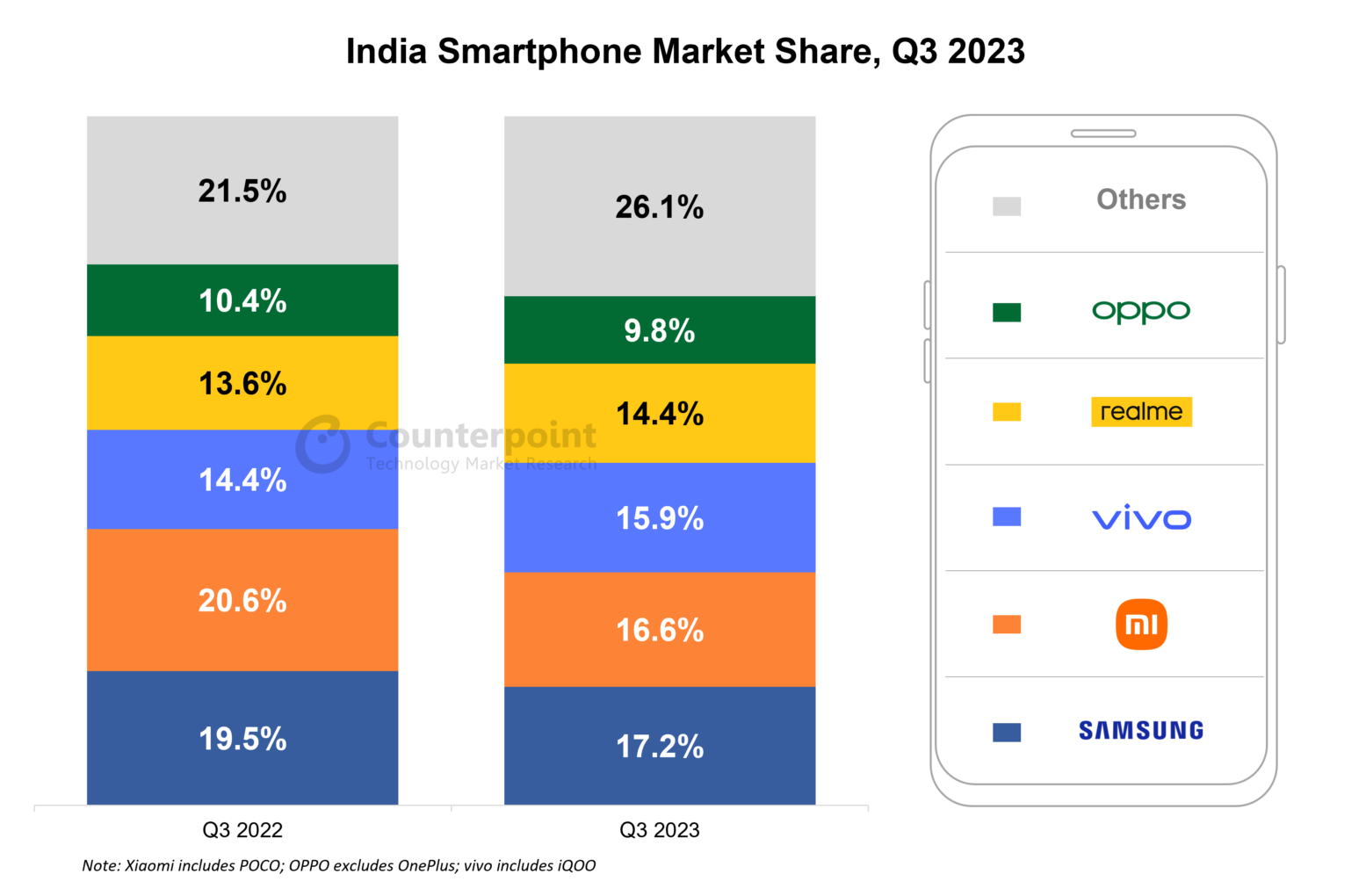

- With a 17.2% share, Samsung remained the market leader for the fourth consecutive quarter.

- Xiaomi took the second spot with a 16.6% share, followed by vivo at 15.9%.

- Apple recorded its highest ever quarterly shipments, crossing 2.5 million units.

- OnePlus took the top spot in the affordable premium segment with a 29% share.

- vivo was the fastest growing brand among the top five, registering 11% YoY growth.

- In the overall market, Transsion brands grew the fastest at 41% YoY.

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires – November 1, 2023

India’s smartphone shipments remained flat in Q3 2023 (July-September) even as Apple recorded its highest ever quarterly shipments during the period, according to the latest research from Counterpoint’s Monthly India Smartphone Tracker. After declining for almost a year, India’s smartphone market is showing signs of recovery with a gradual pick-up in consumer demand going into the all-important festive season.

Commenting on the market dynamics, Senior Research Analyst Shilpi Jain said, “In Q3 2023, OEMs focussed on launching new devices and kept filling in channels to prepare for the festive season ahead. We saw some interesting launches, with key features like 5G and higher RAM (8GB) diffusing to affordable smartphones (sub-INR 10,000, ~$120). The premium segment and 5G were the two focus areas and saw multiple launches. Many OEMs are now coming up with interesting financing schemes through partnerships with financial institutions and by marketing the per-day cost of buying a new device. The market is gradually moving towards growth and we are witnessing positive consumer sentiment during festive season sales. India’s smartphone market will experience growth in the coming quarter due to pent-up demand, elongated festive season and faster 5G upgrades.”

Commenting on the competitive landscape and brand-level analysis, Research Analyst Shubham Singh said, “Samsung maintained its leading position for the fourth consecutive quarter with a 17.2% share driven by the success of its A and M series. Aggressive push in offline through better incentives and price parity across channels, focus on the fastest growing premium segment and innovation through the latest ultra-premium offerings are some of the strategies helping Samsung keep ahead of the competition. Samsung was closely followed by Xiaomi, with its 16.6% market share driven by strong demand for the Redmi 12 series and offline expansion. Xiaomi is effectively capitalizing on the opportunity to provide 5G technology in the budget segment. Its latest Redmi 12 5G series received an overwhelming response from consumers.”

“vivo retained the third spot but was the fastest growing brand among the top five, experiencing 11% YoY growth. Strong offline presence, focussed approach to CMF (Colour, Material, Finish), and targeting the mid-premium segment through its sub-brand IQOO drove the demand for vivo. In the overall market, Transsion brands grew the fastest at 41% YoY. Experiencing a high-growth phase in India, Apple recorded 34% YoY growth. Q3 2023 also marked the best quarter for Apple’s shipments in the country, which crossed 2.5 million units. Premiumization has started in the world’s second largest smartphone market and Apple has again got the timing right to benefit from this trend through its devices and financing offers. OnePlus was the top brand in the affordable premium segment (INR 30,000-INR 45,000, ~$360-$540) with a 29% share driven by strong sales of the OnePlus 11R.”

Other key insights

- Faster 5G upgrades: In Q3 2023, the share of 5G smartphone shipments reached 53%. The main growth driver was OEMs pushing multiple launches in the INR 10,000-INR 15,000 (~$120-$180) segment. The 5G penetration reached 35% in this segment, compared to 7% in Q3 2022.

- Ultra-premiumization trend: The trend of ultra-premiumization (>INR 45,000, ~$540) is steadily gaining momentum with each passing quarter. In Q3 2023, the segment grew 44% YoY driven by the availability of easy financing options, implementation of various incentive programs in the market, and growing consumer aspirations for the latest technology.

- Foldables going mainstream: We are observing an increasing demand for foldables in the ultra-premium segment due to their different form factor, which transforms the way we perceive and utilize smartphones. The future looks promising for them as more OEMs are entering the segment.

- 4G feature phone growth: The share of 4G feature phones in the overall feature phone shipments increased to 32% in Q3 2023 following the launch of the JioBharat platform. Low cost (INR 999, ~$12), features like UPI, and access to a wide variety of apps are the key factors driving this demand.

- Other notable brands that grew YoY during Q3 2023 were Nokia (31%), Motorola (27%), realme (7%) and Google (6%).

The comprehensive and in-depth ‘Q3 2023 India Smartphone Tracker’ is available for subscribing clients.

Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights.

The Market Monitor research relies on sell-in (shipments) estimates based on vendors’ IR results and vendor polling, triangulated with sell-through (sales), supply chain checks and secondary research.

You can also visit our Data Section (updated quarterly) to view the smartphone market shares for World, US, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.