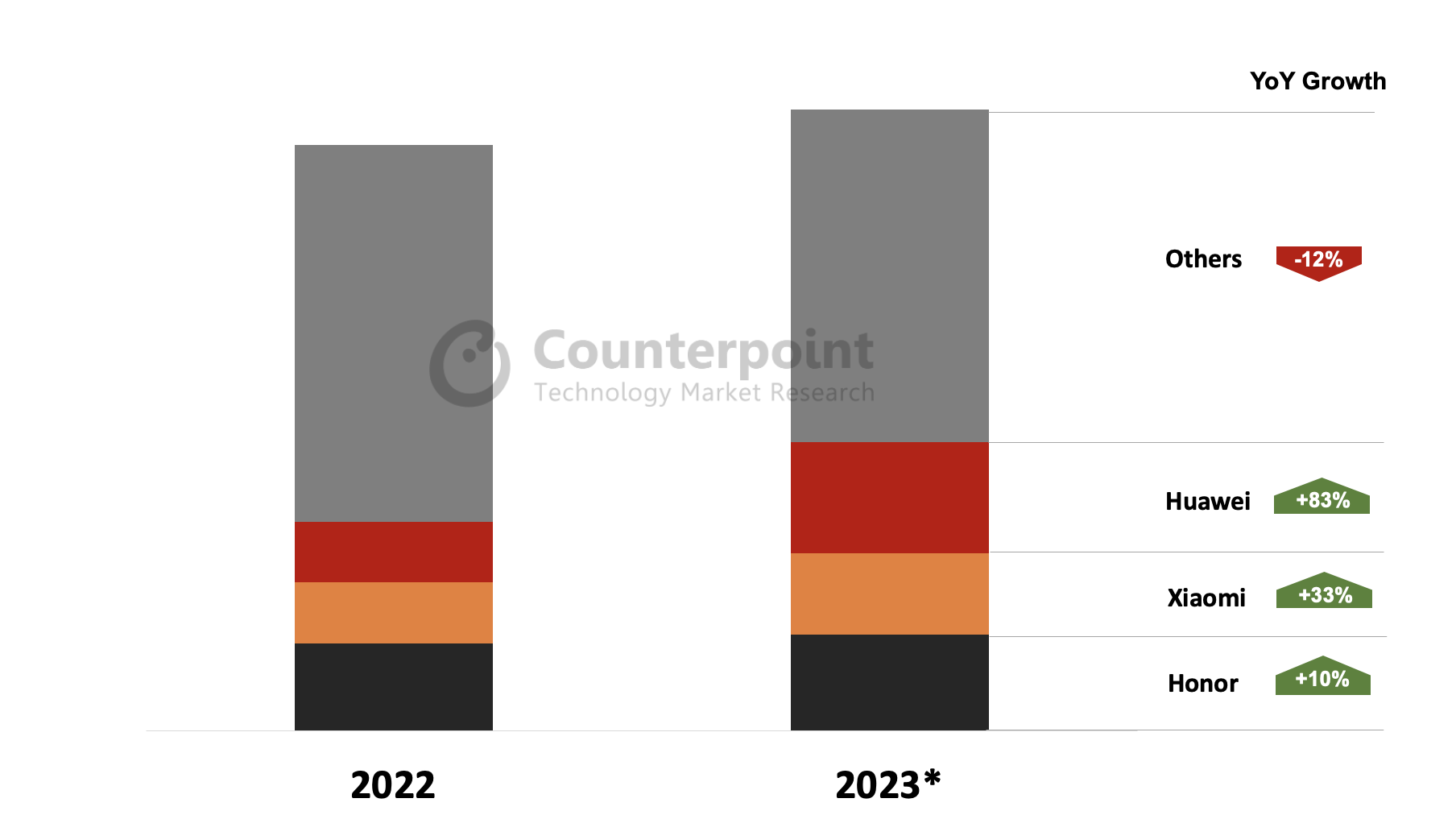

- Drivers: Huawei the standout brand, growing by over 90% during the four-week period

- Drivers: More transparent and earlier promotions ahead of the 11.11 Singles Day sales event

- Expectations: Positive momentum across both WoW and YoY

Beijing, Hong Kong, Seoul, Boston, New Delhi, London – November 14, 2023

China’s smartphone market is signalling a recovery with the first four weeks of October growing on average 11% YoY according to Counterpoint Research’s latest Smartphone 360 Weekly Tracker. Huawei has been the standout brand, accounting for the bulk of net adds share over the period.

“Whether it’s YoY or more short-term WoW, the numbers are suggesting a recovery. There’s some momentum building to be sure,” observes Mengmeng Zhang, senior analyst for China. “This is auspicious as we head into reporting season for the 11.11 sales period.”

China Weekly* Smartphone Sales, October

*Based on first four weeks (Mon-Sun) in October.

With the launch of its new Kirin powered device, Huawei is making a resurgence. “The clear standout in October has been Huawei with its turnaround on the back of its Mate 60 series devices. Growth has been stellar with its new launch marketing and strong media coverage around its ‘Made in China’ chipset,” notes China analyst Archie Zhang. “Demand continues to be high double-digits and we’re also seeing a halo effect, with other models from the vendor performing well.”

China Smartphone Sales by Key Vendors, October*

*Based on October full-month preliminary figures.

Production issues are a recurring theme this year, with both Huawei and Apple coming under pressure to deliver on new devices. The latter is experiencing some issues with specific color variants on the Pro Max, resulting in extended wait times and higher prices on some e-commerce platforms.

Huawei stock shortages are the result of much higher-than-expected demand and the resulting strain from its component supply chain and EMS providers. “Huawei’s ability to scale up to this new normal will be a major determinant not just for their own growth, but for the broader market,” states Ivan Lam, senior analyst for manufacturing. “How they managed the 11.11 period is Huawei’s first true test. Indicators are showing overall sales to be up but how much Huawei contributed to that outperformance is the tell for the rest of the quarter.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com